What are Mutual Funds?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

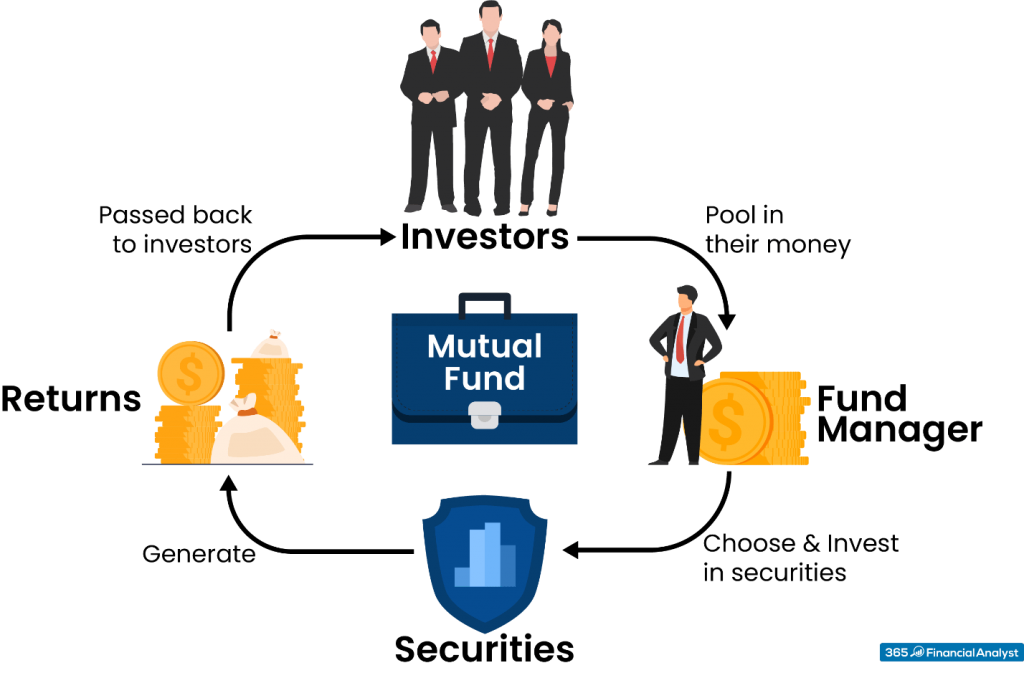

A mutual fund is a pool of money collected from many individual investors and companies in order to invest in various types of assets. A professional portfolio manager is hired to invest the capital in a portfolio of securities. In the end, any gains are passed down to the investors on a pro-rata basis. Unlike stocks, mutual funds represent an investment in many different stocks instead of just one holding. It can be compared to buying a part of a portfolio’s value.

What is Net Asset Value (NAV)?

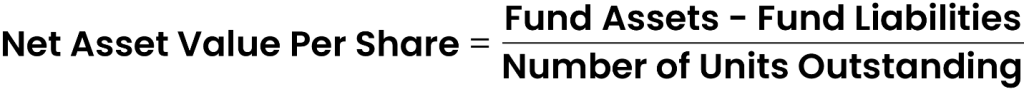

The mutual fund’s share price is called the net asset value (NAV) per share. It is measured daily and represents the total value of portfolio assets minus liabilities, divided by the number of outstanding shares.

Example of NAV Calculation

Let’s assume that a mutual fund has $65 million invested in securities and another $5 million invested in cash, for a total of $70 million in assets. Besides, the fund’s liabilities are $20 million. As a result, the net asset value would be $50 million. If the fund has 5 million shares outstanding, the net asset value per share will be $50 million divided by 5 million shares, or $10 per share.

Mutual Fund Structure

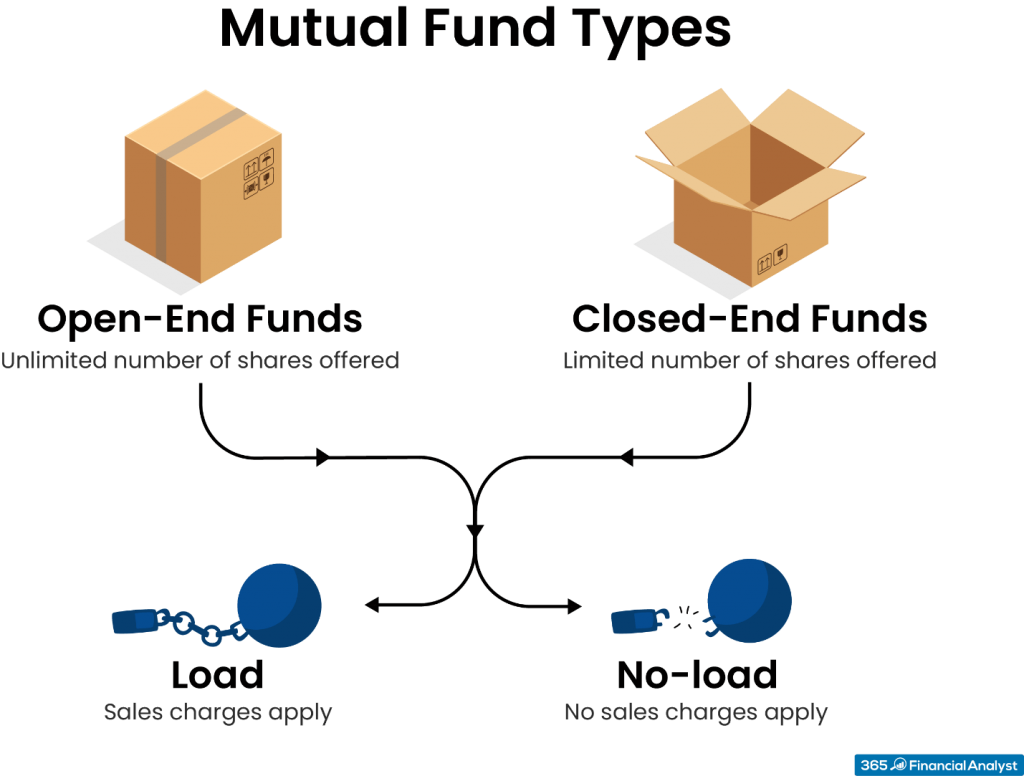

A mutual fund can be set up as an open-end or closed-end fund.

Open-ended mutual funds do not limit the number of shares offered. Such structures accept fresh capital by issuing new shares at the net asset value. The fund’s portfolio manager then uses the cash to acquire more securities. In addition to that, open-end funds may buy back existing shares at the net asset value per share. This allows investors to make use of an investment opportunity while still maintaining their liquidity.

At the same time, cash inflows require finding new investment opportunities and stock redemptions require maintaining adequate cash reserves. To avoid liquidity problems, open-end funds always keep sufficient cash levels for redemptions. However, that may be a double-edged sword — by not using the total fund capital, an opportunity cost arises.

In contrast, closed-end funds issue a limited number of shares only once and through an IPO. After all the shares have been sold, the offering is “closed”, and no new investment capital can flow into the fund. Closed-end funds do not repurchase shares from investors. So, they don’t maintain large cash reserves. Instead, clients can sell them on the open market just like ordinary securities. Actually, a fund’s price on the exchange is determined by supply and demand. Therefore, a fund could trade at a premium (with a price above the net asset value) or at a discount (below the NAV).

Besides, closed-end funds use leverage to increase returns — which is why they realize higher returns than their open-end counterparts. Still, of the total net asset value of all US mutual funds, only 1 percent are in the form of closed-end funds. So, to gain a better understanding, we should consider the downsides associated with closed-end funds. Fundamentally, these structures are less liquid than the open-end funds because of the fixed number of shares issued. Moreover, the fund’s use of leverage makes the share price volatile and unsuitable for all investor types.

Another way of classifying funds has to do with the costs and commissions involved. Based on the sales fees relative to purchasing or redeeming shares, we differentiate between load and no-load fund types.

Load funds are usually sold through retail brokers who receive part of the upfront fee. The sales commission could be a percentage of the amount you invest, or a flat fee. If you put $1,000 into a 6% load mutual fund, you would invest only $940, with the remaining $60 going to the fund as a commission.

On the other hand, no-load funds are bereft of a fee for investing or redemption. We must be very careful though — a fund can market itself as a no-load and still try to make it up by charging other hidden fees. The best way to determine expenses is by reading the fund’s prospectus carefully.

Mutual Fund Types

Depending on the asset class that they invest in, there are four types of mutual funds:

- money market funds

- bond mutual funds

- stock mutual funds

- balanced or hybrid funds

Money market funds invest in short-term debt securities, such as commercial paper, treasury bills, and certificates of deposit. They are considered one of the safest investments and account for 15% of the mutual fund market. Money market funds have three major goals: to provide security of principal, to obtain high liquidity, and to achieve returns close to money market rates. Most of them operate on a constant net asset value basis (often aiming at $1 per share). This forces fund managers to make regular payments to investors, providing them with a regular flow of income. In most cases, investors use money market funds as a place to park money temporarily before investing elsewhere.

Bond mutual funds invest in fixed-income securities, too. The key distinction between bond and money market mutual funds lies in the maturity of the underlying assets. The former holds fixed-income securities with maturities of up to 30 years. By contrast, the money market funds’ maturity rarely goes beyond 90 days.

Moreover, we have equity mutual funds that invest primarily in stocks. These funds can be further divided into active and passive. The goal of actively managed mutual funds is to outperform a benchmark index by selecting individual securities. Conversely, passive funds aim to match the performance of a particular index. Understandably, active funds charge high management and transaction costs. The more frequent purchase and sale of assets, also known as a portfolio turnover, leads to the realization of higher capital gains. This is why actively managed mutual funds usually pay a substantial amount of taxes.

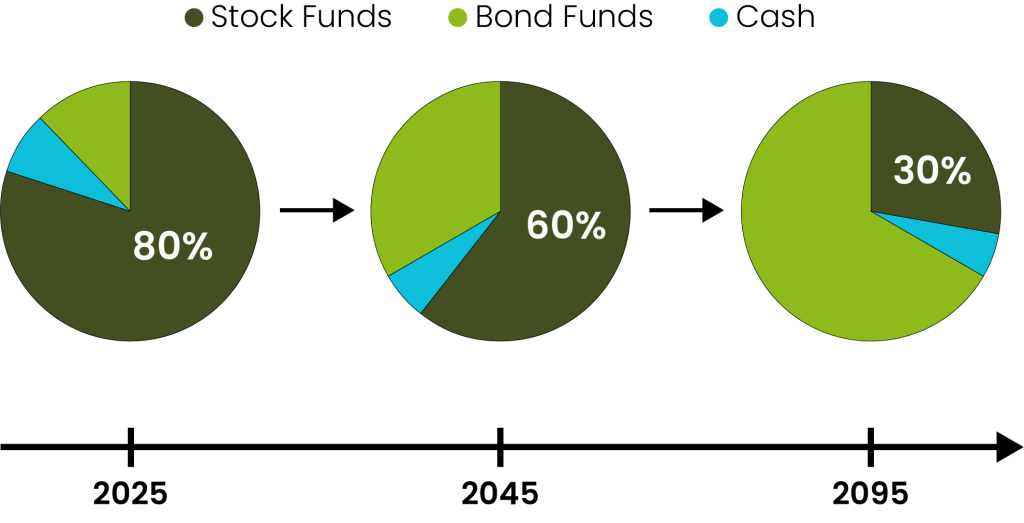

Furthermore, professionals may invest in hybrid or balanced mutual funds. They aim to balance growth and income by investing in a mix of stocks and bonds. Lifecycle (or Target date) funds are the most popular representatives of this category.

Target date funds are useful for those who want to plan for their retirement. The time horizon of a lifecycle fund is specified in its name. If we bought a 2095 target fund, and the current year was 2025, the time horizon would be 70 years. Lifecycle funds are based on the idea that young investors can handle more risk. As maturity date approaches, the percentage of bonds and other low-risk investments increases proportionally.

Beyond Mutual Funds

As a convenient means of diversification, mutual funds are just a part of the spectrum of financial instruments available to investors. To know more about investing, go ahead and read the additional resources we have provided for you.