Selling High, Buying Low: What Is a Short Position?

A short position involves betting on the decline of an asset’s value and profiting from the difference between the initial selling price and the lower buying price.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Any trader knows the golden rule of buying low and selling high, but what if there was a way to flip that and still make a profit? That’s where the concept of a short position comes into play. While buying stocks and watching them rise in value is the conventional path to make money, a short seller will profit from a fall.

A short position (or simply short) plays a significant role in times of downward market movements. It allows investors to benefit from falling prices and mitigate risk effectively, making it a popular trading technique.

This article addresses the short position and associated risk, lists key short-selling terms, and explains how to short a stock through a practical example.

Table of Contents

- What Is a Short Position?

- Key Short Selling Terms

- How to Short a Stock

- How Does Short Selling Work?

- Understanding Short Position Benefits

- Understanding Short Position Risks

- Long vs Short Positions

- Next Steps

- FAQs

What Is a Short Position?

A short position is an investing strategy for exploiting overvalued stocks, where an investor borrows an asset only to resell it on the market and buy it back at a lower price in the future. If you take a short position, you believe the security will decrease in value. And the individuals that undertake these trades are called short sellers. Technically, they borrow shares from their broker or a dealer and sell them to another investor.

With this investing technique, they aim to sell the borrowed shares only to repurchase and return them to the broker. Why? Selling high and buying low is the core principle of shorting a stock to make a profit. A short seller may deal with stocks, FOREX, and futures.

The two main types of short positions are naked and covered. A naked short occurs when an investor sells an asset without actually borrowing it or verifying it can be borrowed. Keep in mind that this is illegal for equities in the US. And if a trader borrows a security and pays a borrowing rate when they hold this position, we call it a covered short.

When traders hold a short position, two actions can occur. If the market price of a security decreases, they buy it back at a lower price and realize a profit. If an asset’s price increases, the short seller loses money.

Key Short Selling Terms

- Days to cover (DTC): This metric calculates how many days it would take for all the short positions in a particular stock to close. It equals the current short-sold shares divided by the average daily trading volume (ADTV) needed to cover the short positions. If Beta Corp short-sells 50 million shares, and the average number of company shares traded daily equals five million, the DTC will be 10 days.

- Short Interest: This is the percentage of legally shorted shares in a company to its total outstanding shares. If Beta Corp has 100 million shares, and the short sales account for 10 million, its short interest stock rate is 10%.

- Borrow Cost: This is a fee that a trader pays to a lender for borrowing a security.

How to Short a Stock

Holding a short position requires investors to sell and locate contracts or securities they don’t own, allowing them to capitalize on downward price movements. Note the following breakdown of the typical process that a short seller undertakes:

- Borrow a stock from a broker;

- Sell the stock on the open market;

- Buy back the stock;

- Return the borrowed stock to the broker.

The difference between the initial sales and the repurchase and any fees involved represents your profit. Before engaging in short selling, investors must estimate how much they’ll pay in interest, fees, and commissions. If these costs exceed potential profit, maintaining a short position may not be worth it.

Suppose John holds a short position by borrowing assets from his broker. Then, John sells the borrowed security to other traders on the market.

If the security price drops, John will realize a profit because he will buy it back at a lower price than the one at which he sold the security. Conversely, if the price increases, he will lose money since he’ll buy back at higher than original levels. Either way, he must repurchase the security and return it to his broker to close the position.

How Does Short Selling Work?

After researching, John forecasts Tesla stock should drop in the next three months. To profit from his bearish view, he borrows 10 stocks when the stock price is $200 and sells them to investors who think otherwise.

John turns out to be correct, and, in three months, Tesla’s stock dropped to $150. He closes the position by purchasing the stock he had initially sold and then delivers it back to the long party, making a $50 per share for a $500 profit.

Suppose that Tesla posts better-than-expected sales during the quarter, and, as a result, the stock price surges to $300. To close his short position, John must buy the stock at the new price, losing $100 per share in the process, for $1,000. If he doesn’t have money to repay, his broker is exposed to a counterparty risk: John may not honor his obligation.

Understanding Short Position Benefits

Shorting a stock significantly impacts market stability, requiring careful analysis, risk management, and compliance with applicable regulations. Investors find them appealing for the following reasons.

Profiting from Falling Prices

To generate gains even in bear markets, some investors may “short the market” by selling securities they don’t own and buying them back at a lower price.

Hedging Against Market Risks

Short selling allows hedging against potential losses in an investor’s long positions. If the market experiences a downturn, a short position can offset the downside risk in an existing long holding.

Speculative Trading Opportunities

A short trade benefits investors from market inefficiencies and short-term price fluctuations. Traders who believe a stock is overvalued or will drop in value can short sell it now to benefit from a price correction in the future.

Diversification

A popular technique for managing the overall risk exposure in an investment portfolio includes holding long and short positions to profit from both upward and downward movements in the market. It’s an additional tool for diversifying an investor’s portfolio.

Arbitrage Opportunities

Short trading is an arbitrage strategy for making a profit from price discrepancies between different markets or securities. Short selling in one market and short buying in another presents an opportunity for traders to exploit the price differential.

Understanding Short Position Risks

Short selling virtually bets against the downward price movement of a stock or asset. And it is considered a highly risky investing technique for the following reasons:

Unlimited Losses

Short sales are risky because a stock can only fall to zero, but there’s no limit on how high it can go. Therefore, the investor’s possible loss is virtually unlimited. That’s why lenders require short sellers to leave the short sale proceeds on deposit as collateral to mitigate the default risk. Then, they invest the profits in short-term securities that generate interest. So, a short seller receives compensation for depositing the collateral at short rebate rates.

Limited Profit

Because short positions take advantage of decreasing prices, investors’ gains are as significant as the difference between the initial and current market prices.

Dividend Payments

In addition, the short seller agrees to pass down any dividends or interest that the lender would otherwise be entitled to if they didn’t borrow the stock. These are called “payments-in-lieu” of dividends or interest.

High Fees

The borrowing costs typically depend on the demand and supply and may change overnight. If the borrow cost and interest rate increase, an investor should re-evaluate whether it’s worth keeping the short position open.

Margin Calls

If you fail to maintain the required margin call (typically about 35%) and don’t supply additional cash or securities, the broker might close out on your open position as a precaution. And eventually, the price could go down, and you’d miss an opportunity to make a profit.

Long vs Short Positions

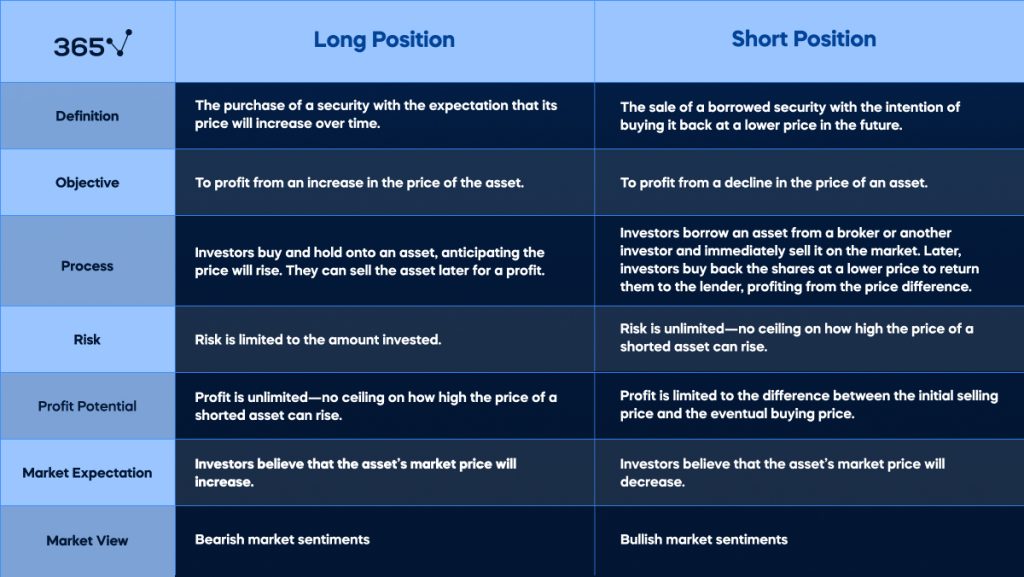

Short and long positions are two sides of the same coin. In practice, there are major differences between a long position and short selling. Consider the following comparison table:

Next Steps

Long and short positions play a significant role in the investment world but are just a fraction of the larger picture. As a financial analyst, you must be acquainted with basic concepts about the financial markets. That’s why our industry experts developed the course Fundamentals of Financial Markets, where you can gain a practical understanding of the key frameworks you’ll need in the field.

If you’re ready to take your career to the next level, we have designed an Investment Analyst Career Track that covers all the necessary concepts investment analysts and associates use. Enroll today and start learning at your own pace.

FAQs

Having a short position means that an investor has sold a security they don’t own, expecting the price of that instrument to decline in value. When you hold a short position, you’ve borrowed a security from a broker or another investor, agreeing to return it in the future. You then sell the asset on the open market, hoping to repurchase it at a lower price later. Short selling involves profiting from the difference between the selling price and the lower buying price.

Suppose Lisa believes that Company Alpha’s stock is overvalued and anticipates a decrease in its price. So, she borrows 100 shares of Company Alpha from her broker. And she sells these shares on the open market at $50 each, which equals $5,000. As expected, the price dropped to $40 per share shortly after that, and Lisa closed her short position by repurchasing 100 shares of company Alpha at $40 each for a total of $4,000. Finally, she returns the borrowed shares to her broker, making a $1,000 profit.

Short positions make money by taking advantage of downward price movements. Investors profit from the higher initial selling price and lower repurchasing amount.