Primary vs Secondary Markets: The Foundation of Financial Trading

Understanding primary vs secondary markets is key to grasping how the financial system functions. While primary markets handle the initial sale of new securities, secondary markets enable ongoing trading and liquidity—both play vital roles in capital formation.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeWhat comes to mind when you hear the word “market”? Perhaps the stock market—or maybe even a flea market. Regardless of the setting, the core idea remains the same: a place where buyers and sellers exchange assets.

In the world of finance, the term “market” is often used broadly, but it’s essential to distinguish between two key types: primary vs secondary markets. While they both play crucial roles in the investment landscape, they serve different purposes.

This guide breaks down what each market does, how they differ, and—most importantly—how secondary markets support the functioning of primary ones. With a clear understanding, you’ll be better equipped to navigate stocks, bonds, and other securities with a more informed, professional mindset.

Primary Markets

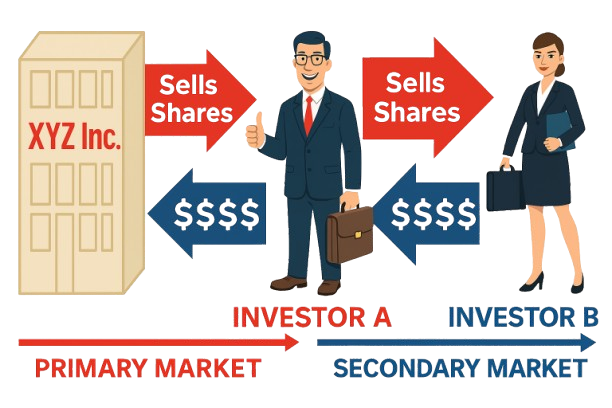

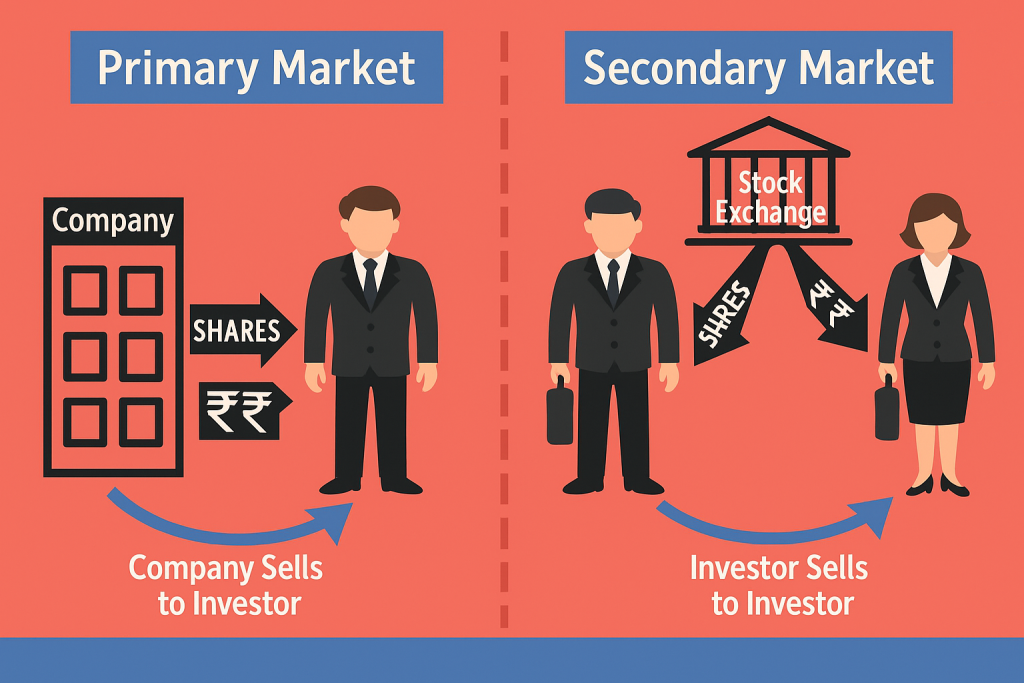

The primary market is where new securities are issued and sold for the first time. It serves as the platform for companies to raise capital directly from investors. One of the most common examples is an Initial Public Offering (IPO)—when a private company offers its shares to the public for the first time, becoming publicly traded. This highlights the distinction between the primary vs secondary markets.

In addition to IPOs, established companies may also raise further capital by selling new securities—this is known as a seasoned offering or seasoned issue.

Both IPOs and seasoned offerings are transactions that take place in the primary market.

Secondary Market

The secondary market is where investors buy and sell securities already issued. Most people commonly refer to it as the “stock market.”

While stocks are sold in the primary market only at their initial issuance, all subsequent trading occurs in the secondary market. Well-known examples of secondary markets include the New York Stock Exchange (NYSE) and NASDAQ.

The Role of Financial Markets in Capital Formation

The primary vs secondary markets play distinct yet complementary roles in the financial system. The primary market facilitates the initial sale of securities—allowing companies to raise capital directly from investors through IPOs and seasoned offerings.

In contrast, the secondary market provides liquidity and ongoing trading opportunities for these securities—enabling investors to buy and sell shares freely.

Together, these markets ensure efficient capital formation and continuous investment opportunities in the broader economy.

To deepen your understanding of how financial markets operate and build practical skills for a successful finance career, consider joining the 365 Financial Analyst platform.