What Are the Most Common Hedge Fund Strategies?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

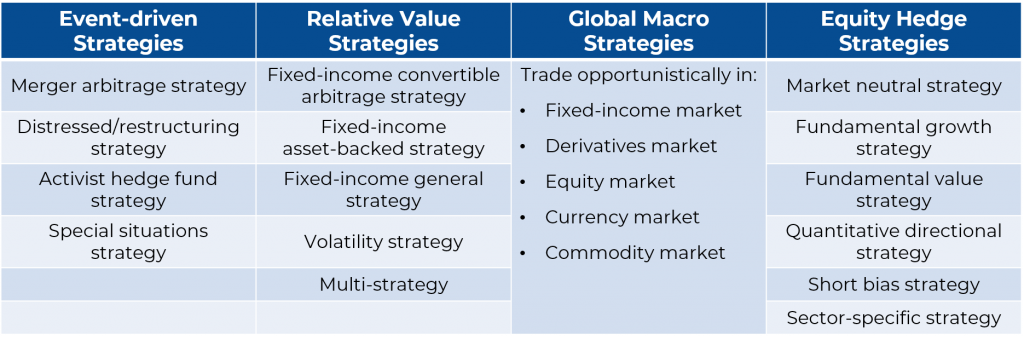

Hedge funds are alternative investments that pool money collected from a multitude of investors. In trying to beat the market, these investment vehicles deploy a variety of strategies relative to the use of leverage, derivatives, and taking short positions. Generally, hedge fund strategies fall into one of the following categories:

- Event-driven strategies

- Relative value strategies

- Global macro hedge fund strategies

- Equity hedge fund strategies

Event-driven Strategies

They are based on various corporate actions such as mergers, acquisitions, or restructuring. They entail taking long or short positions in equity or debt securities of the companies involved.

Here, we have a couple of sub-categories to consider:

- Merger arbitrage involves buying the shares of an acquisition target company and selling short the shares of the buyer. This strategy is expected to profit from the spread between prices of the respective shares or from potential overpayment by the acquirer. The main risk involved is that the deal may not close.

- Distressed or restructuring strategies focus on companies in financial distress. These are firms that are about to file or have already filed for bankruptcy. In such cases, fund managers may choose to take a long or short position in the debt or equity securities of the distressed company. When taking a long position, they bet on a successful restructuring. Thus, they buy the company’s securities at a discount and expect to profit from a price recovery. On the other hand, a short position is expected to be profitable upon unsuccessful restructuring. When going short, fund managers usually pick securities with lower investor protection, such as junior debt or common stock. These two approaches can also be combined by simultaneously taking a long position in senior debt and a short position in junior debt or equity. In this case, the hedge fund manager expects to profit from an increase in the price spread between the two classes of securities.

- Activist investing is based on triggering corporate actions. Activist hedge funds buy a sufficiently large shareholding in a company with the intention to influence its management. They would require the implementation of various corporate actions and strategies to increase the company’s value. These may include divestitures, restructuring, capital distribution, or management changes. Activist investing resembles the approach of private equity funds in trying to gain control over a company. However, the key difference here is that activist investors focus on public companies.

- Special situations funds invest in companies that are undergoing some sort of restructuring other than mergers, acquisitions, and bankruptcy. These include spin-offs, asset sales, and share buy-backs.

Relative Value Strategies

They focus on taking long and short positions in related securities and profiting from a temporary discrepancy in their perceived price relationship. Again, we have several sub-categories:.

- Fixed-income convertible arbitrage exploits any mispricing of convertible bonds. This strategy involves taking a long position in a convertible bond and a short position in the common stock of the same company.

- Fixed-income asset-backed is another relative value strategy. It uses opportunities that arise from mispriced asset-backed securities (ABS) and mortgage-backed securities (MBS).

- Fixed-income general strategies exploit various pricing discrepancies within fixed income markets. These may include relative value positions between 2 different companies or between various securities of the same company.

- Volatility strategies, on the other hand, use various derivative financial instruments to go long or short on market volatility in a single asset class or across different classes.

- Multi-strategy funds, as the term suggests, deploy various existing strategies to use relative value opportunities across asset classes.

Global Macro Hedge Fund Strategies

Rather than examining specific companies, macro hedge funds look for opportunities arising from global economic and political events. They bet on global market trends by taking long or short positions across:

- equities

- derivatives

- fixed income

- currencies

- commodities

Equity Hedge Fund Strategies

They involve taking long and short positions in public equities and related derivatives. They differ from the event-driven or macro strategies in the use of a bottom-up rather than a top-down approach. Here are the most common variations of the equity hedge fund strategies:

- Market neutral strategies focus on selecting undervalued securities to buy and overvalued ones to sell short. Hedge fund managers do that by using quantitative, technical, or fundamental analysis. The overall goal is to keep a net neutral market position and profit from individual securities movements.

- Moreover, we have fundamental growth strategies. They use fundamental analysis to identify and take long positions in companies with high growth potential.

- Fundamental value strategies, on the other hand, take long positions in various undervalued companies.

- Quantitative directional strategies use technical analysis to select undervalued stocks to buy and overvalued ones to sell short. Net market exposure may vary depending on the relative size of long and short positions taken.

- Furthermore, short bias strategies take predominantly short market exposure in companies that are considered overvalued.

- Sector-specific strategies focus on a specific sector of expertise and use quantitative and fundamental analysis to identify different investment opportunities.

Summary

Below is a summary table of the hedge fund strategies we have just discussed:

In practice, many hedge funds begin by employing only one hedge fund strategy. Over time, they develop additional expertise and expand to become multi-strategy funds.

If you are looking for more information on hedge funds structure, fees, and valuation, feel free to use the additional sources we have in store for you!