Derivative Contracts: Forwards vs Swaps

Understanding forwards vs swaps is essential for anyone involved in risk management or derivative pricing. While both contracts share structural similarities, they differ significantly in valuation and cash flow timing. This article explores how swaps can be viewed as a series of forward contracts, highlighting key differences with practical examples.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeForwards and swap contracts are essential financial instruments for risk management and speculative purposes. While they share significant similarities, there are also notable differences between them. In this article, we’ll explore how swaps are like—yet distinct from—a series of forward contracts.

Forwards vs Swaps: Similarities in Contracts

At their core, these contracts are traded over the counter (OTC) rather than on organized exchanges, which means they involve a certain degree of credit risk between the two parties. Additionally, both instruments typically have an initial value of zero when the agreement is made. Over time, as market conditions change, their value fluctuates, and at maturity, it reflects the net settlement between the parties.

Swaps involve the exchange of cash flows at predetermined intervals, and each payment within a swap resembles a separate forward contract. In both cases, today’s agreement concerning a future transaction based on terms set at the initiation is present. This fundamental similarity often leads to the view that a swap can be thought of as a collection of forward contracts.

Forwards vs Swaps: Differences in Contracts

Despite these parallels, there are essential structural differences. In a swap, the agreement typically has a zero value at the start, but the individual payments implied within it do not necessarily align with zero-value forward contracts. This is because not every forward contract corresponding to a payment period within a swap would independently have a zero value at the initiation.

Moreover, while swap payments are fixed upon agreement, the pricing of forward contracts is dynamic. Each forward implied by a swap has a different rate based on future market expectations, making them “off-market forwards.” Unlike standard forwards priced to have zero initial value based on non-arbitrage principles, the implied forwards within a swap often reflect either a premium or discount relative to current forward market rates.

A Practical Example

Consider a simple example to better understand this relationship—particularly in the context of forwards vs swaps. Suppose Ben takes a $10,000 loan from Bank A and simultaneously deposits the same amount into the bank. They agree that Ben will pay a fixed 6% interest rate monthly over three months, while the bank will pay Ben a floating rate of 5% at the end of month one, 6% at month two, and 7% at month three.

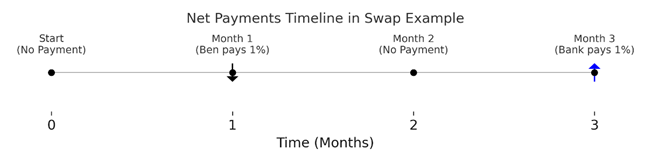

The swap is initiated at zero, with no cash flows being exchanged. At the end of month one, Ben’s obligation at 6% exceeds the bank’s obligation at 5%, meaning Ben pays the bank the 1% difference. By month two, both rates are equal at 6%—resulting in no net payment between the parties. At month three, the floating rate surpasses the fixed rate, and the bank owes Ben a 1% payment. Only net differences are exchanged throughout the swap’s life rather than full cash flows.

Net Payments Timeline

If we view this through the lens of forward contracts—a vital perspective when considering forwards vs swaps—the first forward would be initiated at time zero and settled at the end of month one. A second forward would start at the end of month one and mature at the end of month two, and a third would begin at month two and expire at the end of month three. But each of these forward contracts would have a different initial value because of the differences in expected future rates and, therefore, would not individually start at zero value. When combined, though, the sum of their values would equal zero at the beginning of the swap.

While a single-period swap can be nearly identical to a forward contract, a swap spanning multiple periods comprises several distinct off-market forward contracts.

Forwards vs Swaps: Structure and Valuation

Forwards vs Swap contracts are closely related through their structure and purpose, yet their valuation and cash flow timing differences are crucial to understanding. A swap can be considered a carefully structured series of forward contracts, each tailored to specific future dates and priced individually. This distinction is crucial when managing risk, pricing derivatives, or designing financial products.

A clear grasp of these similarities and differences equips professionals to navigate the complexities of modern financial markets better, and the 365 Financial Analyst platform can help you master risk management, derivative pricing, and financial product design confidently.