Corporate Debt: Understanding Debt Capital

Understanding debt capital is essential in corporate finance. This guide explores the various instruments corporations use to raise debt, such as bank loans, corporate bonds, and commercial papers, highlighting their strategic applications and associated risks. Whether you’re an aspiring finance professional or an experienced executive, mastering these tools is crucial for effective financial management.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeAre you curious about how corporations secure funding through debt? This guide addresses corporations’ various instruments to raise debt capital, highlighting their advantages and complexities. Unlike equity financing, debt involves borrowing funds that must be repaid—often with interest—and offers benefits like tax advantages and control retention.

We’ll examine various debt instruments—from traditional bank loans to corporate bonds and commercial papers—highlighting their strategic uses and inherent risks. Whether you’re a finance student, an entrepreneur, or an experienced executive, understanding these tools is crucial for effective corporate financial management.

Bank Loans: The Traditional Route

Bank loans—often considered a form of debt capital—are a cornerstone of corporate financing globally. These loans may have fixed or, more commonly, variable interest rates tied to benchmarks like LIBOR. (Note that LIBOR was phased out in 2023.)

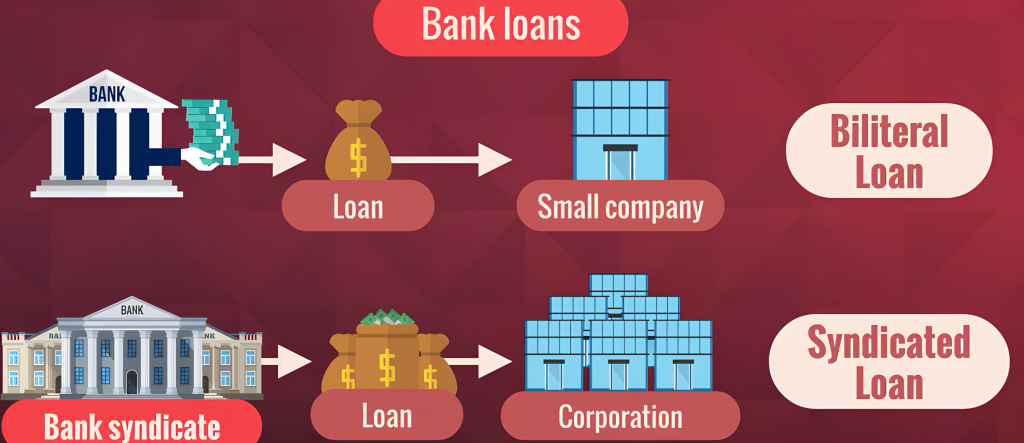

Bilateral and Syndicated Loans

Typically, a single bank issues bilateral loans. For more significant needs—such as business expansion—corporations might opt for syndicated loans from a consortium of banks, thereby sharing the risk and loan amount.

Despite their utility, bank loans have limitations in scale and flexibility, prompting firms to explore other financing avenues.

Corporate Bonds: A Versatile Alternative

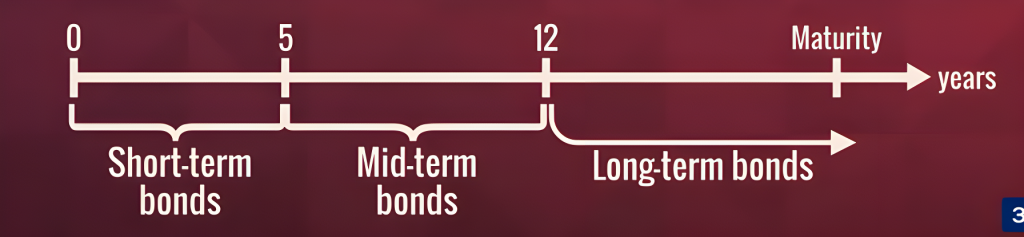

Maturity Spectrum of Bonds

Understanding the maturity spectrum of bonds is crucial for investors and issuers alike. Bonds can be classified into short-term, mid-term, and long-term categories, each with their own strategic uses and risks.

- Short-term bonds typically mature within 0 to 5 years and are often used for quick financing needs with lower interest rate risk.

- Mid-term bonds mature between 5 and 12 years, balancing yield and duration risk.

- Long-term bonds mature after 12 years and can lock in rates for long periods, but they carry higher risk due to fluctuations in interest rates and economic conditions over time.

Why Issue Bonds?

Issuing bonds—albeit complex—offers significant benefits over bank loans, another form of debt capital. Bonds typically incur lower interest costs and impose fewer restrictions. Unlike bank loans—which may come with stringent covenants—bonds provide greater operational freedom.

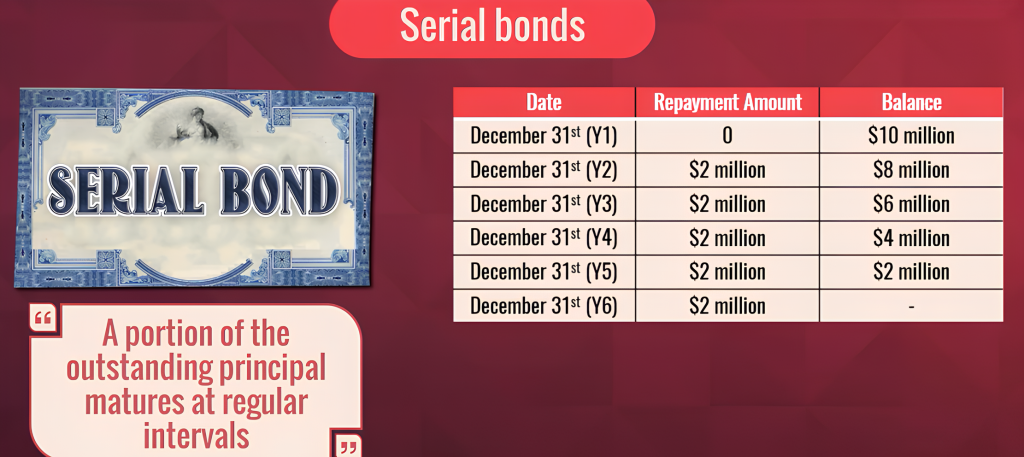

Serial and Term Bonds

Serial bonds mature in increments, reducing credit risk by gradually decreasing the principal owed. An example is a $10-million bond issue with $2 million maturing annually over five years.

Conversely, term bonds mature all at once on a set date—as would be the case if the $10-million issue matures in six years.

Medium-Term Notes (MTNs)

MTNs—a special case of corporate debt capital—are a special case of corporate debt that can be issued across various maturity ranges. They’re usually repaid within 5 to 10 years but potentially extend up to 100 years. These notes are highly customizable; investors can specify their preferred face value and maturity within the available ranges.

Once specified, an agent confirms the issuer’s willingness to sell these notes—making MTNs continuously offer tailored securities for specific buyers. This flexibility in terms and conditions makes MTNs attractive to issuers and investors.

Commercial Paper: Short-Term Financing

Large corporations often issue commercial paper to manage short-term financial needs, such as payroll. These unsecured notes are exempt from SEC regulation if their maturity is under 270 days—facilitating quick turnover and reduced compliance.

Market Conditions and Rollover Risk

Commercial paper is subject to rollover risk, which becomes critical during market downturns. The need for continual refinancing means companies must be able to issue new papers as old ones mature.

During financial crises—such as the one in 2008—even financially stable companies can find themselves unable to roll over their debt capital, such as commercial paper, due to a freeze in market liquidity. This forces them to seek other forms of financing, often at higher costs, to bridge the gap.

Yield Calculations: Discount and Add-On

Calculating returns on commercial papers is crucial for understanding their value as short-term investments. Note how discount and add-on yields are calculated:

- Discount Yield: Investors purchase the paper at a discount, and the yield is calculated based on the difference between the purchase price and the face value at maturity.

- Add-On Yield: The yield is added to the principal amount, and investors receive the total of the initial investment plus yield at maturity.

Investors focus on yields when considering commercial papers. As seen above, a 270-day commercial paper with a par value of $100 and a holding period yield of 1.45% might be quoted with a discount yield, priced at $98.57 at issuance, and pay $100 at maturity. Alternatively, if quoted with an add-on yield, it would pay $101.45 at maturity.

Debt Capital Options: Types, Uses, and Risks

Corporations have various debt instruments to meet financial needs, from traditional bank loans and versatile corporate bonds to short-term commercial papers. Each type has specific uses, benefits, and risks, forming a complex corporate finance landscape.

Discover the intricacies of debt capital in corporate finance and enhance your understanding by joining the 365 Financial Analyst platform.