Money Market Instruments: Bank Discount Yield

Money market instruments like treasury bills are key tools for short-term investing due to their liquidity and low risk. A common way to measure their return is through the bank discount yield, which annualizes the discount based on face value. While quick and simple, this method has limitations that investors should understand for accurate performance evaluation.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeInvestors often purchase short-term bond instruments to diversify their portfolios. Evaluating the performance of these securities requires specific return measures tailored to their short duration and high liquidity. One commonly used metric in this context is the bank discount yield (BDY), which helps assess returns on instruments like treasury bills. Before exploring these metrics, let’s review some foundational concepts related to the money market.

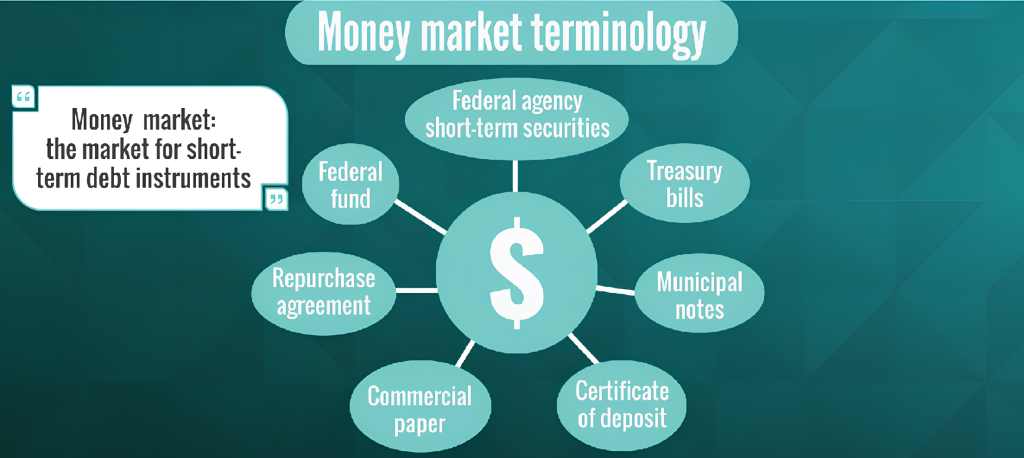

Understanding the Money Market

The money market is where short-term debt instruments (highly liquid and low risk) are traded. These securities are so liquid they can be quickly converted to cash with minimal price fluctuation. Investors benefit from this liquidity because they can sell these instruments instantly when needed.

Two Types of Instruments

Money market securities generally fall into one of two categories:

- Interest-bearing instruments—where borrowers repay the principal plus interest (like traditional loans)—are commonly used forms of debt financing.

- Pure discount instruments are sold below face value and do not pay periodic interest. Instead, investors earn a return from the difference between the purchase price and the face value repaid at maturity.

U.S. Treasury Bills: A Prime Example

U.S. Treasury bills (T-bills) are the most widely recognized pure discount instruments. Issued and backed by the federal government, T-bills carry virtually no default risk. Investors buy them at a discount and maturity; the government repays the full-faced value. For example, a $1,000 T-bill purchased for $980 will yield a $20 gain when held to maturity.

Calculating Return: Bank Discount Yield

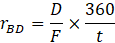

Instruments like T-bills are quoted using what’s known as the bank discount basis. This method converts the discount given as a percentage of the face value into an annualized rate. To understand how this works, let’s look at how the yield on a bank discount basis (BDY) is calculated using the following formula:

rBD represents the annualized yield on a bank discount basis, and D is the dollar discount—the difference between the T-bill’s face value and its purchase price. F is the face value of the bill, t is the number of days until maturity, and 360 is the day-count convention used in banking to represent one year.

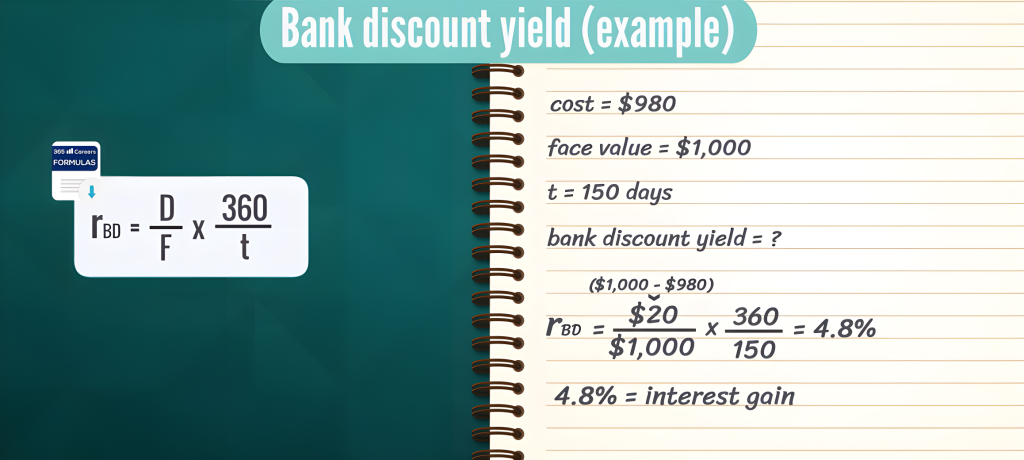

Calculation Example

Suppose we purchase a T-bill for $980, with a face value of $1,000 and 150 days remaining until maturity. What is the bank discount yield on this investment?

Using the (above) formula, we plug in the values:

We first calculate the dollar discount by subtracting the purchase price from the face value. Then, we divide that by the $1,000 face value and multiply it by 360/150. The result (4.8%) represents the yield earned by holding the T-bill to maturity.

Limitations of Bank Discount Yield

Now, let’s look at some limitations of using the bank discount yield.

There are three key reasons why it doesn’t accurately reflect the actual return investors earn.

- Face Value Bias

The bank discount yield is calculated based on the bond’s face value rather than its purchase price. Returns should always be measured against the invested amount, not the face value. - 360-Day Assumption

The BDY assumes a 360-day year instead of the more realistic 365-day calendar year, which slightly overstates the yield. - No Compounding

The bank discount yield uses simple interest, ignoring the effect of compounding—i.e., the ability to earn interest on interest.

Bank Discount Yield Measures

While the bank discount yield offers a quick way to quote returns on discount instruments like T-bills, its reliance on face value, a 360-day year, and simple interest limits its accuracy. For a more precise understanding of investment performance, especially when comparing different securities, investors should consider alternative yield measures that account for actual investment cost, compounding, and a more realistic time basis.

To deepen your knowledge and master more accurate financial metrics, consider joining the 365 Financial Analyst platform for expert-led training and hands-on practice.