M&A Deals Lifecycle

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

At what point of a company’s lifecycle can we expect M&A deals?

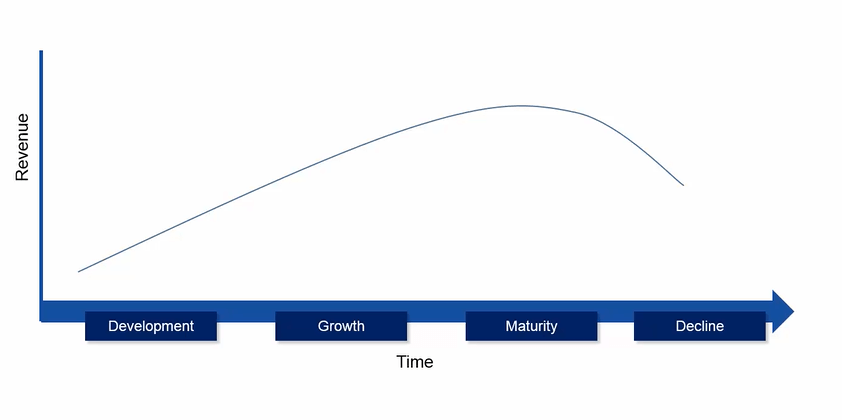

Let’s look at the following graph. It depicts the various stages that a company goes through. The horizontal axis shows the development of time, and the vertical axis explains the revenue that the company is expected to generate at a given stage of its development.

The four stages are:

- Development – these are the early days of the company, when it makes little to no money and is still a start-up

- Growth – an exciting period, when the company breaks through and sells more of its products

- Maturity – businesses become very profitable and competition increases significantly

- Decline – the company loses market share because of a declining product portfolio or substitute products; gradually, its profitability declines and it starts to burn cash

All right! So these are the four stages a company goes through.

Let’s look at these stages in the context of M&A!

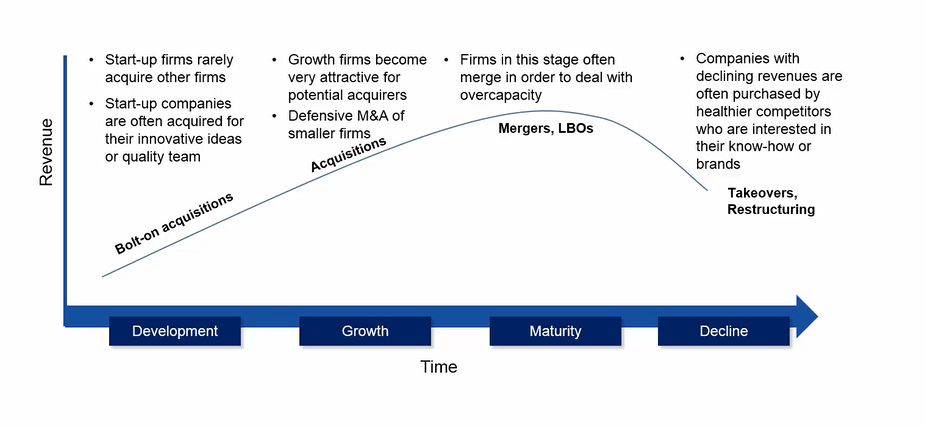

How likely is it that a company will buy other companies in its early start-up days? No, it won’t, right? It has no money to do that! Start-up firms are often acquired for their innovative ideas or quality team. They are ideal for the so-called “bolt-on acquisitions” being relatively cheap and full of upside.

Growth firms are an attractive target for larger companies. The established players in an industry have specific departments with people who carefully study such growth firms. These companies aren’t the typical buyer, either. They have lots of opportunities to grow organically and use their cash to invest in their own business.

Mature firms are frequent buyers of start-up and growth companies. Understandably, these companies are cash rich and can afford to acquire external growth when they need it.

At this stage of development, it is not infrequent to observe mergers of equals too. The main purpose of these transactions is dealing with overcapacity. If there is too much competition within an industry, the merger of two competitors makes sense.

Another type of transactions frequently observed at this stage are Leveraged Buyouts, which are very peculiar.

And finally, we have the declining stage. Companies in this stage of development aren’t very attractive in terms of growth potential and profitability. This doesn’t mean they don’t have quality assets. Often, these companies are acquired for their name, brand, patents, know-how, historical relationships, or access to distribution channels. These are established businesses that have become obsolete with time and need a complete turnaround.