Budgeting Approaches: Top-Down Budgeting vs Bottom-Up Budgeting

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

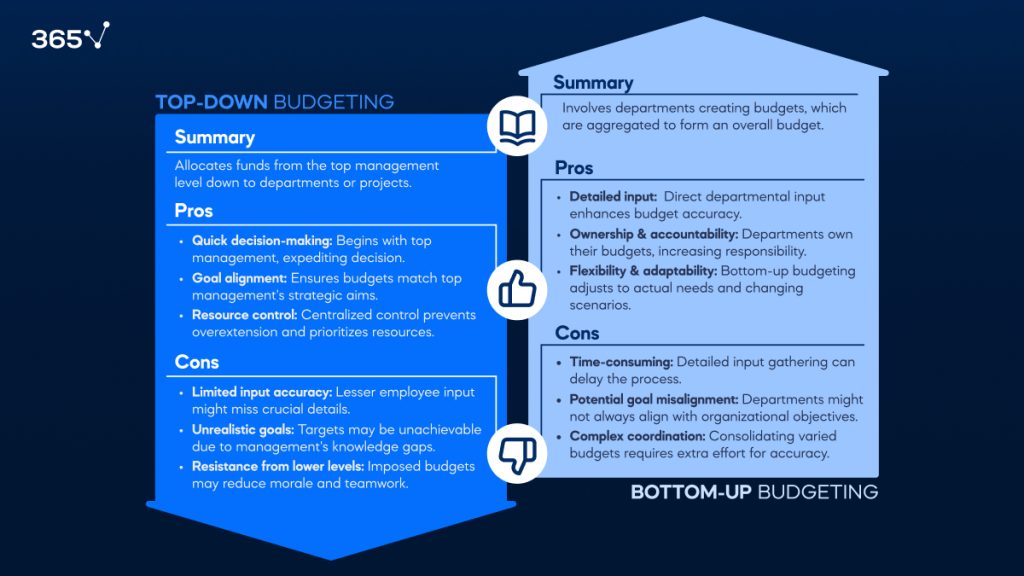

In Financial Planning and Analysis (FP&A), two predominant budgeting approaches have consistently vied for prominence: bottom-up budgeting and top-down budgeting. While both methodologies aim to allocate resources efficiently and align with organizational objectives, their derivation and execution differ significantly.

The bottom-up budgeting begins at the grassroots, accumulating input from individual departments or projects and consolidating them into the overall budget. In contrast, the top-down approach sees senior management setting the overarching budgetary goals, which are then allocated downward to various departments.

This article delves into the intricacies of both budgeting approaches, weighing their advantages, challenges, and best-fit scenarios to guide businesses in making informed budgetary decisions.

Bottom-Up Budgeting

The bottom-up approach starts from the lowest level of detail, where finance professionals compile inputs into a comprehensive model, forming budget expectations.

Each department assesses its own financial needs and requirements, formulating a budget later submitted for consolidation on an overall organizational level. This method offers a detailed and realistic understanding of the needs and challenges of each department. While it encourages greater employee participation and fosters ownership—leading to enhanced commitment to budgetary goals—it can also be time-consuming. Additionally, the combined sum of all departmental budgets may exceed the organization’s financial capability.

Suppose you’re the Sales Manager at Spaceland, a boutique hotel in the heart of Hokkaido, Japan. Your task is to use the bottom-up approach to predict the company’s annual revenue for the coming year.

How do you choose among the budgeting approaches? Start with a presumed 3,000 total rooms in the hotel.

Then, you contemplate seasonal variations in occupancy, with 60% as a reasonable average based on past data.

With this information, you can easily calculate the expected rooms to be sold by multiplying the room count by the occupancy rate:

Number of available rooms × Occupancy rate = Expected number of rooms to be sold

= 3,000 × 60% = 1,800

Finally, multiply the result by the average daily rate charged per room ($100) to obtain the expected revenue for next year:

Expected number of rooms to be sold × Average price per room = Expected revenue

= 1,800 × $100 = $180,000

Top-Down Budgeting

The top-down budgeting approach starts with macro indicators and works down to micro ones. It is driven by the organization’s senior management or central budgeting team. In this approach, the leadership determines the total budget amount first and then allocates specific portions to the various departments or projects. This method ensures that the overarching budget aligns with the strategic goals and priorities of the organization. It often allows for quicker implementation since it sidesteps the need for detailed input from every department. One of its drawbacks is that it might not always capture the nuanced needs of individual departments, and it can sometimes lead to feelings of exclusion among employees not directly involved in the decision-making process.

Let’s calculate the expected annual revenue of Spaceland Hotel using top-down budgeting. For this, we will require a different set of data.

Suppose 20,000 annual tourists visit Hokkaido. With a 20% market share, Spaceland expects around 4,000 bookings next year.

Number of tourists × Market share = Expected number of hotel guests

= 20,000 × 20% = 4,000

In the hospitality industry, assuming a double occupancy rate is typical. Following this practice, Spaceland has 2,000 occupied rooms:

Expected number of hotel guests / 2 = Expected number of hotel rooms

= 4,000/2 = 2,000

Finally, we multiply the projected number of rooms by the average price per double-bed room ($100) to obtain the expected annual revenue of $200,000:

Expected number of rooms to be sold × Average price per room = Expected revenue

= 2,000 × $100 = $200,000

Because both approaches use different variables, results may vary, though only sometimes significantly. Therefore, organizations should choose a budgeting technique that suits their needs.

Choosing a Budgeting Approach

The following three aspects determine which budgeting approach to employ:

- The time frame in question

- The desired level of forecasting accuracy

- The extent of details available

For short-term planning, firms typically compare both approaches to triangulate the results—meaning that the bottom-up and top-down methods should agree on similar projections. In our example, Spaceland’s management should agree on revenue expectations for the next year between $180,000 and $200,000. Organizations will often take the average of the two.

Firms avoid the bottom-up approach for long-term projections due to numerous unpredictable variables. Lack of detailed data renders it ineffective for strategic planning, leading them to opt for top-down budgeting, which requires less detail.

Budgeting Approaches: Advantage and Disadvantages

Both bottom-up and top-down budgeting come with their distinct set of advantages and disadvantages.

Based on individual department inputs, the bottom-up budgeting frequently yields a meticulously customized budget that mirrors each unit’s unique needs and challenges. This level of detail can boost employee morale and foster a sense of ownership, as it directly involves them in the budgeting process. But this detail-oriented approach can be time-consuming and occasionally result in an aggregate budget that exceeds the organization’s total financial capacity.

On the other hand, top-down budgeting—guided by the organization’s overarching goals—ensures alignment with broader strategic objectives and is often quicker to implement. Yet, this method might occasionally overlook the specific needs of individual departments, potentially leading to resource mismatches. Additionally, the lack of input from lower-level employees can sometimes result in feelings of detachment or reduced buy-in for the proposed budgets.

In summary, while bottom-up budgeting offers a detailed perspective built from the ground up, top-down budgeting provides a broader, strategic view directed by organizational leadership. Their choice often hinges on the organization’s size, culture, and specific objectives.

Budgeting Approaches: Next Steps

Regardless of the budgeting approach they choose to implement, companies always follow specific steps. We advise familiarizing yourself with the Key Steps of Budget Preparation.

Why not take your finance career to the next level?

Enroll in our Financial Analyst Career Track to enhance your expertise in financial principles and concepts. Gain experience in interpreting data and making informed decisions. The program covers diverse aspects of business, enabling you to apply skills in a dynamic environment. Sign up for free today.