FP&A Guide: Budget Preparation Steps

Budget preparation steps

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

An organization’s Budget is often said to be its “business compass.” Learning to identify financial objectives and factor in potential complications, isn’t only the priority of companies, of course. A clear indicator of that is the proliferation of personal budgeting apps in recent years. As it is practiced in the business world, budget preparation is a core function of financial analysis. And unfortunately, there are no apps or shortcuts for it! Here’s what you need to know to get started:

What Is Budget Preparation?

To complete the Budget of an organization, the responsible parties must understand its current operations in detail, so that they can set the proper goals ahead. It essentially involves the coordination of finance and non-finance objectives and efficient communication across the whole organization.

There are two main approaches to budget preparation:

Bottom-up budgeting begins by analyzing specific entity details, such as projected sales units, historical product sales rates, and ultimately calculating projected revenue.

Top-down budgeting begins with broad macro-indicators—such as potential consumer numbers and market share—before considering factors like units and pricing to forecast revenue.

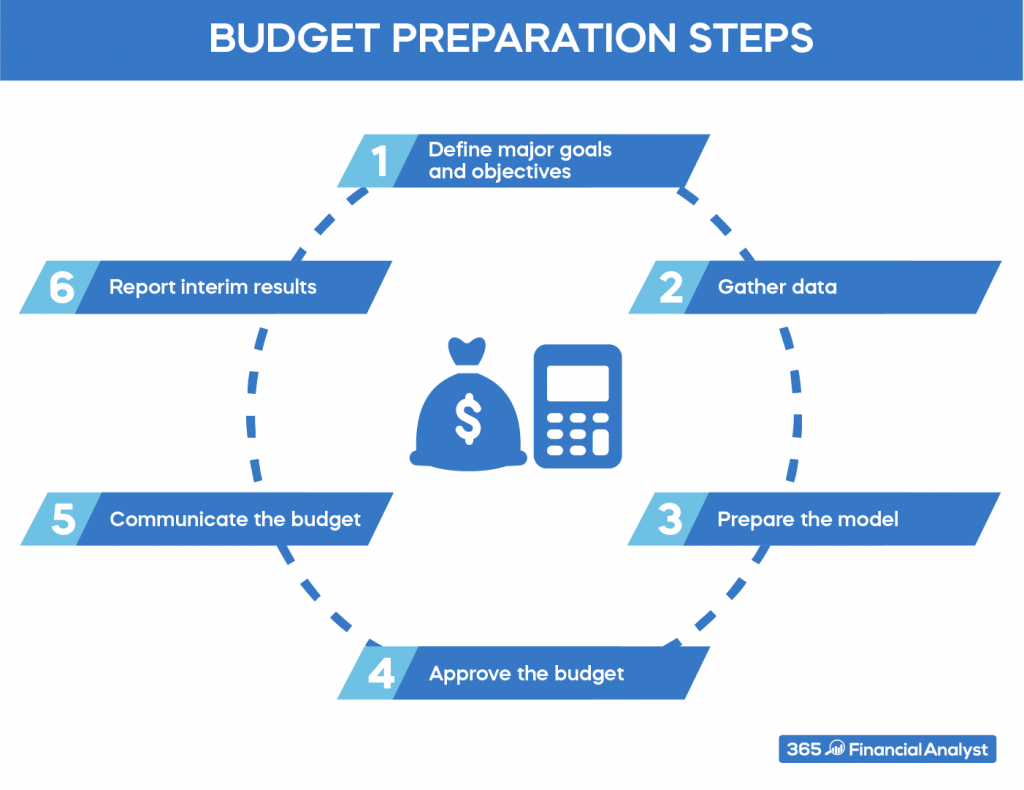

What Are the Steps to Budget Preparation?

For most companies, the budgeting process requires several months to complete. Some even take an entire fiscal year to prepare the Budget for the next one. Typically, budget preparation is continuous in nature, with the firm building up its projections on predefined goals and objectives.

An organization typically follows several steps when drafting a budget.

Budget Preparation – Step 1: Define Major Goals and Objectives

These are the quantitative expectations of the company’s future performance. Let’s say that a firm aims at a 5% growth in profitability for the next year. How does it achieve that? Does it expect higher sales? Will cost reduction contribute to this goal? Answering these questions requires the company to prepare a detailed budget, breaking down the overall objective into smaller targets.

Budget Preparation – Step 2: Gather Data

Here, the department heads provide their estimates and assumptions on the expected sales, production levels, availability of resources, planned restructuring, and so on. Every department or sub-structure in the organization comes up with its own plan and puts it forward for further consideration.

Budget Preparation – Step 3: Prepare the Model

Once data gathering is complete, the managers pass the estimates over to the Budget Committee, which compiles all the information available and prepares the model. A Budget Committee is a group of people (usually members of the finance team) that bears the overall responsibility of the budgeting process. Quite often, they do some overall adjustments to synchronize the views of all the individual preparers. For instance, if the HR department and the Production department set different priorities, these should be properly aligned.

Budget Preparation – Step 4: Approve the Budget

Upon preparing and synchronizing the model, the Budget Committee is ready to approve the final Budget. As soon as the final sign-off is complete, they move on to disseminating the report down the line.

Budget Preparation – Step 5: Communicate the Budget

After Budget approval, the Budget Committee should communicate it to the department managers in charge. The Sales Managers are primarily responsible for implementing the Sales Budget, so they need to be aware of the specific changes in revenue targets for the next year. Production managers should know the approved production levels and plan their resources accordingly. It’s a whole process that thrives on teamwork and cooperation!

Budget Preparation – Step 6: Report Interim Results

Overall, budgeting requires effective communication across departments—not only upon preparation but also during implementation. To that end, reporting interim results is the next key step to consider. Most importantly, financial analysts should monitor major variances and explain the reasons for them.

What’s Next?

These are the basic principles of preparing a company budget workable for the neighborhood flower store and multinational corporations alike. Experienced sales managers and business planners know, however, that there’s a lot more that goes into the actual preparation and implementation of a Master Budget. This document comprises several others – the Operating, Cash Flow, and Capital Budgets – and provides a detailed picture of the company’s financial goals. It is prepared through collaboration between management personnel across different departments, and with the help of managerial accountants who specialize in gathering and analyzing data to enable better budgeting decisions.

But even the most precise budget can sometimes fail to account for unpredicted variations.

Beyond Budgeting

Suppose that the monthly Payroll Expenses for January come up at $100 million, whereas the Budgeted ones are set at $90 million. Why did the variance occur? Was the budget set unreasonably low? Were there any extraordinary charges not considered in advance?

You need to find the reason by examining those variations. Many companies use this feedback as a basis for preparing next year’s annual business plan. With time, you can adjust and revise the goals and expectations and start all over again in the following financial period.

Just like budgeting, variance analysis is a never-ending process that goes along with the company’s operations and you’re likely to encounter it early on in your professional practice.

To can start learning how budgeting and variance analysis work with our course FP&A: Building a Company’s Budget. Find out how to analyze data, prepare a robust Master Budget, integrate financial models, and much more. This comprehensive training will set you up with the skills you need to tackle real-world tasks as a true and tested financial analyst!

Ready to Take the Next Step toward a Career in Finance?

Whether you are a total beginner or a working professional, our Financial Analyst Career Track has what it takes to build up your knowledge and grow your expertise at your own pace. Find the right fit for you and start learning today!