Horizontal vs. Vertical Models

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

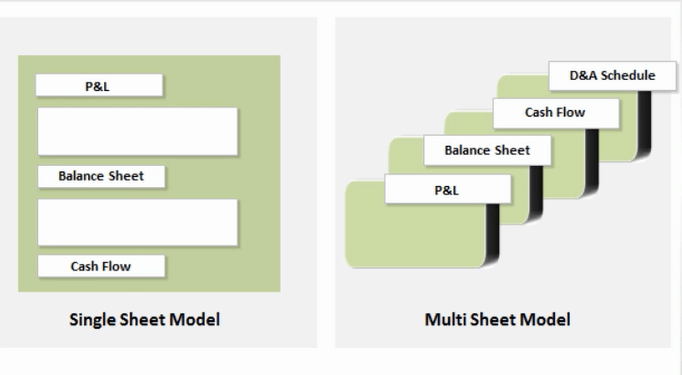

There are two types of financial models – single and multi-sheet models. Single sheet or also known as vertical models contain the different areas of the model on a single sheet, while a multi-sheet model is composed of separate sheets for every single area of the model.

In general, single sheet models are used when the model that has to be created is smaller- it will include fewer drivers and will not be very detailed. They are easy to use and simpler to understand, which is a very good thing. The problem is that at some point, the model might expand and include additional parameters that were not considered before. If a single page model expands too much, it becomes difficult to manage. Typically a one page model will include the following sections:

- Assumptions

- Calculations

- Income Statement

- Balance Sheet

- Cash Flow

- Summary

With multi-sheet models every sheet will represent a different section of the model. There will be a separate sheet for the Assumptions, Income Statement, Balance Sheet, Cash Flow, D&A schedule, Debt schedule, Historical Inputs, etc.

Naturally, multi-sheet models are better positioned for more complex structures and higher level of detail.