Liquidity Management

Liquidity management ensures a company’s financial stability and operational continuity. Effective management involves maintaining sufficient cash flow and strategically utilizing liquidity ratios to anticipate and mitigate financial challenges. This proactive approach is vital for navigating the complexities of business finances and fostering long-term growth.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeLiquidity describes a company’s ability to convert assets into cash quickly and without significant loss, meeting short-term financial obligations. Consider its practical implications. Some companies—flush with excess cash—rarely face liquidity concerns. For instance, Apple once boasted over $250 billion in cash—focusing on optimizing these reserves for productivity rather than just covering short-term needs. Conversely, firms under financial strain must prioritize effective liquidity management to maintain solvency. Regrettably, the value of this practice is often realized too late.

What Is Liquidity Management?

Liquidity management involves a company’s ability to access cash when needed. This requires effective management of all primary and secondary liquidity sources.

Primary liquidity sources used daily are the most accessible assets and include:

- Ready cash balances derived from sales, receivables, and investment income

- Short-term funds like trade credits and bank credit lines

- Efficient cash flow management, such as centralized collections to prevent cash from being tied up in subsidiaries

Secondary liquidity sources—key to liquidity management—are not part of regular company operations but could significantly affect their financial structure. After depleting primary options, companies resort to these sources only in urgent cash shortages.There are three types of secondary liquidity sources.

- Liquidating assets: Selling short- or long-term assets below market value for quick turnover

- Debt renegotiation: A strategy to persuade creditors to temporarily suspend interest and possibly principal payments to protect their loans

- Bankruptcy: If other measures fail, a company may file for bankruptcy and reorganization to protect itself from creditors while restructuring under court approval.

Utilizing these sources often signals a company’s financial health decline, posing risks to investors.

Influencing a Company’s Liquidity Position

Factors influencing a company’s liquidity position in liquidity management include cash inflows and outflows, summarized by the adage “Collect early and pay late.” Improved liquidity results from faster cash receipts than payments—exemplifying effective working capital management.

Liquidity drags and pulls directly influence a company’s cash flow by delaying inflows and accelerating outflows.

Liquidity Drags

Liquidity drags—such as uncollected receivables and obsolete inventory—delay or reduce cash inflows, straining available funds under liquidity measures. Moreover, tight credit conditions can worsen liquidity issues by increasing borrowing costs and limiting access to short-term capital.

Liquidity Pulls

Conversely, liquidity pulls—a core focus of liquidity measures—accelerate cash outflows. Early payments, for example, diminish funds that could otherwise yield returns through short-term investments. Reduced credit limits may compel more frequent payments—adversely affecting liquidity and supplier relationships.

Remember: “Collect early and pay late.”

Likewise, restrictions on short-term credit lines could lead to liquidity problems in liquidity management. Companies are likely to face liquidity crises if banks cut their credit lines. To avoid this, firms often secure more credit than needed—a practice known as “overbanking,” common in emerging economies or unstable banking systems.

Analyzing Company Liquidity with Ratios

Measuring and comparing company liquidity involves analyzing a set of ratios that reflect the relationship between current assets—like cash, marketable securities, accounts receivable, and inventory—and current liabilities. This analysis is vital for effectively managing liquidity. We use such liquidity ratios as the current and quick ratios to gauge liquidity.

Current Ratio Dynamics

The current ratio is calculated by dividing a company’s current assets by its current liabilities:

A higher current ratio indicates a company’s stronger ability to meet short-term obligations, a key aspect of liquidity management. A current ratio below one suggests negative working capital, typically signaling insufficient cash to cover short-term debts—although there are exceptions.

For example—despite a current ratio under one—Walmart effectively manages its short-term obligations through advantageous payment terms with suppliers, no customer credit, and efficient inventory management.

So, liquidity ratios—while indicative—must be interpreted in context to assess a company’s financial healthfully.

Context and Implications

Various transactions influence the current ratio. For instance, when a firm issues long-term debt to raise capital, it temporarily boosts cash flow, improving the current ratio. But this also increases long-term debt—highlighting the need not to evaluate the current ratio in isolation. Instead, analyzing trends over time and comparing them with peer companies provides a fuller understanding of their implications.

The relevance of a current ratio also varies depending on the perspective, particularly in liquidity management. For example, a supplier assessing whether to extend credit will scrutinize a company’s current ratio to gauge its financial health. If a firm struggles financially, it may delay payments and accumulate debt, leading to a rise in current liabilities. If liabilities outpace assets, the current ratio deteriorates—signaling potential risk for suppliers.

Shareholder View on Current Ratio

A company with a high current ratio compared to its peers might indicate excessive funds locked in nonproductive assets like surplus cash, securities, or excess inventory—heightening the risk of unsold goods and losses.

Consequently, shareholders tend to be wary of high current ratios. While an industry average isn’t a target for all companies to achieve—firms can manage working capital effectively even if their ratios deviate from the average—a consistently low ratio significantly below industry standards signals a red flag. In such instances, it’s crucial to determine the reasons behind the substantial discrepancy.

For instance, if a company’s low current ratio stems from minimal inventory, is this a result of efficient inventory management, or does it suggest missed sales due to underproduction? Although liquidity ratio analysis doesn’t provide definitive answers, it highlights potential areas of concern in liquidity management.

Quick Ratio Dynamics

Although the current ratio is useful, it may not accurately reflect a firm’s ability to meet short-term obligations. This is because it includes inventory, which is the least liquid form of current assets and often has a book value that does not reflect the market value or condition of the products. Inventory can be overvalued—leading to an inflated current ratio.

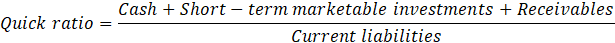

To address this issue, the quick or acid-test ratio—which excludes inventory—is used. This ratio focuses on “quick assets”—cash, short-term marketable investments, and receivables readily convertible into cash.

The quick ratio is calculated by dividing the sum of these quick assets by current liabilities:

A higher quick ratio indicates a greater likelihood that the company can cover its short-term liabilities.

The primary main distinctions in the measures we’ve addressed lie in treating a company’s current assets; unlike the current ratio, the quick ratio excludes inventory. Additionally, it’s crucial to consider various factors when calculating these metrics—including the historical trends and industry standards for each ratio.

Strategic Liquidity Management

Effective liquidity management is critical for maintaining a company’s financial stability and operational continuity. Companies must strategically manage their cash flows and understand the implications of their liquidity ratios—such as the current and quick ratios—to avoid insolvency and support growth opportunities. Proactive liquidity management prevents financial crises and positions a company for success in a competitive business environment.

By mastering these financial strategies through the comprehensive courses offered on the 365 Financial Analyst platform, you can take a proactive step towards safeguarding and enhancing your company’s financial health.