Holding Period Return and Yield Conversions

Holding Period Return (HPR) is a key metric for evaluating investment performance over time. This guide explains how to calculate HPR and convert it into standard yield measures like MMY, EAY, and BEY for clearer, standardized comparisons. Understanding these conversions helps investors make more informed decisions across various asset types.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeInvesting involves measuring returns to determine the success of financial decisions. One of the most fundamental ways to evaluate investment performance is by calculating the Holding Period Return (HPR). Whether you’re considering a single stock or a portfolio of bonds, understanding HPR and its related yield measures is essential. This guide walks you through the definition, calculation, interpretation, and conversion of various financial return metrics.

What Is Holding Period Return?

The Holding Period Return (HPR) represents the total return earned on an investment over the period it’s held. This return is expressed as a percentage of the initial investment value. The basic formula for HPR is:

This formula gives a snapshot of the return over the entire investment period, regardless of its length.

Cash Flows in HPR Calculations

In many cases, investments generate interim cash flows, such as dividends or interest payments. To account for this, we adjust the numerator of the HPR formula:

This modified version gives a more accurate representation of the total return earned.

Holding Period Return Examples

1: Treasury Bill

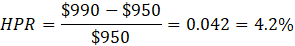

Suppose you purchase a T-bill for $950, and four months later, it’s worth $990. Since there are no additional cash flows, the HPR is calculated as follows:

The investment yielded a holding period return of 4.2% over four months.

2: Apple Stock with Dividends

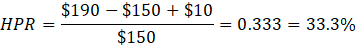

Imagine you buy one share of Apple for $150 and sell it a year later for $190. If Apple paid a $10 dividend during the year, the holding period return would be:

This means you earned a 33.3% return on your initial investment over one year—including price appreciation and dividends.

Yield Conversions: HPY, MMY, EAY, and BEY

Calculating the holding period return becomes progressively more complex when the investment pays additional cash flows. Imagine a situation where we have hundreds of stocks and bonds and need to calculate their holding period return.

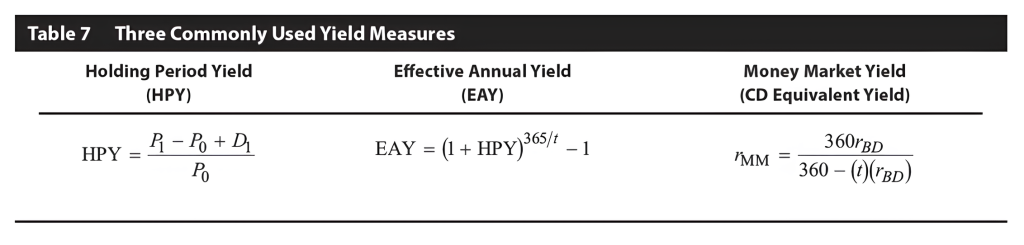

We focus on three commonly used return yield measures:

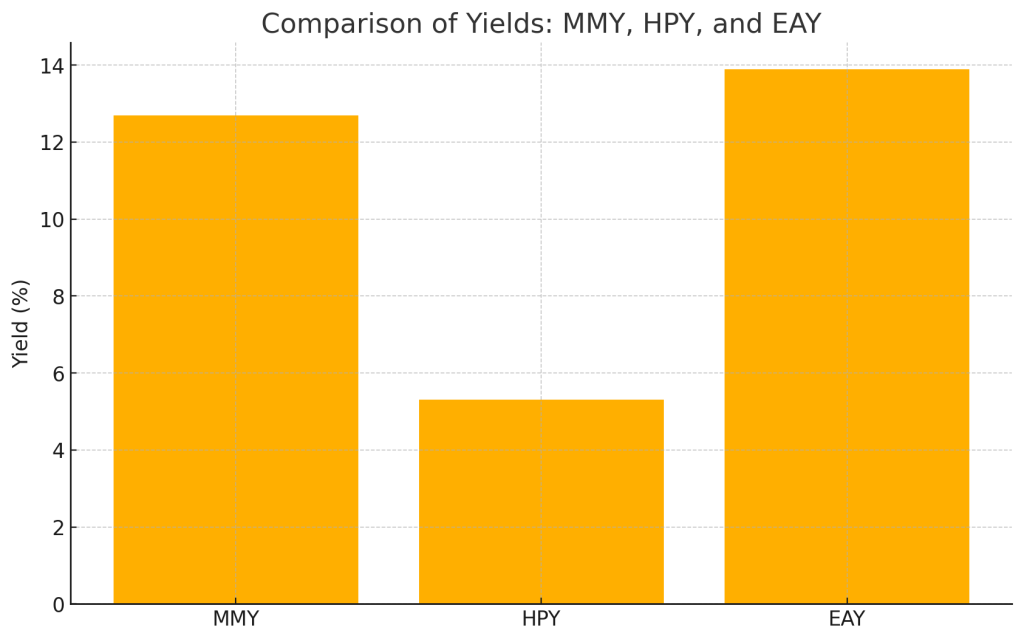

- Holding Period Yield (HPY): This is the actual return investors earn when they hold a security until its maturity.

- Effective Annual Yield (EAY): An EAY annualizes the holding period yield using a 365-day basis and incorporates compounding.

- Money Market Yield (MMY): This is an annualized return measure based on a security’s price. It ignores compounding and assumes a 360-day year.

Treasury Bill Yield Conversion

Suppose we buy a $1,000 T-bill that matures in 150 days for $950. The seller quotes the security using a money market yield of 12.7%. We want to calculate the holding period yield and the effective annual yield of the T-bill.

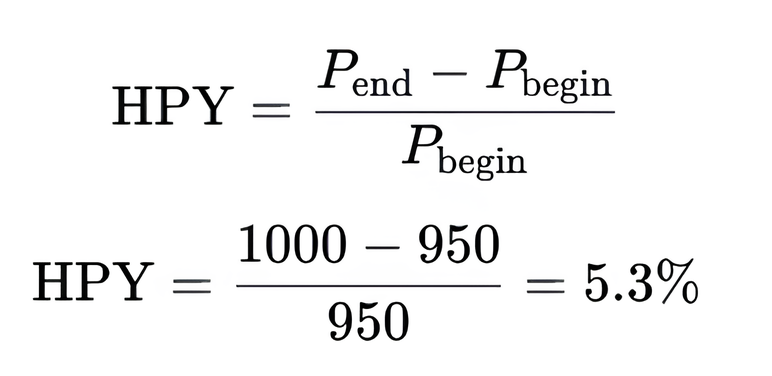

Step 1: Calculate HPY

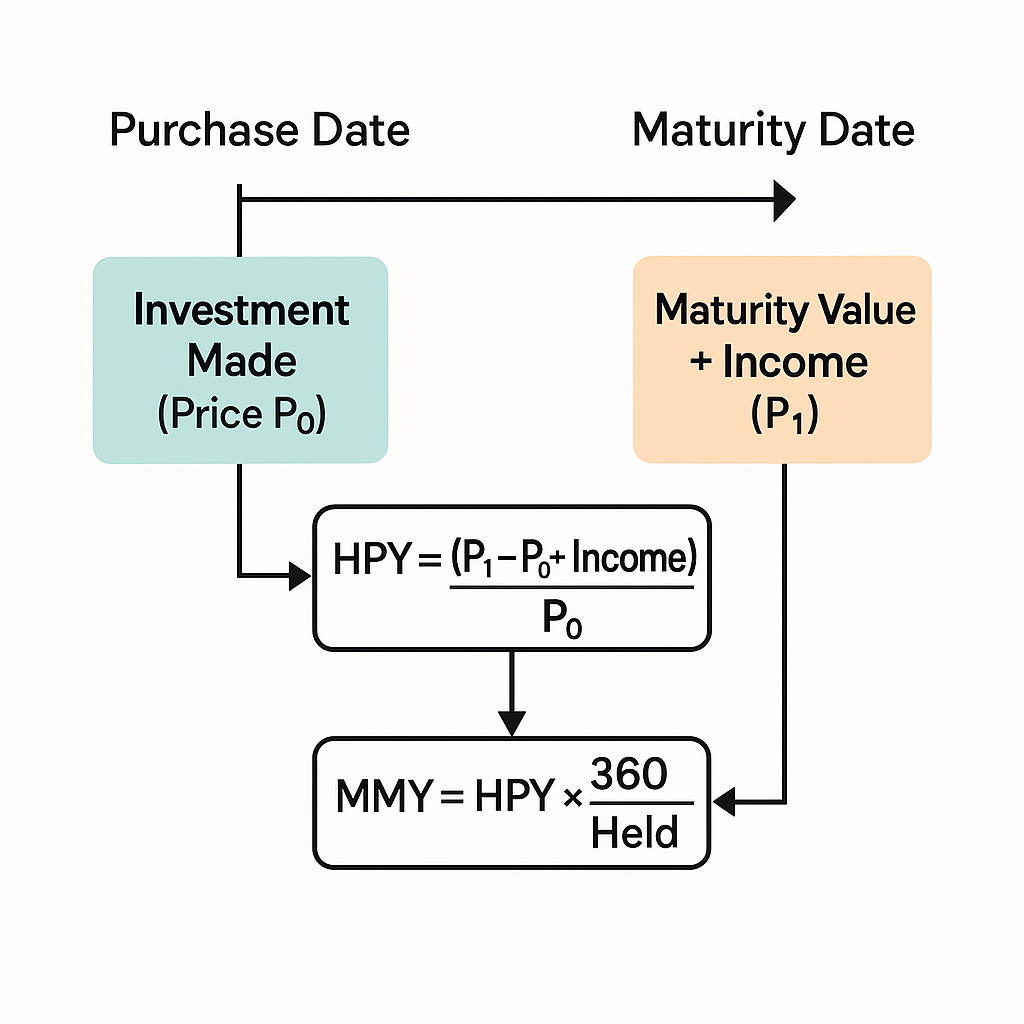

Using this formula calculates the total return earned over the investment period, combining price change and any income received:

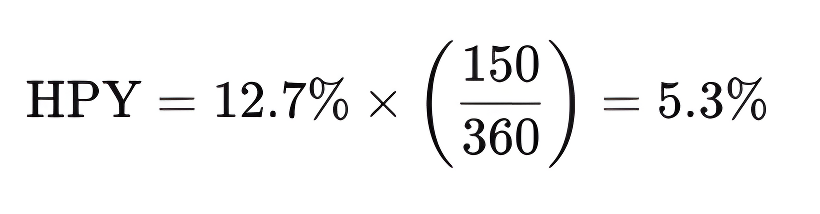

Alternatively, we can use the relationship between MMY and HPY:

This version simplifies the MMY calculation by expressing it directly in terms of the holding period yield and the number of days the investment is held.

Substituting the known values shows how MMY annualizes the HPY based on a 360-day year, which is standard practice for money market instruments:

HPY is not an annualized measure, while the money market yield is. This formula effectively transforms an annualized return into a periodic one.

The flow of return calculation from investment to maturity shows the conversion from HPY to MMY.

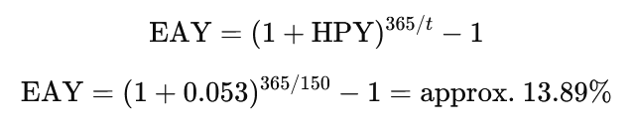

Step 2: Calculate the Effective Annual Yield (EAY)

Once we know the holding period yield, we can find the effective annual yield:

Notice that the EAY is higher than the money market yield because it uses a 365-day basis instead of a 360-day one and incorporates the effects of compounding.

Bond Equivalent Yield (BEY)

An additional measure of return is the bond equivalent yield (BEY). In the US, many long-term debt instruments, such as corporate bonds, pay interest semiannually. The BEY converts the semiannual yield into an annualized measure by simply multiplying it by 2—since there are two six-month periods in a year.

This approach ignores compounding. The bond equivalent rate is more of an approximation of the actual yield. Still, it’s widely used because it’s simple and easy to calculate.

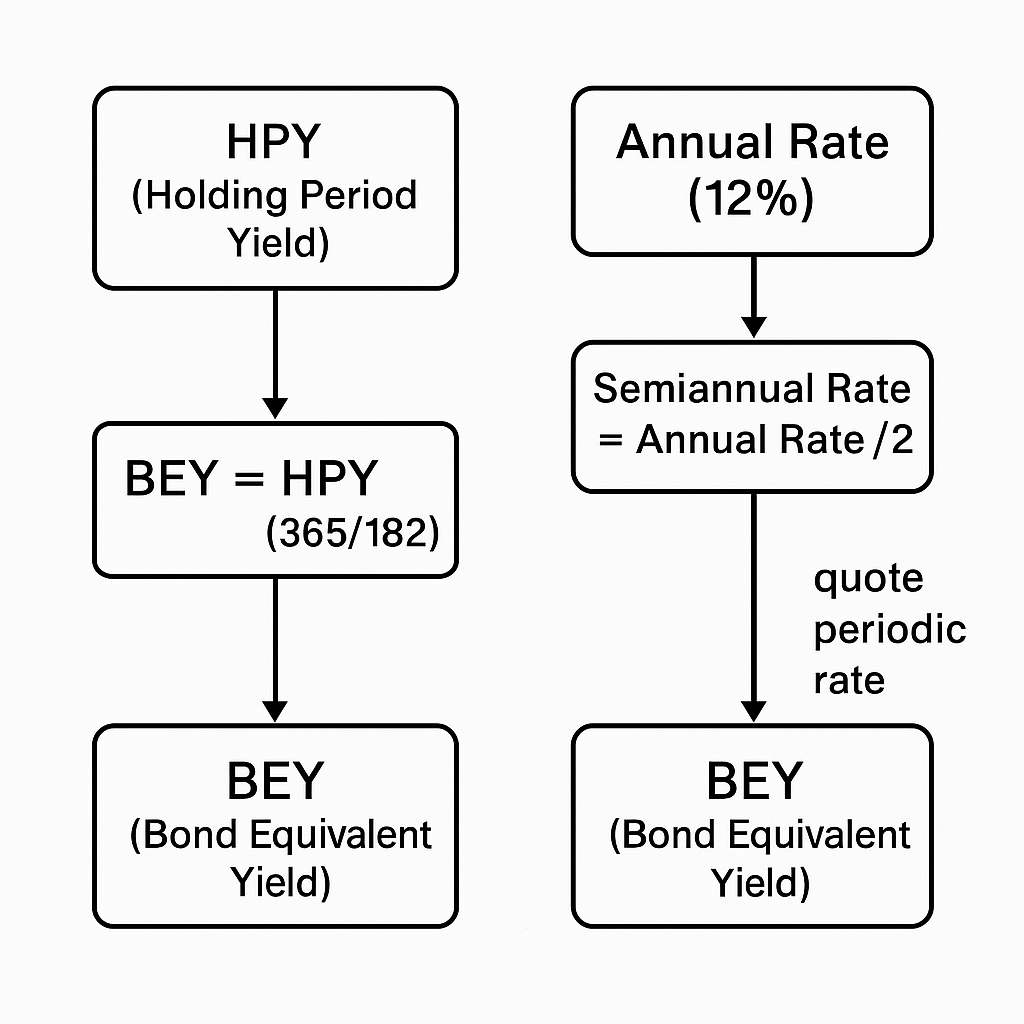

Converting from HPY to BEY

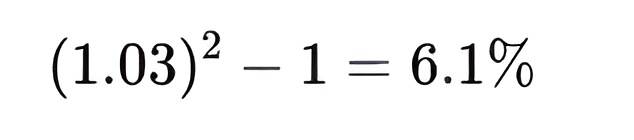

Suppose a three-month investment has a holding period yield of 3%. Convert the three-month yield into a semiannual rate by compounding:

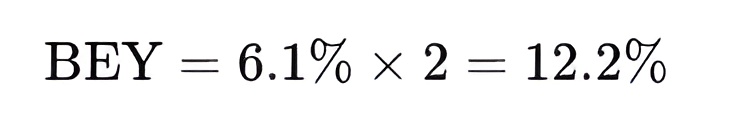

Multiply by 2 to get the bond equivalent rate:

This provides a simple approximation of a semiannual yield, which helps compare it to bonds that pay interest twice a year.

Converting from Annual Rate to BEY

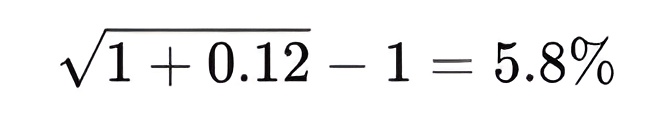

Assume the annual rate is 12%. Find the semiannual rate:

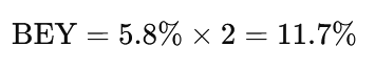

Multiply by 2:

This assumes simple interest division—commonly used for quoting bond-equivalent or periodic rates when compounding is not taken into account.

Mastering Holding Period Return and Yield Conversions

Understanding Holding Period Return (HPR) is essential for evaluating investment performance, but converting it into yields like MMY, EAY, and BEY allows for more precise comparisons across different securities. These conversions account for compounding, day-count conventions, and time frames, making it easier to analyze returns consistently and make informed investment decisions.

Comprehending HPR and yield conversions ensures accurate investment comparisons. To apply these concepts confidently, start learning with 365 Financial Analyst.