Accounts Receivable Management: Evaluating Collection Efficiency

Accounts receivable management plays a vital role in maintaining liquidity and financial stability by ensuring timely customer payments. Evaluating such metrics as the average collection period, aging schedules, and the weighted average collection period helps firms identify collection risks and strengthen cash flow. Proactive management supports profitability and long-term competitiveness.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeAccounts receivable management is a critical component of working capital management, directly affecting a company’s liquidity, profitability, and financial stability. The key metric used to evaluate performance in this area is the average collection period, which measures the number of days it takes for a firm to collect payments from its customers.

Monitoring this ratio helps businesses determine whether customers are paying invoices on time. A prolonged collection period may indicate issues with the company’s credit policy, inefficiencies in collection efforts, or broader economic conditions that slow customer payments.

Investors and financial analysts frequently examine accounts receivable performance, comparing it to industry averages to assess whether a company is collecting receivables efficiently. But the average days of receivables alone do not provide the complete picture. A more detailed analysis involves reviewing the aging schedule of receivables and calculating the weighted average collection period (WACP).

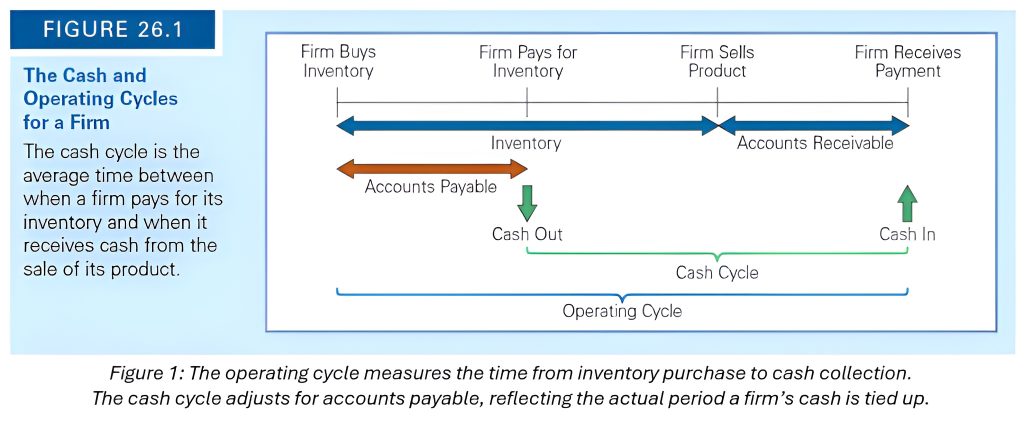

Operating and Cash Cycles

Accounts receivable management is part of a broader cycle that includes inventory management and accounts payable. Together, these determine the firm’s operating cycle and cash cycle.

A longer accounts receivable period extends both the operating and cash cycles, which can strain liquidity if not carefully managed.

Accounts Receivable Aging Schedule

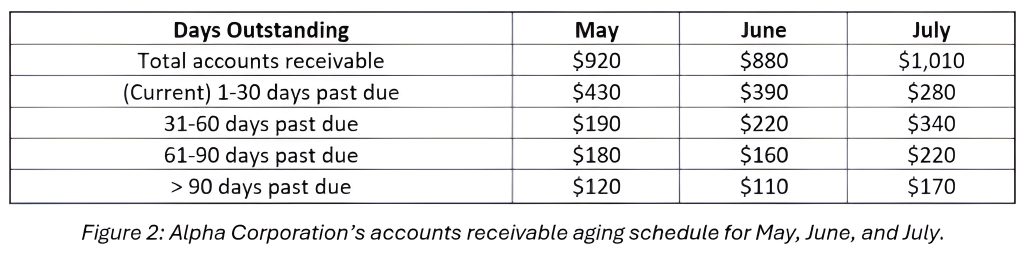

The aging schedule categorizes receivables based on how long they have been outstanding. This provides insights beyond a single average figure by showing how much of the receivables are overdue. For example, Alpha Corporation’s schedule (below) shows that while total receivables rose from $920 in May to $1,010 in July, the share of accounts more than 60 days past due also increased, signaling a growing collection risk.

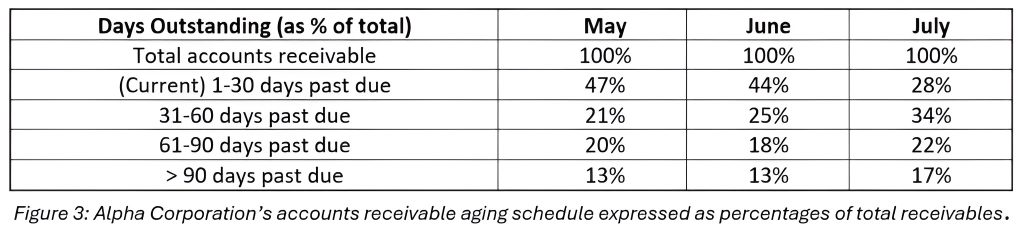

To better visualize the structural shift, the same receivables are expressed as percentages of the total in Figure 3. This highlights the relative decline in current receivables and the increase in overdue accounts.

This bottom-heavy trend (Figures 2 and 3) underscores the growing collection risk and signals the need for tighter credit management.

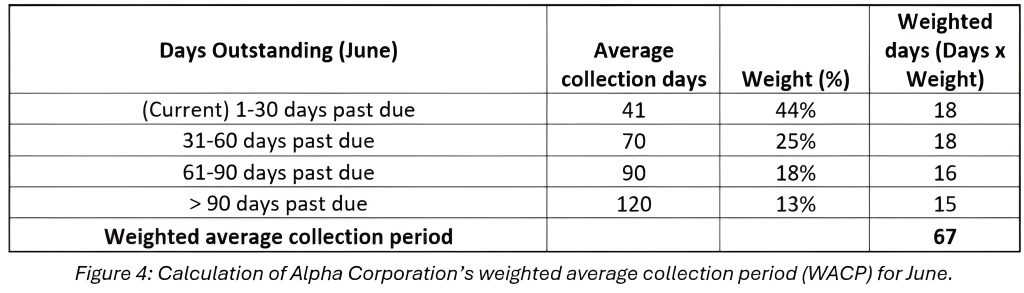

Weighted Average Collection Period

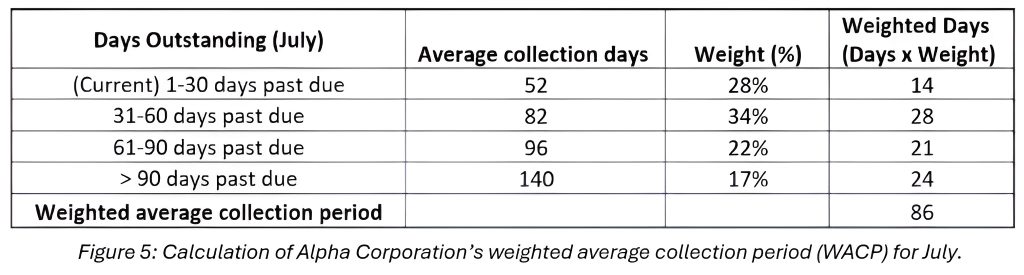

While the aging schedule helps visualize overdue receivables, the WACP provides a single metric that accounts for the age distribution of receivables. It’s calculated by multiplying each aging category’s percentage by its average collection days.

The upward trend signals worsening efficiency in receivables collection.

Analysis Limitations

Although the aging schedule and WACP provide valuable insights, they require detailed internal data that is often unavailable to external analysts. Investors and creditors may therefore rely on financial disclosures, but these alone might not capture collection risks. Tracking historical trends within the firm, however, gives managers a clearer view of whether receivables issues are temporary or systemic—highlighting the importance of effective accounts receivable management.

Ensuring Strong Accounts Receivable Management

Accounts receivable management is more than monitoring average collection days. By combining the aging schedule with the weighted average collection period, firms gain a deeper understanding of customer payment behavior.

Alpha Corporation’s July results highlight the dangers of delayed collections—an increase in overdue accounts and a rising WACP signal the need to reexamine credit policies and collection practices. Proactive monitoring ensures healthier cash flow, strengthens liquidity, and positions the firm competitively within its industry.

Joining the 365 Financial Analysis platform gives you access to hands-on resources and case-based insights that help you apply these practices, safeguard liquidity, and keep your firm ahead of the competition.