Accounts Payable Management

Accounts payable management plays a critical role in balancing liquidity, supplier relationships, and financing costs. By evaluating trade credit terms, monitoring days payable outstanding, and weighing early payment discounts, companies can optimize working capital while maintaining trust with suppliers.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeWorking capital management requires careful attention to accounts receivable, inventory, and accounts payable. Together, these elements determine how effectively a company manages liquidity and ensures operational efficiency. Among them, accounts payable stands out because it not only affects short-term cash flow but also influences supplier relationships and financing costs.

Accounts Payable Management is crucial since most companies rely on trade credit when purchasing goods. Suppliers extend this credit and allow firms to delay payment for inventory. The obligation appears as accounts payable on the balance sheet. Understanding trade credit terms, the costs implied in those terms, and the timing of payments is essential for finance managers who must balance savings, liquidity, and supplier trust.

Trade Credit Terms

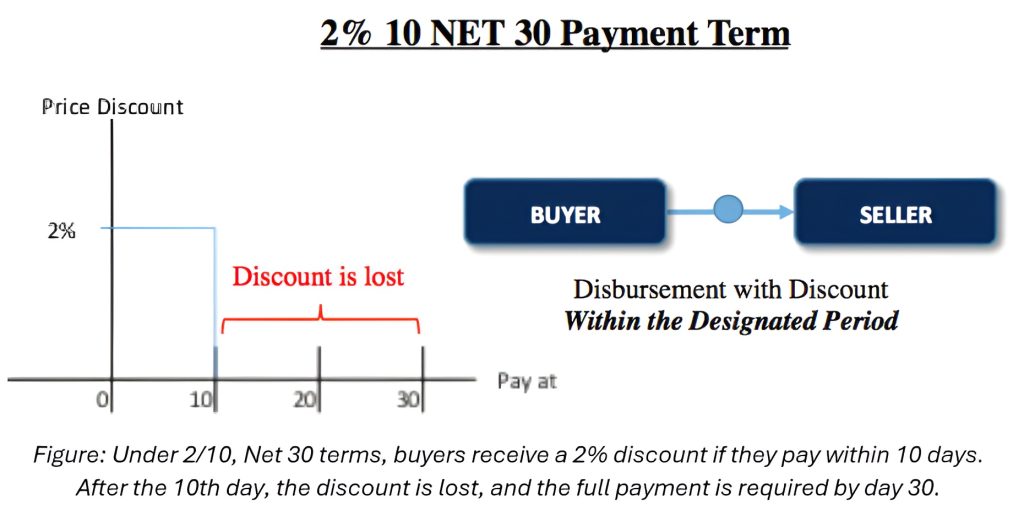

Trade credit agreements specify both the payment deadline and the possibility of early payment discounts. For instance, if a supplier specifies “Net 30,” the invoice must be settled within 30 days. Some suppliers, however, encourage quicker payments by offering discounts. A typical example is “2/10, Net 30,” which means the buyer can deduct two percent from the invoice if payment is made within 10 days, while the full amount is due within 30 days otherwise.

From a financial perspective, accounts payable management requires managers to weigh whether the benefit of the discount outweighs the opportunity to use funds elsewhere. Skipping a discount can amount to accepting an implicit financing cost, which can be surprisingly high.

Calculating the Cost of Trade Credit

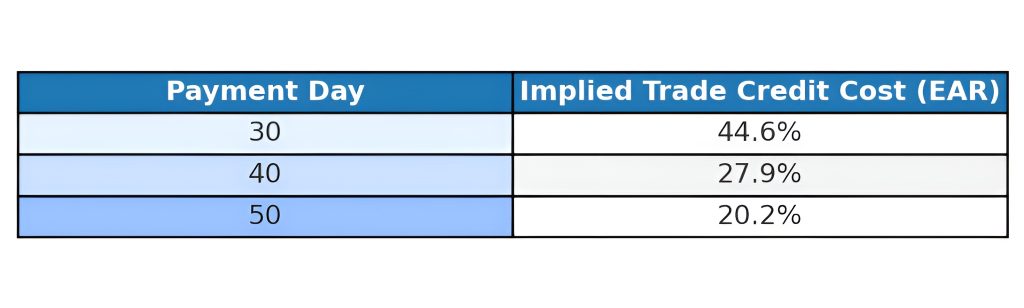

The implied cost of forgoing a discount is measured using the effective annual rate (EAR). The formula annualizes the holding period return and adjusts for compounding across a 365-day year:

The holding period return (HPR) is calculated as the discount rate divided by one minus the discount rate. At the same time, t represents the number of days between the end of the discount period and the actual payment date.

Consider a supplier offering “2/10, Net 50” on a $1,000 purchase. If the buyer chooses not to pay within the 10-day discount period, the financing cost becomes substantial.

The first 10 days represent a zero-interest loan. Once the discount period ends, the cost of trade credit rises sharply and then gradually declines as the due date approaches. If the firm doesn’t take the discount, the most cost-effective choice is to delay payment until as close to the net due date as possible.

The Benefits and Risks of Trade Credit

Trade credit is widely used because of its simplicity. Unlike bank loans—which involve extensive documentation and transaction costs—trade credit is immediate and convenient. It allows businesses to conserve cash, invest funds elsewhere temporarily, or benefit from discounts if they have sufficient liquidity.

Poor accounts payable management, however, can create risks. Paying suppliers late may damage relationships and weaken trust, while paying too early may erode liquidity or cause the firm to miss better financing opportunities. Striking the right balance is crucial.

Evaluating Accounts Payable Practices

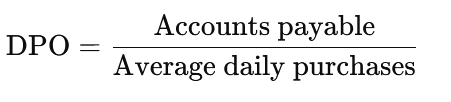

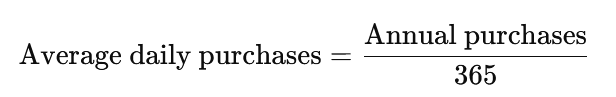

One common way to assess how a company manages accounts payable is by calculating the days payable outstanding (DPO). This metric shows how many days, on average, a firm takes to pay its suppliers.

where average daily purchases are equal to annual purchases divided by 365:

Suppose Company Alpha reports accounts payable of $350 million and annual purchases of $4 billion. Dividing $350 million by the result of $4 billion over 365 yields an average of 31.94 days. This means Alpha typically pays its suppliers in about 32 days.

The next step is comparison. If Alpha’s suppliers generally offer 30-day terms, then its payment behavior is consistent with expectations. If the firm pays earlier, it may incur unnecessary financing costs unless discounts are captured. If payment is made later, it risks tension with suppliers. Companies with abundant liquidity may prefer early payment to secure discounts, while those with tighter cash positions may delay payment to preserve cash flow.

Accounts Payable Management: Striking the Right Balance

Accounts payable management is not just about delaying payments; it is about balancing cost, liquidity, and supplier relationships. Trade credit offers flexibility and convenience, but the implied cost of skipping discounts can be steep. Finance managers must therefore evaluate trade credit terms carefully, calculate the cost of not taking discounts, and monitor average payment practices through metrics like DPO.

The optimal strategy is the one that maintains strong supplier trust while supporting profitability and efficient use of working capital.

To deepen your expertise in applying these strategies and mastering financial decision-making tools, consider joining the 365 Financial Analysis platform, where practical insights and hands-on resources can accelerate your growth.