Multiples Valuation

bestseller

Master Multiples Valuation: Apply relative valuation techniques to assess company value

Start for free

Start for free

What you get:

- 2 hours of content

- 21 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Multiples Valuation

bestseller

Start for free

Start for free

What you get:

- 2 hours of content

- 21 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

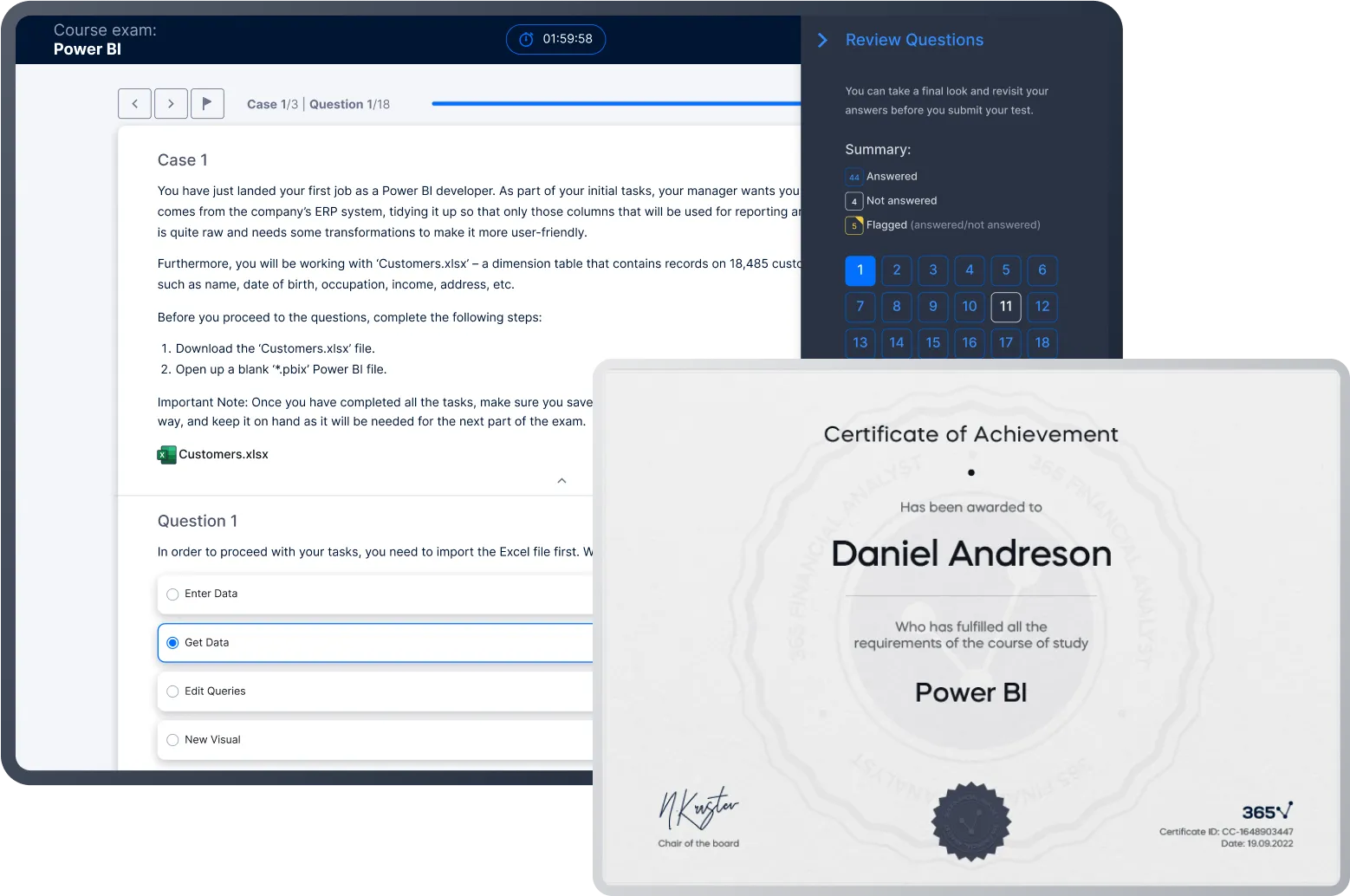

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 2 hours of content

- 21 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

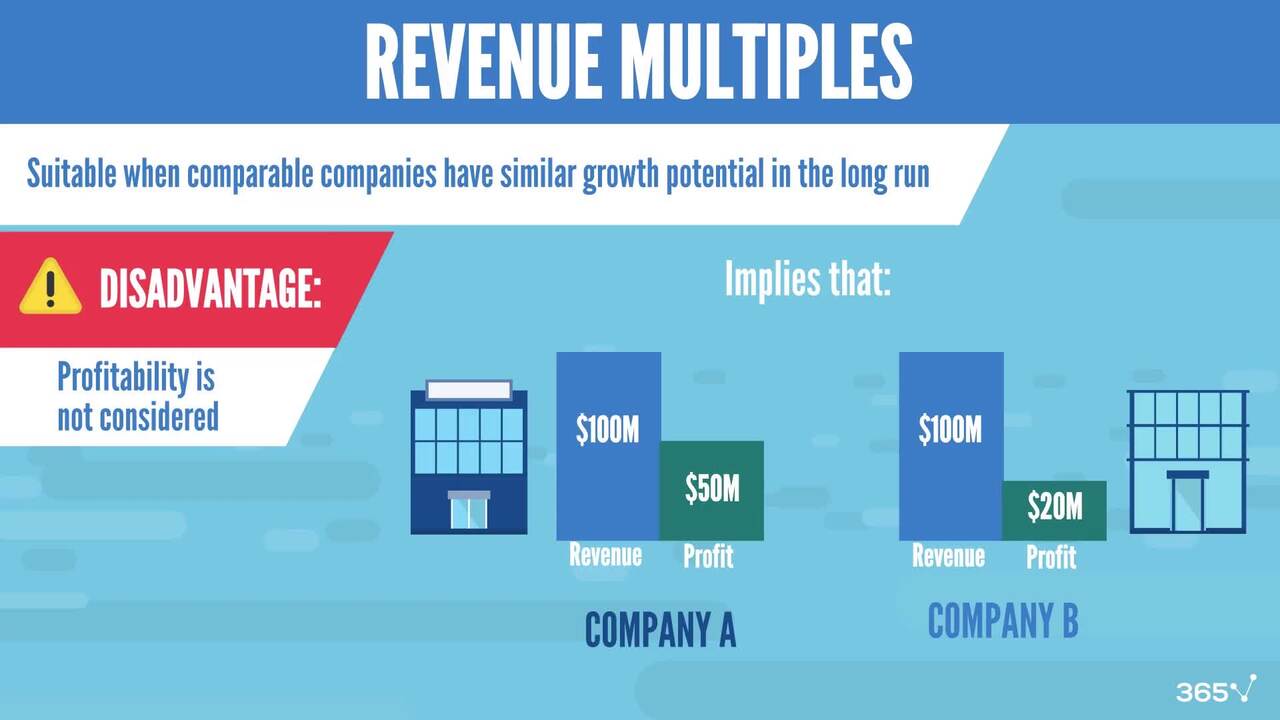

- Skilfully apply multiples valuation in practice to assess company value and triangulate DCF results, enhancing valuation accuracy

- Gain a deep understanding of the drivers of company value

- Clean and polish valuation multiples from one-off and non-core items, ensuring a true representation of a company’s intrinsic value

- Confidently compute both trading and transaction multiples

- Learn to identify and select suitable peer companies to perform an accurate relative valuation

- Acquire practical valuation skills that will impress hiring managers

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 How to Use Valuation Multiples

5 min

1.2 Types of Valuation Multiples

3 min

1.3 Transaction Multiples

3 min

1.4 Key Principles of Relative Valuation

7 min

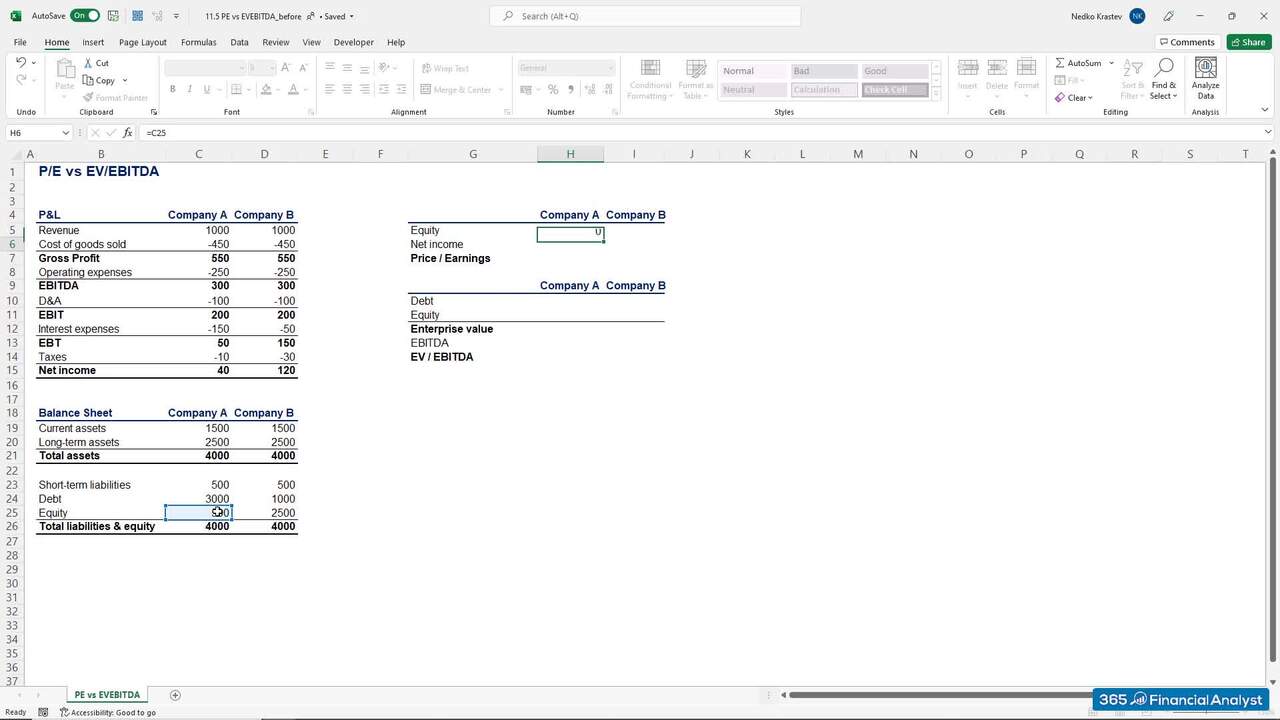

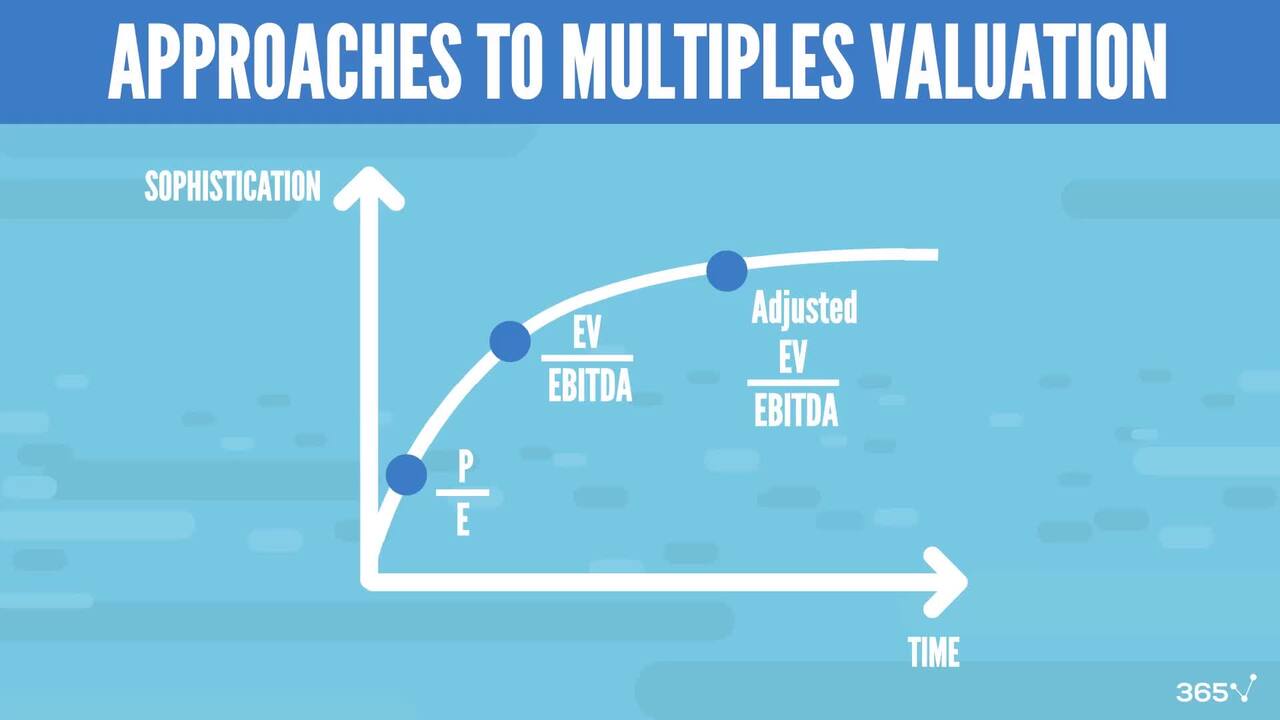

1.5 Earnings Multiples Comparison (PE vs EV/EBITDA)

6 min

2.1 Practical Example: Introduction

5 min

Curriculum

- 2. Valuation Multiples: Comprehensive Practical Example8 Lessons 44 MinThis segment presents a hands-on exercise where we value Volkswagen using valuation multiples. Together, we work out the optimal list of peers, the types of multiples to be used, and how to adjust every company’s financials to obtain a proper valuation.Practical Example: Introduction5 minPeer Group Selection9 minP&L Comparison5 minHow to Adjust EBIT5 minHow to Adjust Enterprise Value3 minHow to Adjust EBIT: Practical Example8 minHow to Adjust Enterprise Value: Practical Example6 minConclusion3 min

Topics

Course Requirements

- Highly recommended to take the Intro to Excel, Accounting and Financial Statement Analysis, and Corporate Finance courses first

- You will need Microsoft Excel 2016, 2019, or Microsoft Excel 365

Who Should Take This Course?

Level of difficulty: Intermediate

- Aspiring investment bankers, financial analysts, investment analysts

- Existing investment bankers who have recently started their career and need to improve their valuation skills

- Business owners and startup founders who want to learn how to value their business

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ned Krastev is an entrepreneur and educator who has helped over 1.6 million students worldwide gain business, finance, and data skills. After earning his Master's degree in Finance from Bocconi University in Milan, he built a career with leading companies including PwC Italy, Coca-Cola European Partners, and Infineon Technologies. In 2014, Ned published his first online course on financial modeling and valuation, sparking his passion for online education. Today, as Founder & CEO of 365 Careers and Co-founder of 365 Data Science, he leads one of the most successful global providers of professional training, aiming to bridge the gap between academic theory and real-world business application.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.