Macroeconomics

Deepen your understanding of the global economy: explore macroeconomic policy, international trade, and decision-making drivers

Start for free

Start for free

What you get:

- 5 hours of content

- 8 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Macroeconomics

Start for free

Start for free

What you get:

- 5 hours of content

- 8 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 5 hours of content

- 8 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

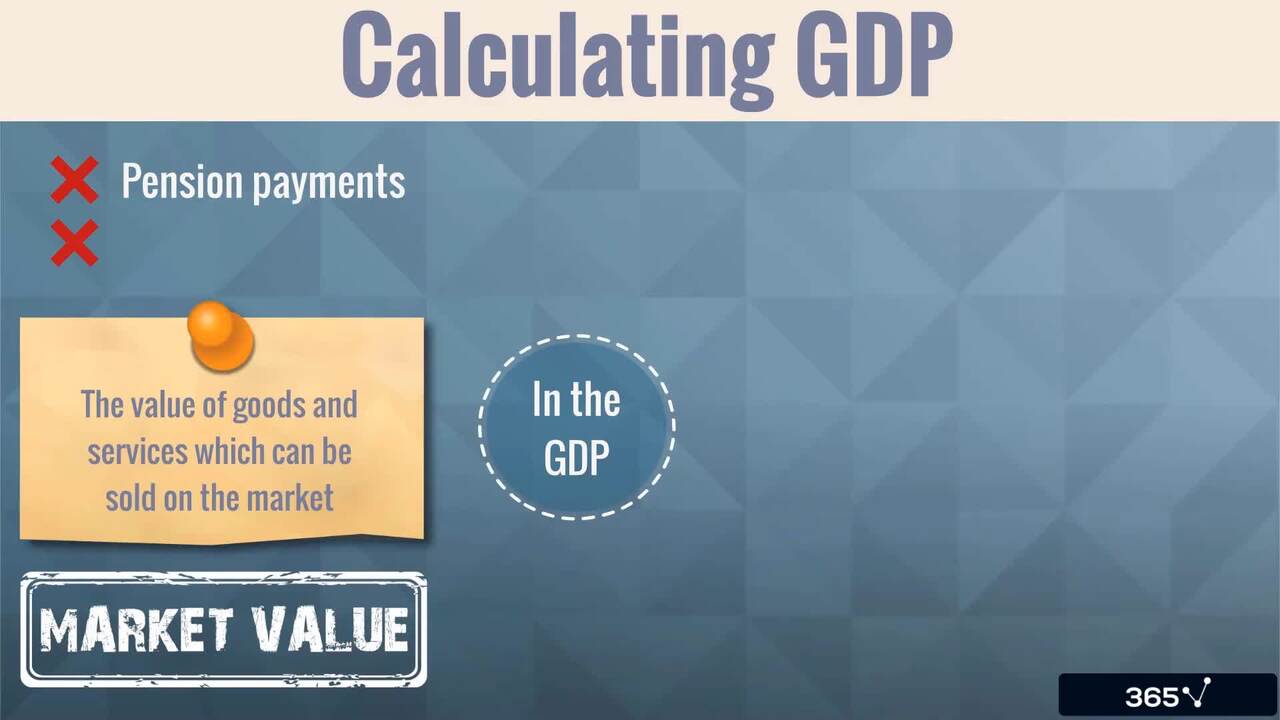

- Accurately measure economic growth and distinguish between nominal and real GDP to assess economic progress

- Gain a deep understanding of business cycle phases and develop the ability to identify the current economic phase

- Recognize the importance of key economic indicators like inflation and unemployment and the impact they have on the economy

- Explore and analyse the driving forces behind the relationship between demand and supply

- Have a clear idea how monetary and fiscal policy impact economic output

- Grasp the economic benefits of international trade

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the course cover

1 min

1.2 Types of GDP

6 min

1.3 GDP Calculation Methods

2 min

1.4 Nominal and Real GDP

10 min

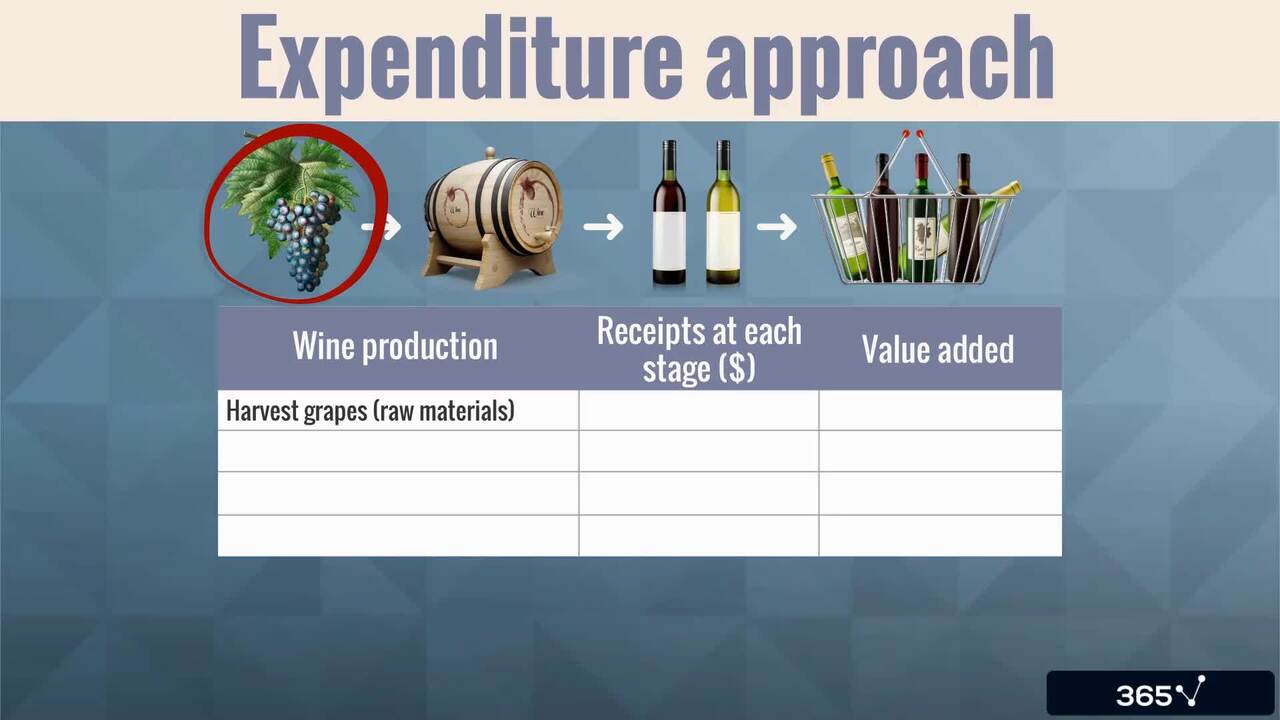

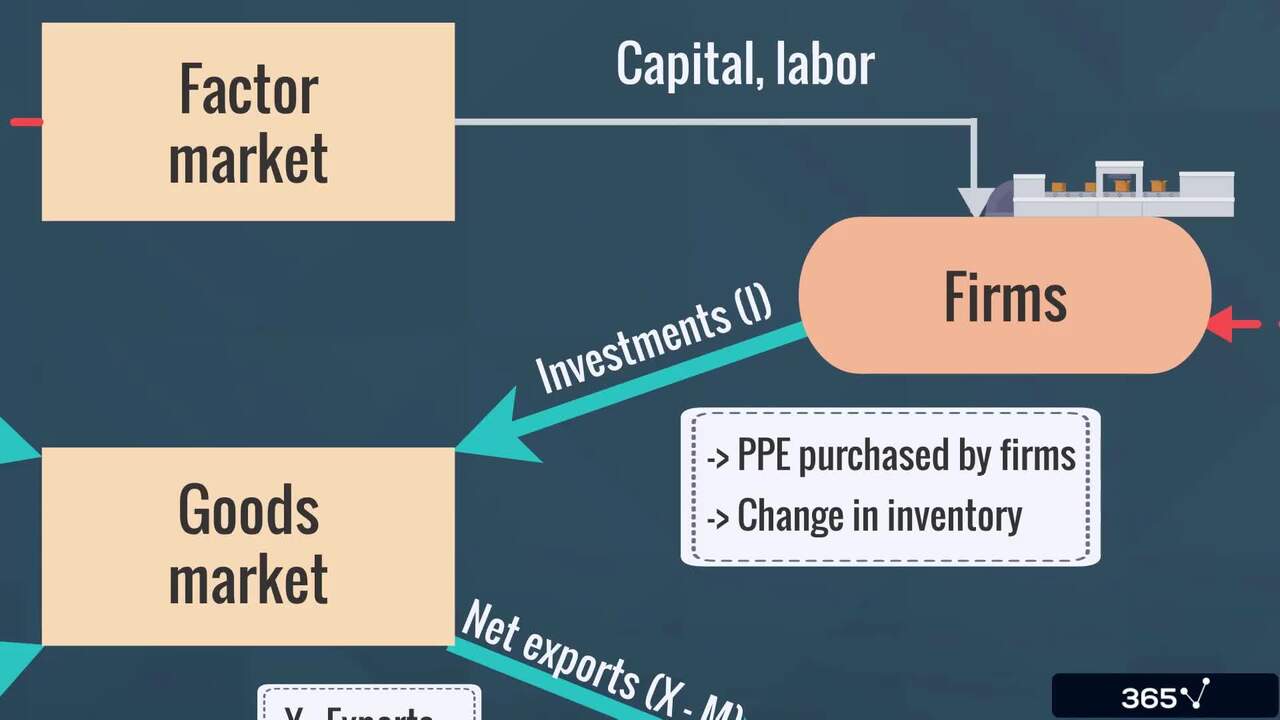

1.5 The Expenditure Approach

8 min

1.6 The Income Approach

7 min

Curriculum

- 2. Business Cycles12 Lessons 67 MinThis section of the Macroeconomics course covers the theory of business cycles and their relationship with factors of production, the housing market, and the external trade sector. You will learn about the types and measures of unemployment and the impact of inflation on economic growth. We define various concepts, including inflation, hyperinflation, disinflation, deflation, cost-push, and demand-pull inflation. Finally, we show you how to calculate major economic indicators.Business Cycle Phases5 minResource Use and the Business Cycle6 minThe Housing Market and the Business Cycle4 minExternal Trade and the Business Cycle4 minTheories of the Business Cycle8 minTypes of Unemployment5 minMeasures of Unemployment5 minInflation4 minIndexes Used to Measure Inflation8 minUses and Limitations of Inflation Measures5 minCost-push and Demand-pull Inflation9 minTypes of Economic Indicators4 min

- 3. Monetary and Fiscal Policy25 Lessons 92 MinThis section is dedicated to the importance and limitations of monetary and fiscal policies. We explore the functions and definitions of money and the money creation process. This will help you understand the quantity theory of money, the Fisher Effect, and the monetary transmission mechanism. We also cover the roles, objectives, and limitations of monetary/fiscal policy, the cost of expected and unexpected inflation, and the qualities of effective central banks.Introduction to Monetary and Fiscal Policy3 minFunctions of Money3 minDefinitions of Money1 minThe Money Creation Process4 minThe Quantity Theory of Money2 minTheories of Money Demand and Supply5 minThe Fisher Effect3 minRoles and Objectives of Central Banks5 minCosts of Expected and Unexpected Inflation4 minMonetary Policy Tools3 minThe Monetary Transmission Mechanism5 minQualities of Effective Central Banks4 minThe Relationship between Monetary Policy and Economic Growth4 minInflation, Interest Rate and Exchange Rate Targeting3 minExpansionary or Contractionary Monetary Policy2 minLimitations of Monetary Policy5 minRoles and Objectives of Fiscal Policy5 minFiscal Policy Tools5 minEffective Tax Policy3 minModelling the Impact of Taxes and Government Spending7 minThe Ricardian Equivalence3 minNational Debt to GDP - Does it Matter?5 minFiscal Policy Limitations2 minExpansionary or Contractionary Fiscal Policy3 minInteraction between Monetary and Fiscal Policy3 min

- 4. International Trade and Capital Flows10 Lessons 42 MinIn the final section of the Macroeconomics course, we explain the difference between Gross Domestic Product and Gross National Product and how to calculate them. You will learn more advanced macroeconomics functions, such as the absolute and comparative advantage and the Ricardian and Heckscher-Ohlin models of trade. In addition, we explore the types and economic implications of trade and capital restrictions. Finally, we introduce the concept of Balance of Payments (BOP) and the functions and objectives of major international trade organizations.Gross Domestic Product vs. Gross National Product2 minCosts and Benefits of International Trade4 minComparative Advantage vs. Absolute Advantage6 minThe Ricardian and Heckscher Ohlin Models of Trade4 minTrade Restrictions7 minTrading Blocks4 minCapital Restrictions3 minThe Balance of Payments6 minThe Balance of Payments (continued)3 minInternational Trade Organizations3 min

Topics

Course Requirements

- No prior experience or knowledge is required. We will start from the basics and gradually build your understanding. Everything you need is included in the course

Who Should Take This Course?

Level of difficulty: Beginner

- Economics students

- Anyone interested in gaining a deeper understanding of the economic forces that shape our world

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Antoniya is a finance professional with vast experience in accounting, auditing, financial management, and multiple high-level finance roles. She holds two master’s degrees—in Finance and in Contemporary Educational Technologies. She has worked as an auditor at PwC, as a financial controller at Atos, as an FP&A Manager and Senior Manager at Coca-Cola, and currently, as a Finance Manager at 365. Her passion for finance and teaching brought her to the 365 Тeam. She has been tutoring on various topics, including accounting, financial reporting, financial planning and analysis, economics, etc. Antoniya’s qualifications and engaging teaching style make the learning process enjoyable, and her courses have helped numerous students progress in their careers.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.