LBO Modeling in Excel

trending topic

Master LBO Modeling in Excel: Learn to build real-world leveraged buyout models from scratch

Start for free

Start for free

What you get:

- 4 hours of content

- 75 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

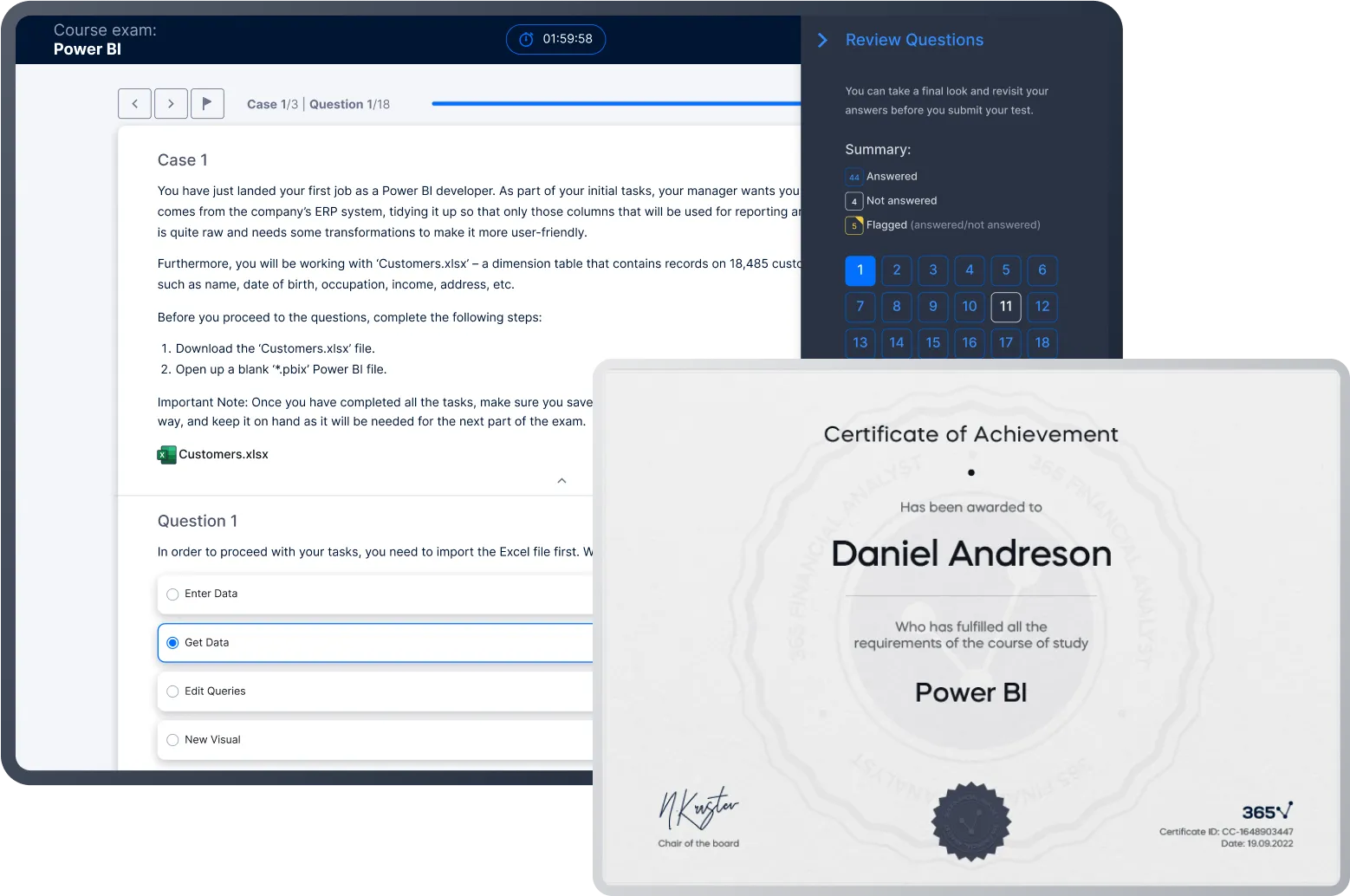

- Course exam

- Certificate of achievement

LBO Modeling in Excel

trending topic

Start for free

Start for free

What you get:

- 4 hours of content

- 75 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 4 hours of content

- 75 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

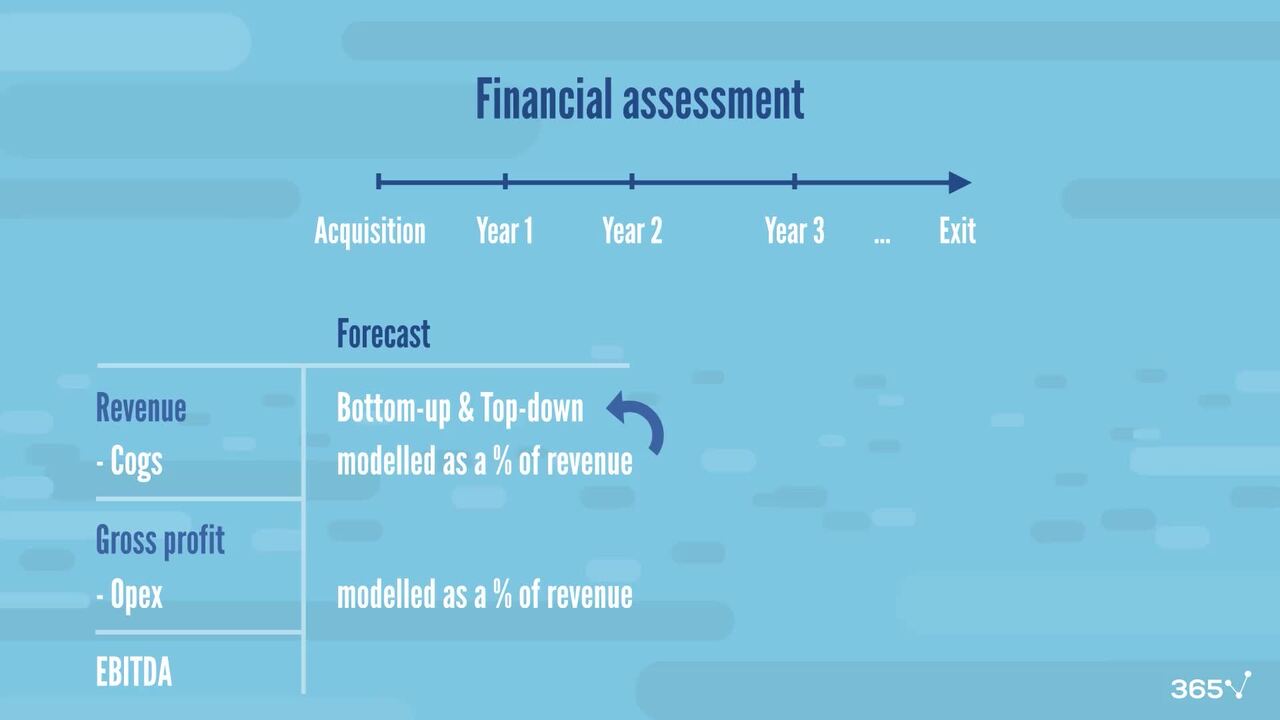

- Improve your financial modeling skills by learning to build sophisticated LBO valuation models

- Learn from an experienced instructor and adopt industry-standard best practices in financial modeling

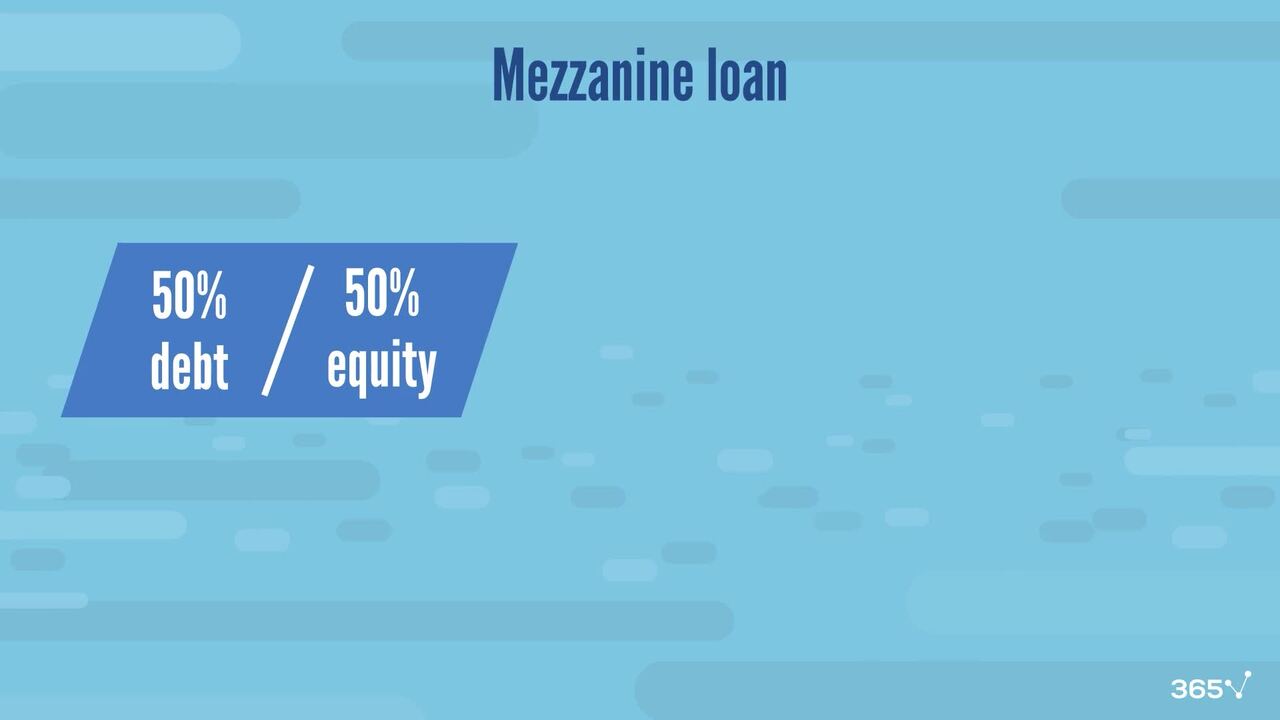

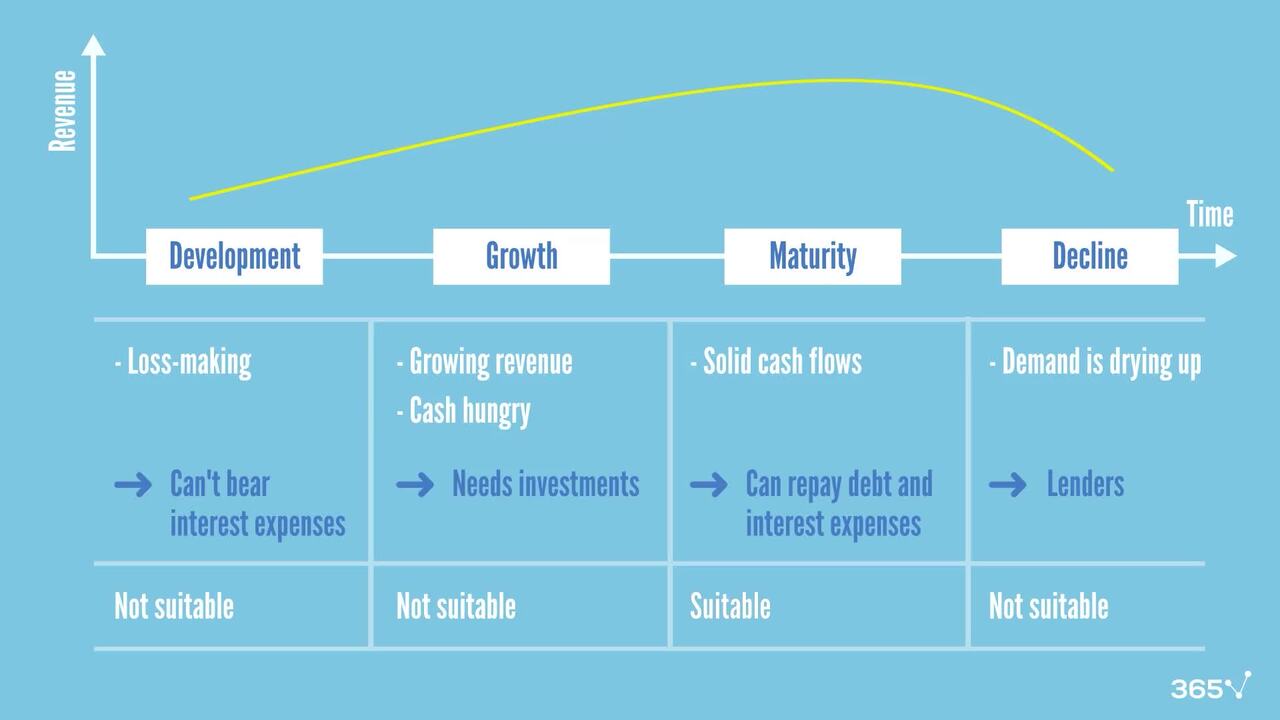

- Gain a deep understand of the mechanics of leveraged buyouts and how they generate value for financial sponsors

- Develop an intuition on screening for LBO targets and finding companies that are prime candidates for LBO deals

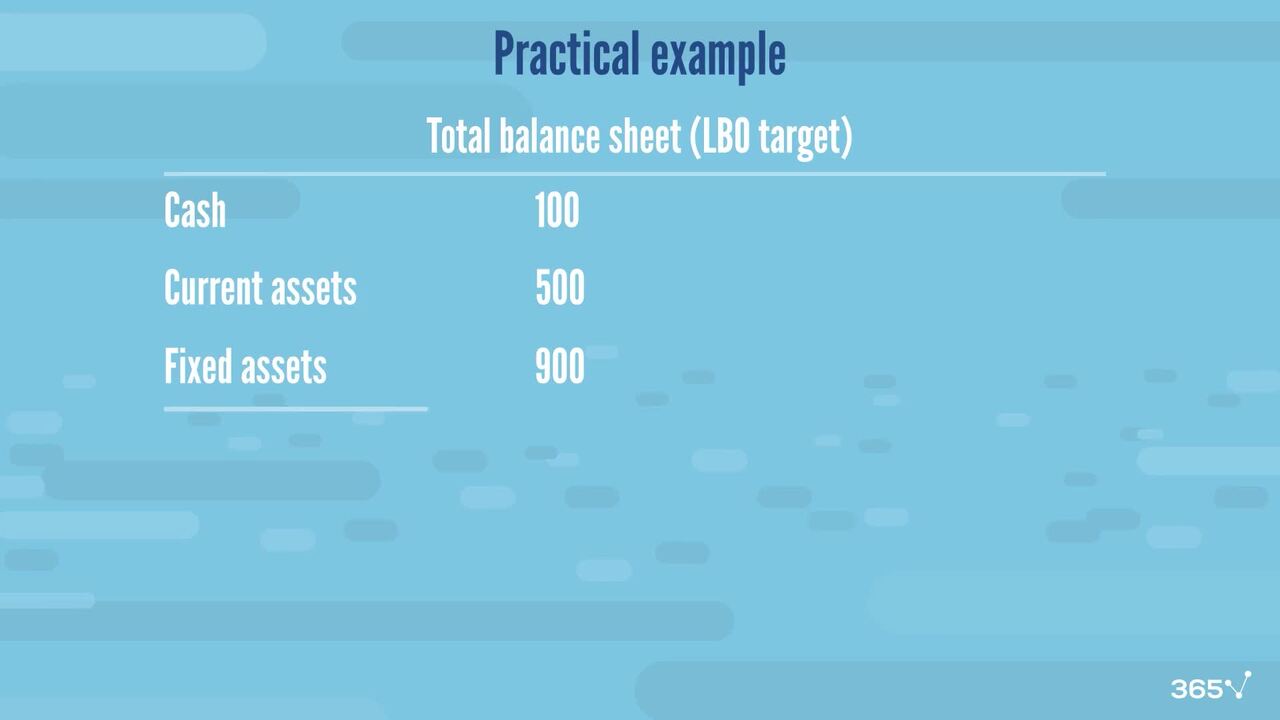

- Create a complete LBO model that includes critical technical elements like fixed asset rollforwards, debt and equity schedules, and revolver loan modeling

- Acquire practical valuation skills that will impress hiring managers

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What is an LBO?

4 min

1.2 How an LBO works in practice

5 min

1.3 Who are the lenders in an LBO

5 min

1.4 What is debt capacity and how to define the maximum debt capacity in an LBO deal?

3 min

1.5 When is an LBO a feasible option?

4 min

1.6 How to determine the maximum LBO price

3 min

Curriculum

- 2. The Dell LBO: A real-life LBO case study4 Lessons 13 MinIn 2013, Michael Dell partnered with investment firm Silver Lake in a deal aiming to delist Dell from public markets. This is the company he had started 29 years earlier. At the time, analysts believed Dell wasn’t positioned well from a strategic perspective because they were too reliant on PC sales, a segment that was slowing down due to the introduction of devices such as tablets and smartphones, which caused shifting consumer behaviour. Mr Dell, on the other hand, saw things differently. He believed the company was uniquely positioned, as a process of transition that started in 2008 was now running its course. In short, this is the context, which led to the Dell LBO.Dell case study - Intro to the deal2 minDell case study - Dell's business from a strategic perspective5 minDell case study - Parameters and specifics of the deal5 minDell case study - The aftermath1 min

- 3. Build a paper LBO model in Excel9 Lessons 34 MinThis section teaches you how to create your first LBO model: a paper LBO. This simple, intuitive exercise allows you to reinforce the theory learned in the first part of the course.Intro to the Paper LBO exercise4 minWorking on debt capacity of the deal4 minObtaining equity needed for the LBO deal3 minFilling in P&L projections4 minWorking on Debt schedule and P&L completion3 minCalculating Cash Flow3 minCompleting financial projections4 minObtaining Equity at exit and IRR5 minSensitivity analysis4 min

- 4. Comprehensive LBO modeling case study30 Lessons 121 MinThis exercise will provide valuable insights into the intricacies of an LBO transaction and its associated financial modeling. This is a comprehensive modeling exercise that teaches you how to model the financing of an LBO transaction, the revolver statement, and how to calculate the rate of return of financial sponsors.Case description Read now3 minIntroduction to LBO Modeling exercise1 minKey drivers in the LBO model8 minConstructing the Profit and Loss header3 minAnalyzing historical Profit and Loss figures2 minValuing the Target company3 minEstimating transaction fees5 minSources and uses of funds4 minShaping the Balance sheet at transaction5 minGoodwill calculation1 minIntegrating assumptions into the Drivers sheet6 minBuilding a Fixed asset roll forward schedule4 minForecasting financials using the Drivers sheet4 minCompleting the Profit and Loss statement (up to EBITDA)5 minModeling Working capital5 minFilling in the Balance sheet at transaction sheet3 minAdd financials to the Balance sheet3 minProjecting Fixed asset roll forward5 minDeveloping a Debt schedule6 minCreating a Fixed asset amortization schedule5 minStructuring Cash Flow3 minDesigning the Financing sheet5 minEstimating Cash Flow4 minBuilding an Equity schedule4 minFinalizing the Financing Cash Flow2 minModeling the Revolver facility (first part)8 minCompleting the Profit and Loss statement2 minModeling the Revolver facility (second part)1 minBalancing the Balance sheet4 minExit valuation and IRR comparison7 min

Topics

Course Requirements

- Highly recommended to take the Intro to Excel, Accounting and Financial Statement Analysis, Corporate Finance, and DCF valuation courses first

- You will need Microsoft Excel 2016, 2019, or Microsoft Excel 365

Who Should Take This Course?

Level of difficulty: Intermediate

- Aspiring private equity analysts, investment bankers, financial analysts, investment analysts

- Existing private equity analysts who have recently started their career and need to improve their valuation skills

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ned Krastev is an entrepreneur and educator who has helped over 1.6 million students worldwide gain business, finance, and data skills. After earning his Master's degree in Finance from Bocconi University in Milan, he built a career with leading companies including PwC Italy, Coca-Cola European Partners, and Infineon Technologies. In 2014, Ned published his first online course on financial modeling and valuation, sparking his passion for online education. Today, as Founder & CEO of 365 Careers and Co-founder of 365 Data Science, he leads one of the most successful global providers of professional training, aiming to bridge the gap between academic theory and real-world business application.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.