Introduction to Management Accounting

This Introduction to Management Accounting Course guides you through core finance principles, including budgeting, decision-making, cost classification, variance analysis, and performance measurement. Throughout the lessons, you’ll engage with real-world case studies, helping you apply your new skills in practical scenarios

Start for free

Start for free

What you get:

- 7 hours of content

- 25 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Introduction to Management Accounting

Start for free

Start for free

What you get:

- 7 hours of content

- 25 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 7 hours of content

- 25 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Gain a clear understanding of management accounting roles, purpose, and core competencies

- Learn the fundamentals of cost classification and behavior—including distinctions between fixed and variable, direct vs indirect, production vs non-production costs

- Conduct cost-volume-profit analysis to effectively calculate break-even points, margin of safety, contribution margins, and target profit units

- Apply standard costing and variance analysis to monitor, control, and improve business performance

- Examine and understand the purpose and use of key performance measurement tools such as KPIs, the Balanced Scorecard, and Benchmarking

- Perform sensitivity analysis in Excel to assess potential outcomes in various scenarios

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What Does the Course Cover?

5 min

1.2 What is Management Accounting?

3 min

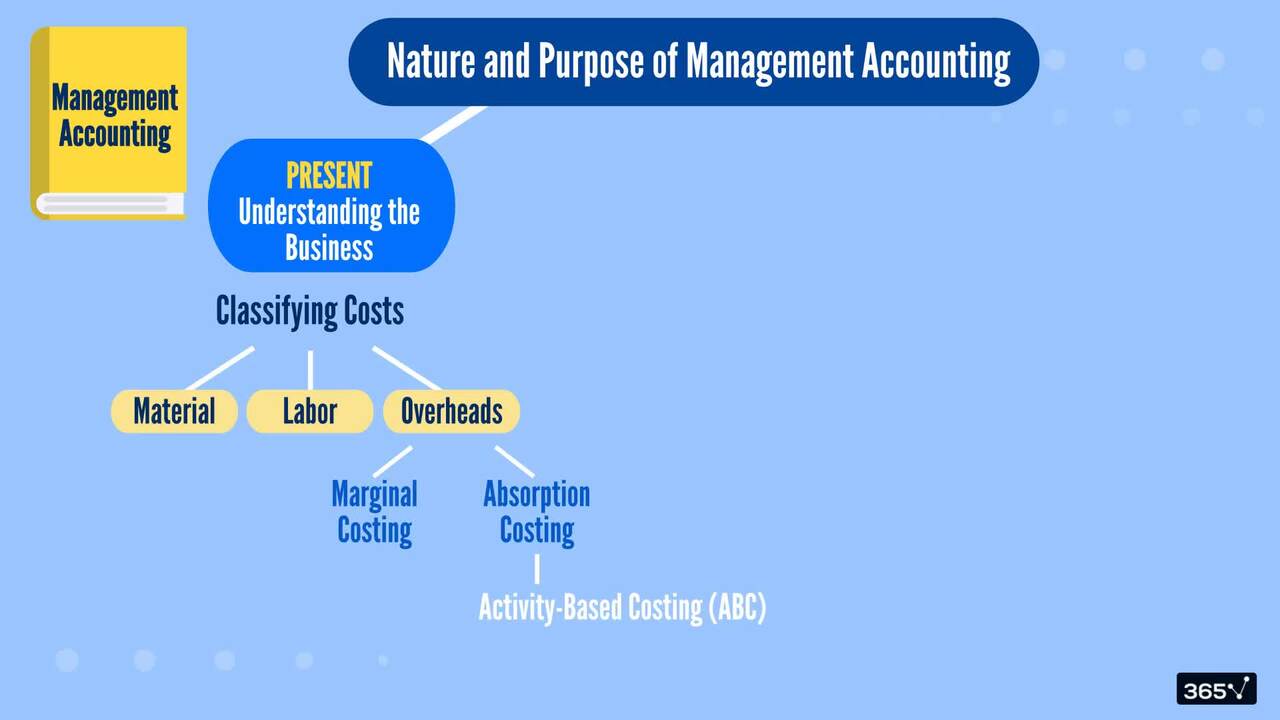

1.3 Purpose of Management Accounting

4 min

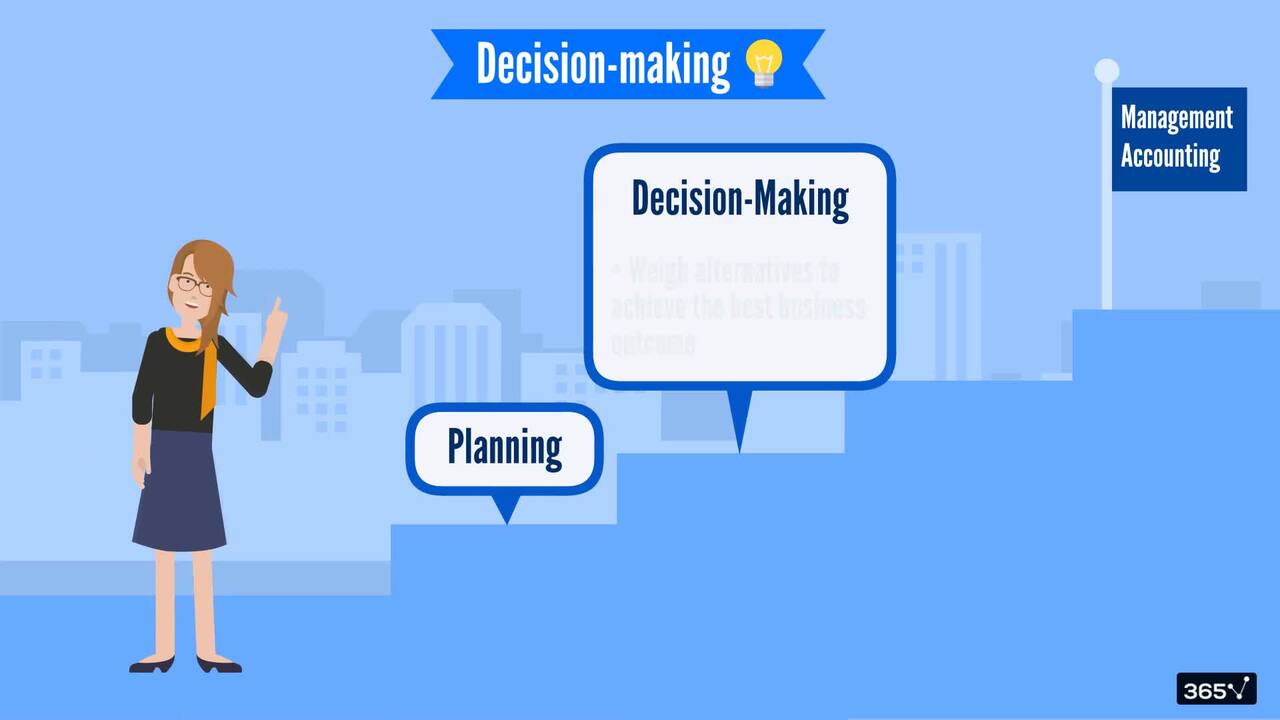

1.4 Planning, Decision-Making, and Control

4 min

1.5 Strategic, Tactical, and Operational Planning

5 min

1.6 Management vs Financial Accounting

5 min

Curriculum

- 2. Cost Concepts and Classification6 Lessons 28 MinThis section covers cost classification and behavior, including production vs non-production costs, direct vs indirect costs, and fixed, variable, and stepped costs. Additionally, we’ll categorize expenses by function and nature, reinforcing your understanding with a practical case study. You'll also receive a further introduction to management accounting concepts and study management accounting fundamentals in more detail. Understanding your cost structure can improve financial planning and performance.Cost Classification Basics6 minProduction vs Non-production Costs6 minCosts by Function vs Costs by Nature4 minDirect vs Indirect Costs4 minFixed, Variable, and Stepped Costs3 minTypes of Costs - Velocity Case Study5 min

- 3. Cost-Volume-Profit Analysis6 Lessons 32 MinManagerial accounting careers encompass various responsibilities, including conducting cost-volume-profit (CVP) analysis to aid in strategic decision-making. You’ll learn how to determine the break-even point, calculate contribution margins, and interpret the margin of safety. We also discuss methods to set and achieve target profits. A case study will reinforce these concepts and demonstrate sensitivity analysis. This is crucial among the myriad managerial accounting topics discussed in this section.Cost-Volume-Profit Analysis4 minCalculating Break-Even Point and Contribution Margin6 minCalculating Margin of Safety3 minTarget Profit in CVP Analysis3 minCVP Analysis - Velocity Case Study10 minSensitivity Analysis - Velocity Case Study6 min

- 4. Cost Accounting Techniques7 Lessons 55 MinThis section of our online managerial accounting course overviews various cost accounting techniques. You’ll examine accounting for material, labor, and overhead costs. Practical applications of overhead allocation and the differentiation between marginal and absorption costing techniques are discussed, along with a case study to apply these techniques.Cost Accounting Techniques - Overview9 minMaterials Cost Accounting7 minLabor Cost Accounting7 minOverheads Cost Accounting6 minAllocating Overheads - Velocity Case Study9 minUnderstanding Marginal and Absorption Costing7 minProfit Calculation with Marginal and Absorption Costing - Velocity Case Study10 min

- 5. Budgeting Basics7 Lessons 40 MinIn this section of our management accounting course, you’ll grasp the purpose and process of budgeting. You’ll learn the benefits of effective budgeting, follow a step-by-step budget preparation guide, and explore various budgeting techniques. The section will also explore the distinctions between budgeting and forecasting and how to manage budgets using variance analysis—further clarifying the purpose of managerial accounting.Introduction to Budgeting6 minThe Importance and Benefits of Budgeting6 minBudget Preparation Steps4 minThe Master Budget6 minBudgeting Techniques7 minBudgeting vs Forecasting6 minBudgeting Control and Variance Analysis5 min

- 6. Standard Costing and Variance Analysis8 Lessons 55 MinLearn about standard costing and its role in management accounting. We’ll explore the advantages and limitations of standard costing and introduce variance analysis. Through a practical case study, you'll discover how to analyze sales, material, labor, and variable overhead variances, enhancing your management accounting skills.Understanding Standard Costs5 minBenefits and Limitations of Standard Costing4 minVariance Analysis Overview9 minSales Variances6 minMaterial Variances9 minLabor Variances8 minVariable Overhead Variances8 minVariance Analysis - Velocity Case Study6 min

- 7. Performance Measurement and Control5 Lessons 34 MinThe final section of this management accounting course focuses on performance measurement and control. It introduces concepts and key indicators, explores balanced scorecard methods, explains control systems, and teaches about benchmarking. Upon completion, you’ll be well-prepared to pursue a managerial accounting certificate to further validate your expertise.Performance Measurement Overview6 minKey Performance Indicators (KPIs)9 minThe Balanced Scorecard6 minPerformance Control Systems5 minBenchmarking8 min

Topics

Course Requirements

- Highly recommended to take the Intro to Excel and Accounting and Financial Statement Analysis courses first

- You will need Microsoft Excel 2010, 2013, 2016, 2020, or Microsoft Excel 365

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring financial controllers and financial analysts

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Antoniya is a finance professional with vast experience in accounting, auditing, financial management, and multiple high-level finance roles. She holds two master’s degrees—in Finance and in Contemporary Educational Technologies. She has worked as an auditor at PwC, as a financial controller at Atos, as an FP&A Manager and Senior Manager at Coca-Cola, and currently, as a Finance Manager at 365. Her passion for finance and teaching brought her to the 365 Тeam. She has been tutoring on various topics, including accounting, financial reporting, financial planning and analysis, economics, etc. Antoniya’s qualifications and engaging teaching style make the learning process enjoyable, and her courses have helped numerous students progress in their careers.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.