Introduction to Industry and Company Analysis

Master industry and company analysis: Gain expert insights into the key drivers of business performance

Start for free

Start for free

What you get:

- 1 hour of content

- 35 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

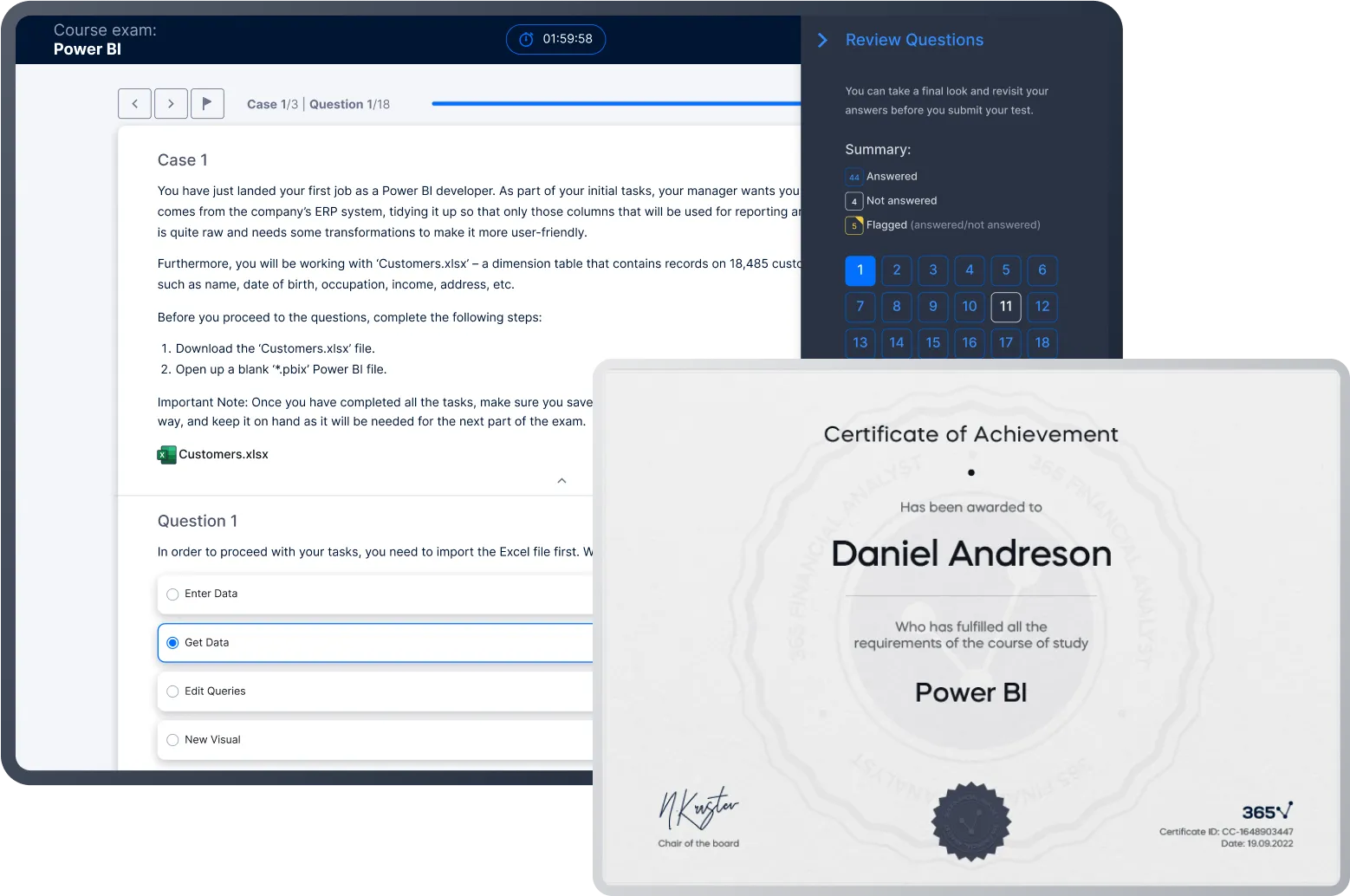

- Course exam

- Certificate of achievement

Introduction to Industry and Company Analysis

Start for free

Start for free

What you get:

- 1 hour of content

- 35 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 1 hour of content

- 35 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Gain a comprehensive understanding of the key drivers impacting business performance, both at the company-specific level and across the industry

- Identify and analyse the unique idiosyncratic factors that impact individual company performance

- Leverage Michael’s Porter 5 Forces model to assess the attractiveness of an industry

- Develop the skills to find peer companies and effectively conduct comparative analysis

- Use the industry life cycle model to understand the competitive forces and value drivers in a specific sector

- Expand your business acumen with analytical skills

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Course Introduction

2 min

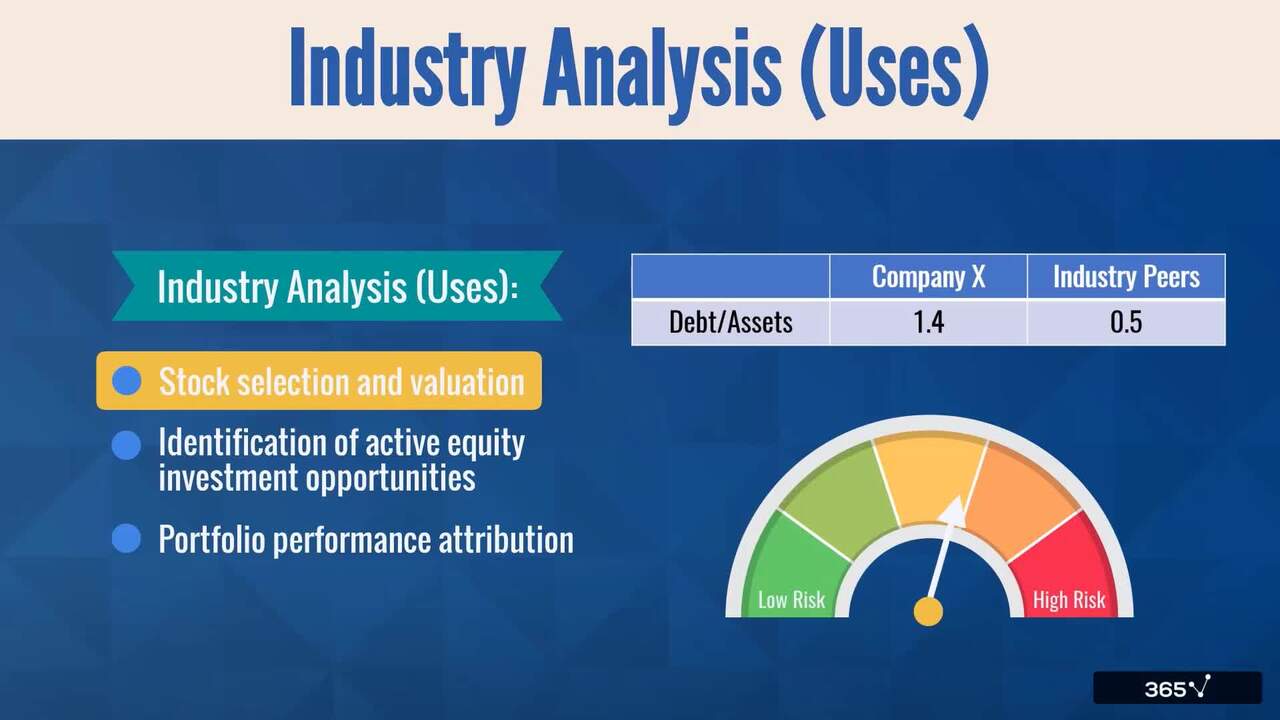

1.2 Industry Analysis

3 min

1.3 Industry Classification Systems

4 min

1.4 Commercial Industry Classification Systems

3 min

1.5 Governmental Industry Classification Systems

3 min

1.7 Cyclical vs. Non-cyclical Firms

5 min

Curriculum

- 2. Pricing Power and Company Analysis7 Lessons 45 MinThis section covers the industry life cycle and its characteristics providing examples from various economic sectors. It also outlines several factors that influence industry growth. To wrap up the Industry and Company Analysis course, we examine the constituent elements of a complete company analysis.Barriers to Entry6 minIndustry Concentration6 minIndustry Capacity6 minIndustry Life-cycle Model8 minRepresentative Industries (Characteristics)6 minIndustry Growth, Profitability, and Risk (External Influences)5 minCompany Analysis (Elements)8 min

Topics

Course Requirements

- No prior experience or knowledge is required. We will start from the basics and gradually build your understanding. Everything you need is included in the course.

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring finance professionals

- Individuals seeking to enhance their business literacy and understanding

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ivan Kitov is the COO of 365 Data Science and a CFA charterholder with over 12 years in finance. He holds a Master's in Financial Economics from Erasmus University Rotterdam and combines expertise in corporate finance, investments, and strategy with a passion for AI and machine learning. Since 2019, he has created courses that have helped thousands of students worldwide gain practical finance and data skills, with the goal of making 365 Data Science the top global platform for aspiring professionals.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.