Introduction to Equity Securities

Master the intricacies of equity financing: Explore various types of equity securities and essential investment principals

Start for Free

Start for Free

What you get:

- 1 hour of content

- 5 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Introduction to Equity Securities

Start for Free

Start for Free

What you get:

- 1 hour of content

- 5 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 1 hour of content

- 5 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Gain a comprehensive understanding of various types of equity securities

- Learn effective investing strategies in both local and non-domestic stocks

- Explore how equity financing helps businesses create value

- Understand the difference between an equity security’s market value and book value and the related implications for investors

- Grasp the critical relationship between cost of equity, return on equity, and IRR

- Expand your finance skillset by mastering key investment principles and techniques

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Introduction to Equity Securities

2 min

1.2 Equity Securities (Characteristics)

7 min

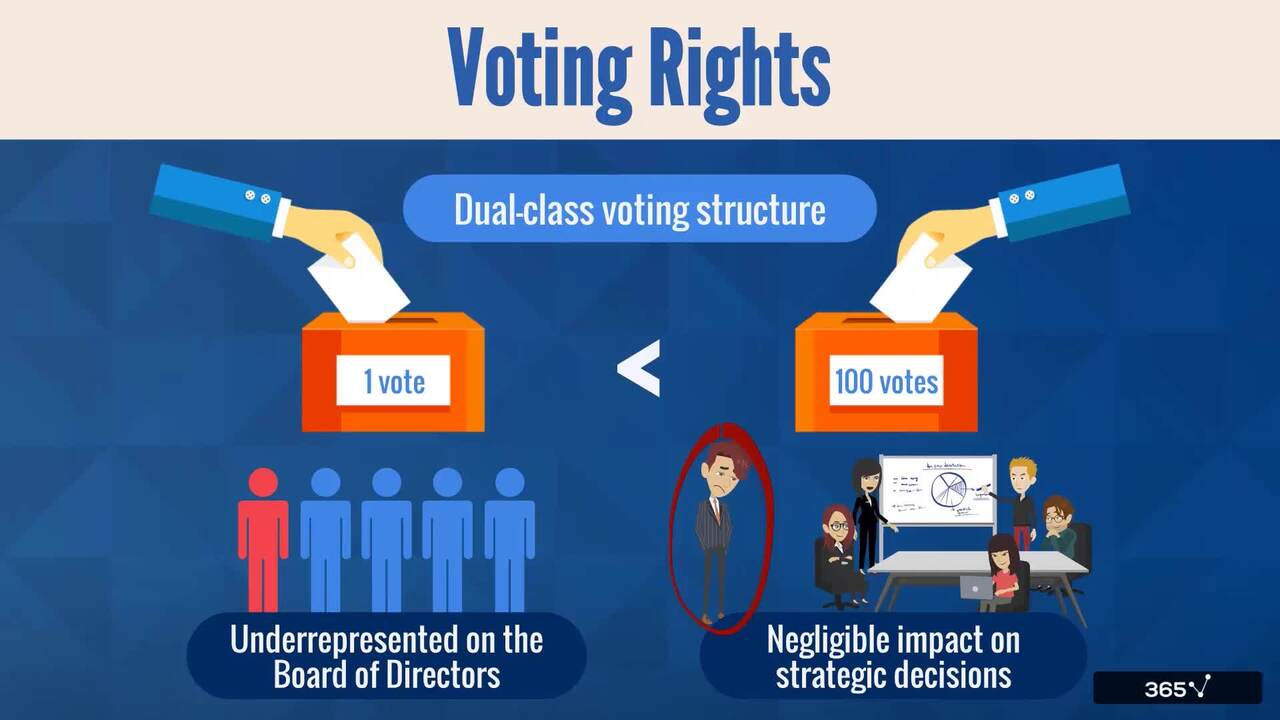

1.3 Voting Rights

2 min

1.5 Private vs. Public Equity

6 min

2.1 Non-domestic Stocks

8 min

2.3 Equity (Risk and Return)

5 min

Curriculum

- 2. Foreign Equities and Equity Risk6 Lessons 25 MinTo broaden your perspective, we teach you how to invest in non-domestic stocks. Namely, we explore the difference between direct and indirect investing through depository receipts. We further divide the latter into unsponsored and sponsored and explore how they differ with respect to voting rights. Then, we examine two additional ways to gain foreign equity exposure: through global depository receipts (GDRs) and American depository receipts (ADRs). After covering the basics, we provide a deeper insight into the risk and return characteristics of various equity securities. More specifically, we explain the role of equity securities in company financing. Then, we discuss the difference between the market and the book value of equity. Finally, we touch upon the relationship between a company’s cost of equity and return on equity and investors’ required rate of return.Non-domestic Stocks8 minEquity (Risk and Return)5 minThe Role of Equity in Company Financing2 minMarket vs Book Value of Equity2 minReturn on Equity4 minCost of Equity4 min

Topics

Course Requirements

- No prior experience or knowledge is required. We will start from the basics and gradually build your understanding. Everything you need is included in the course.

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring investment professionals

- Individuals seeking to enhance their investment literacy and understanding

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ivan is the COO of 365 Data Science and a CFA charterholder with over 12 years of professional experience in the financial sector. He earned his Master’s degree in Financial Economics from the Erasmus University of Rotterdam, the Netherlands in 2010 and has been fascinated by the world of artificial intelligence and machine learning ever since. Seeing how data science truly redefined the finance industry over the last decade, Ivan knew that he couldn’t stay on the sidelines. In 2019, he published his first online course on corporate finance, combining his expertise with his love of teaching. His goal is to establish 365 Data Science as the best learning platform for aspiring data professionals in the world.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.