Fundamentals of Financial Markets

Navigate financial markets with confidence: Acquire fundamental knowledge in financial instruments, regulations, and market dynamics

Start for free

Start for free

What you get:

- 5 hours of content

- 97 Interactive exercises

- 4 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Fundamentals of Financial Markets

Start for free

Start for free

What you get:

- 5 hours of content

- 97 Interactive exercises

- 4 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 5 hours of content

- 97 Interactive exercises

- 4 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Gain a deep understanding of the organization of financial markets

- Build the knowledge needed to invest intelligently with a long-term mindset.

- Learn index investing and the main types of equity and fixed-income indexes.

- Calculate and interpret the value, price, and total return of an index

- Understand market efficiency and how its forms impact investment decisions.

- Examine key asset classes and construct optimized investment portfolios.

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Course Introduction

2 min

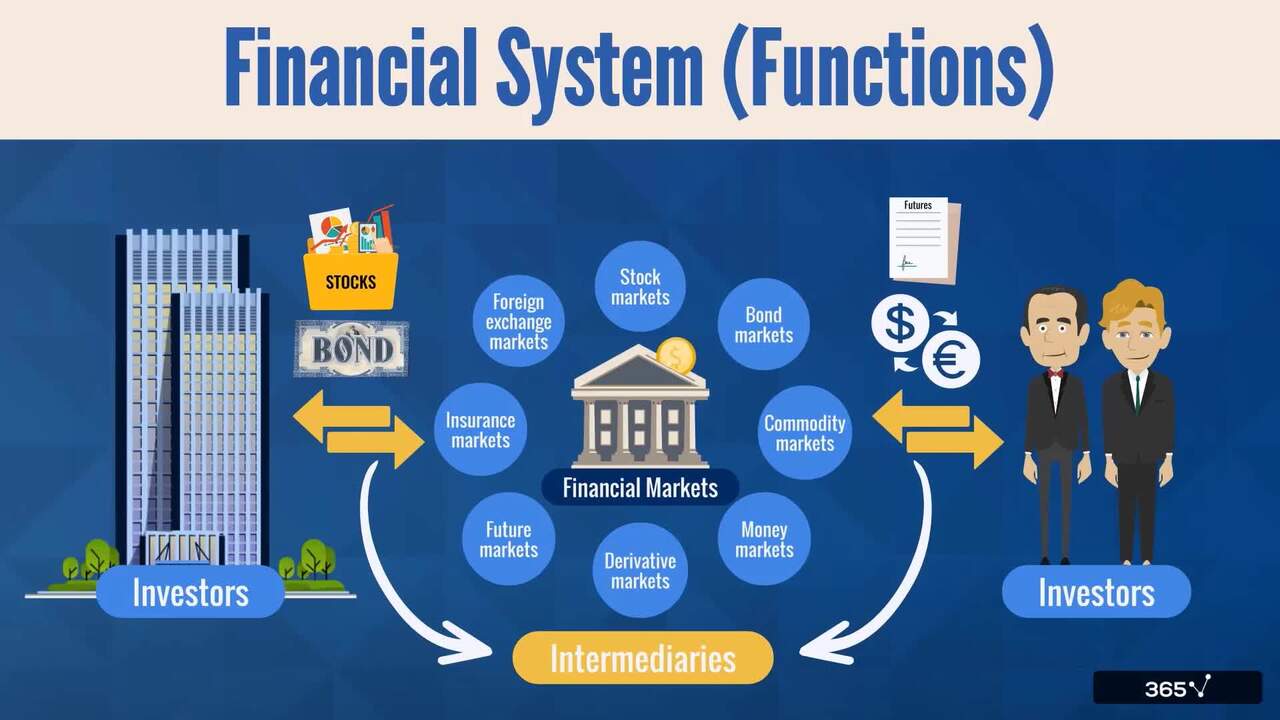

1.2 Financial System (Functions)

2 min

1.3 Financial System (Purposes)

5 min

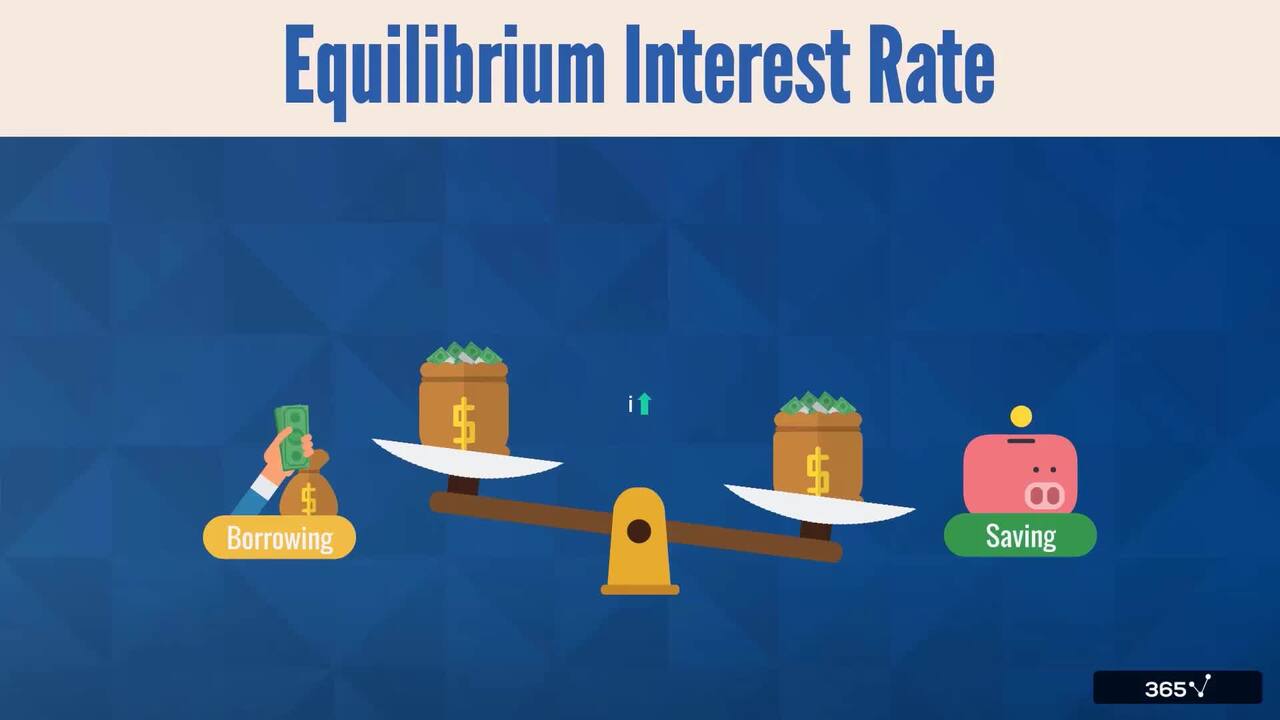

1.4 Equilibrium Interest Rate

3 min

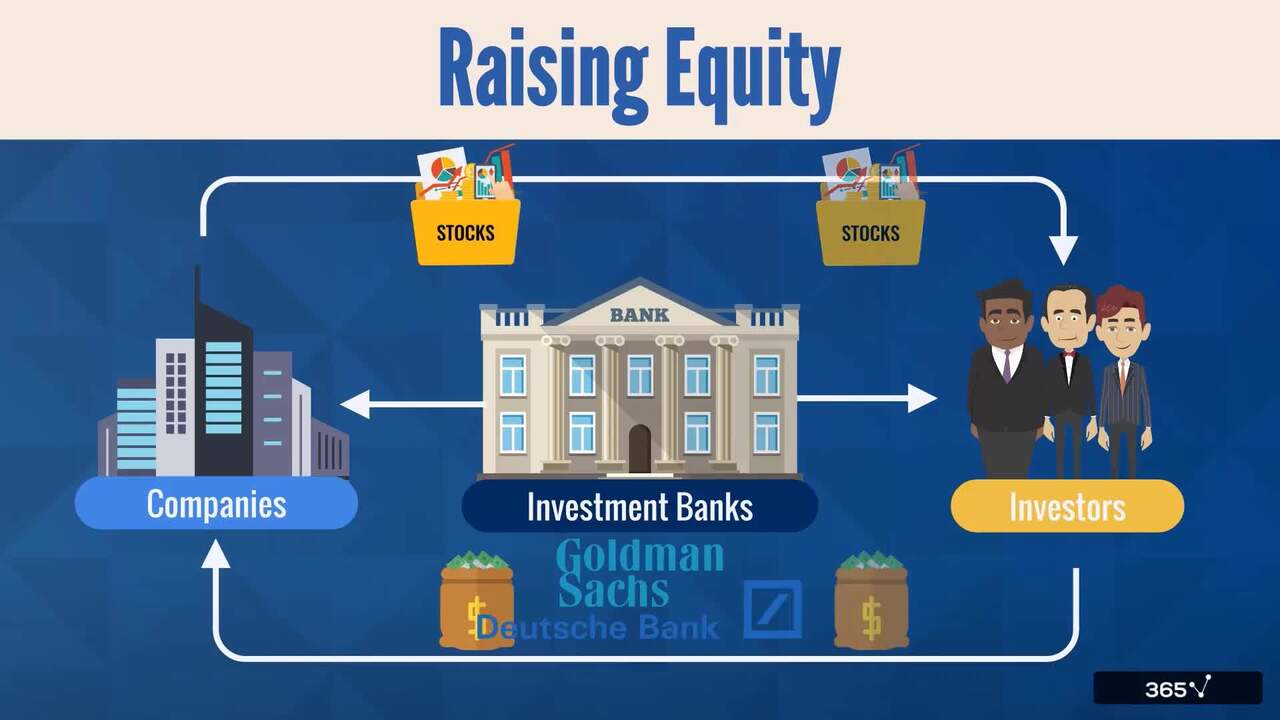

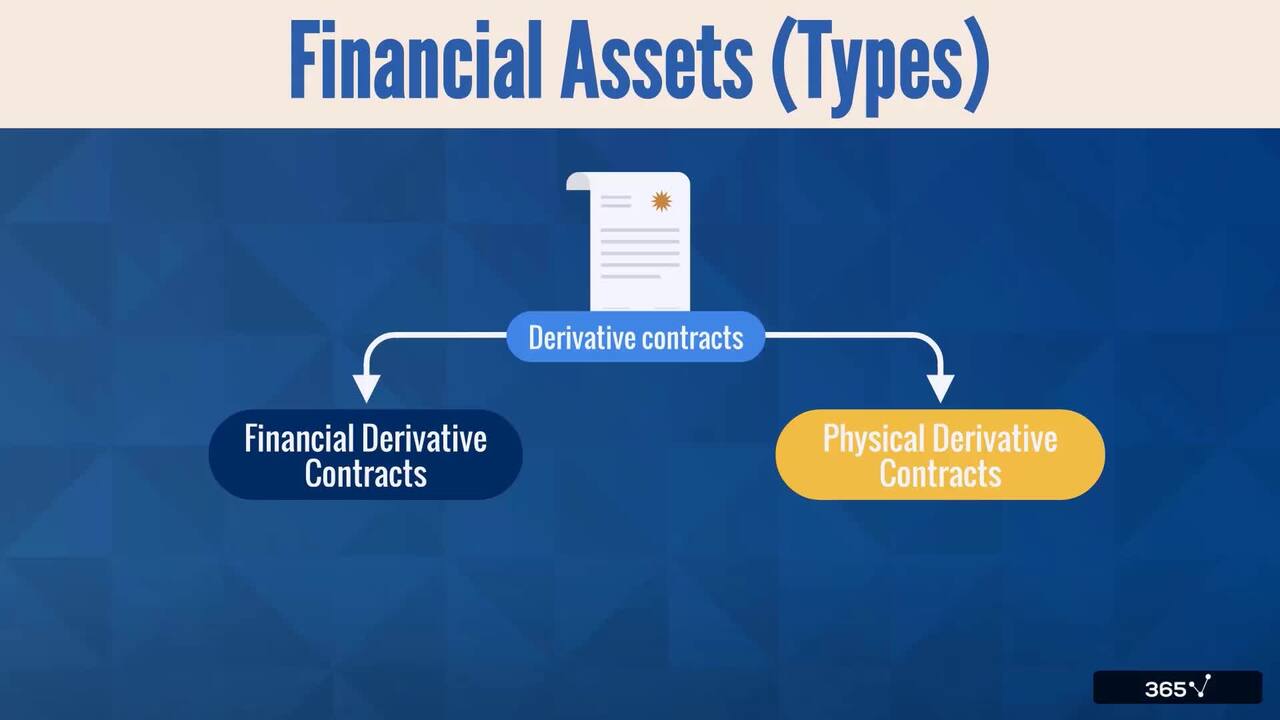

1.5 Asset Classification

5 min

1.7 Security Types

5 min

Curriculum

- 2. Security Market Indexes19 Lessons 60 MinIn this section of the Fundamentals of Financial Markets course, we discuss the meaning of security market index and the difference between index price and total return. We examine the choices and issues in index construction and management and compare different weighting methods and how they affect index return. Towards the end of the section, we describe the different types of equity, alternative investments, and fixed income indexes.Security Market Index1 minPrice and Total Return5 minSingle-period Total Return2 minIndex Value (Multiple Time Periods)2 minIndex Construction and Management2 minIndex Weighting3 minEqual Weighting2 minMarket-capitalization Weighting2 minFloat-adjusted Market-capitalization Weighting2 minFundamental Weighting3 minPrice-weighted Index (Value and Return)5 minMarket-capitalization-weighted Index (Value and Return)3 minEqual-weighted Index (Value and Return)4 minIndex Rebalancing4 minMarket Indexes (Applications)5 minEquity Index Types4 minFixed-Income Index Types2 minAlternative Investment Index Types4 minSecurity Market Indexes (Comparison)5 min

- 3. Market Efficiency11 Lessons 49 MinIn the last section of the Fundamentals of Financial Markets course, study investments from a theoretical perspective with the concept of market efficiency as the central point of discussion. Of course, we also touch on several types of equity securities. To help you grasp the practicalities, we highlight the difference between intrinsic and market value. Inevitably, the factors that affect a market’s efficiency will be observed, too. Such an in-depth understanding will give you a bird’s-eye view of the market. You will learn how to differentiate between market types and what their implications for fundamental and technical analysis are. And finally, we discuss how behavioral finance can help us learn about financial markets and understand market anomalies.Market Efficiency4 minMarket vs. Intrinsic Value2 minMarket Efficiency Factors7 minMarket Efficiency Forms6 minMarket Efficiency Forms (Implications)5 minMarket Anomalies3 minMarket Anomalies (Types)4 minMomentum and Overreaction Anomalies3 minCross-Sectional Anomalies3 minOther Market Anomalies7 minBehavioral Finance5 min

Topics

Course Requirements

- No prior experience or knowledge is required. We will start from the basics and gradually build your understanding. Everything you need is included in the course.

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring investment professionals

- Individuals seeking to enhance their investment literacy and understanding

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ivan Kitov is the COO of 365 Data Science and a CFA charterholder with over 12 years in finance. He holds a Master's in Financial Economics from Erasmus University Rotterdam and combines expertise in corporate finance, investments, and strategy with a passion for AI and machine learning. Since 2019, he has created courses that have helped thousands of students worldwide gain practical finance and data skills, with the goal of making 365 Data Science the top global platform for aspiring professionals.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.