Fundamentals of Equity Valuation

Master the fundamentals of equity valuation: Learn and apply key valuation models to measure company value accurately

Start for free

Start for free

What you get:

- 1 hour of content

- 36 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

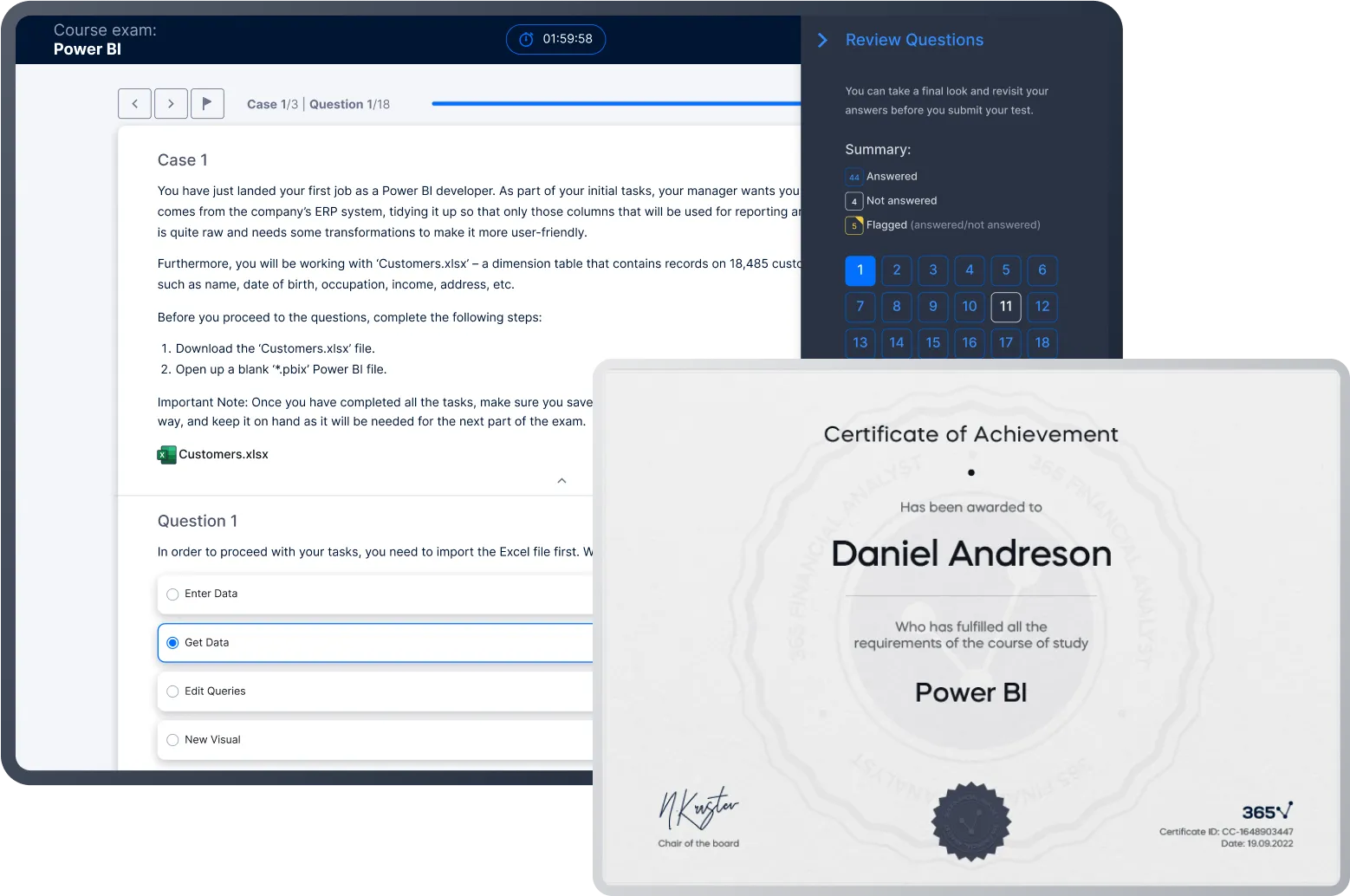

- Course exam

- Certificate of achievement

Fundamentals of Equity Valuation

Start for free

Start for free

What you get:

- 1 hour of content

- 36 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 1 hour of content

- 36 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Apply present value models and relative valuation multiples to accurately determine company value

- Clearly distinguish between the market value and intrinsic value of stocks

- Gain familiarity with key stock transactions, including dividend payments, share splits, and share repurchases

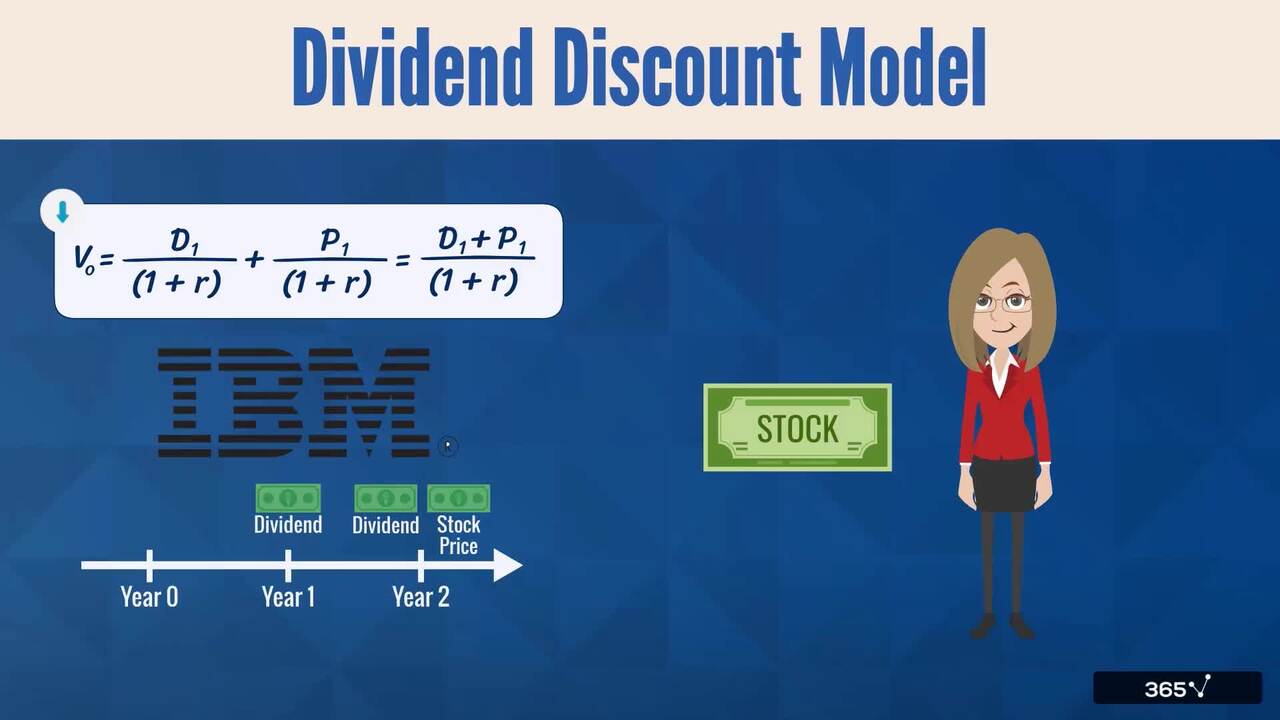

- Estimate a stock’s intrinsic value using Gordon’s Dividend Discount Model

- Develop a comprehensive understanding of the strengths and limitations of different valuation models

- Acquire essential valuation skills that will enhance your career prospects and technical expertise

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Introduction to Fundamentals of Equity Valuation

2 min

1.2 Market vs. Intrinsic Value

6 min

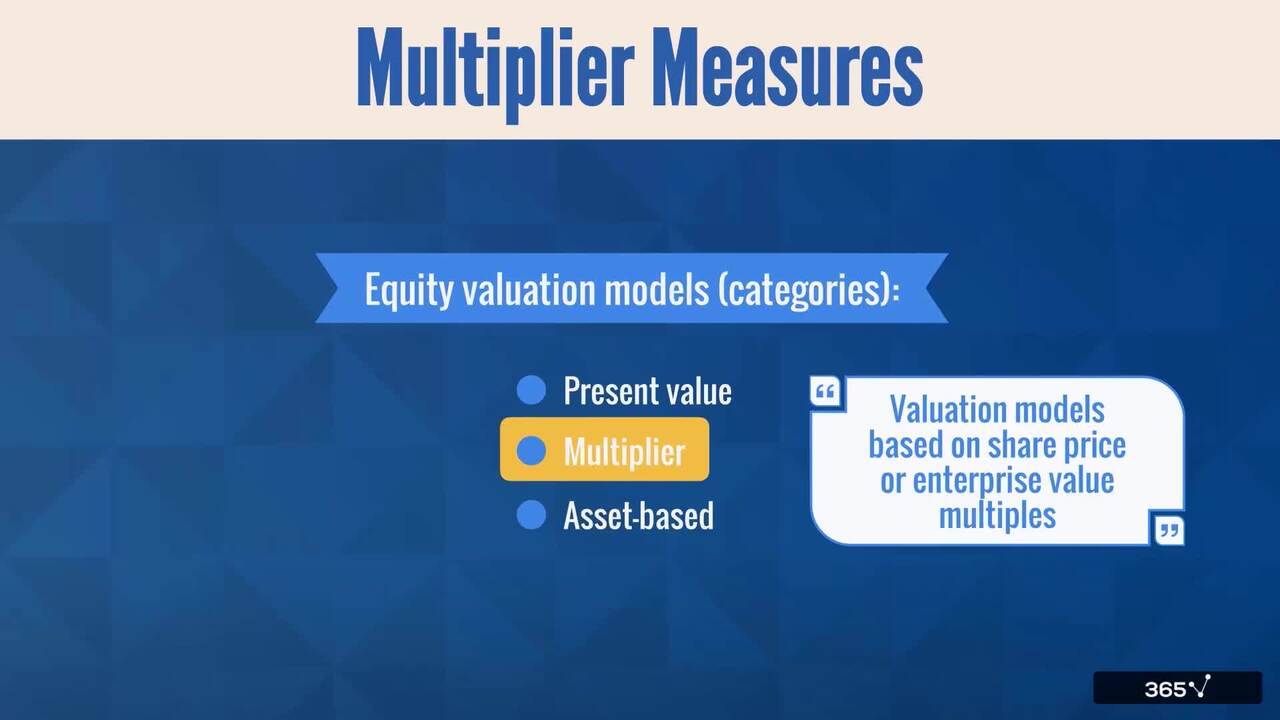

1.3 Equity Valuation Models (Categories)

4 min

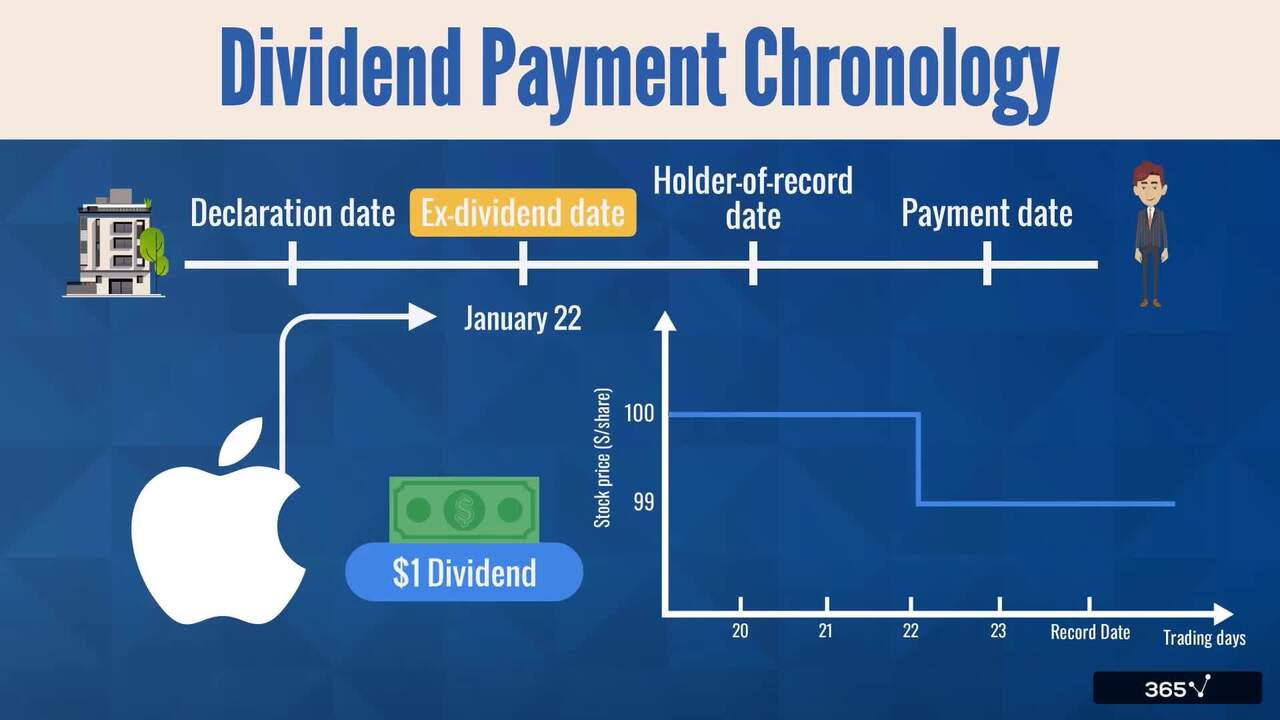

1.4 Dividend Payments

6 min

1.5 Dividend Payment Chronology

2 min

2.1 Dividend Discount Model

6 min

Curriculum

- 2. Present Value Models7 Lessons 31 MinThis section is dedicated to the specifics of some present value models. We examine in detail the dividend discount and free cash flow to equity models and teach you to calculate the intrinsic value of non-callable, non-convertible preferred stocks. But that’s not all. You will also learn about the Gordon growth model and which company characteristics to consider before applying this method.Dividend Discount Model6 minFree-cash-flow-to-equity Model4 minRequired Rate of Return (Common Equity)4 minFundamental Value of Preferred Stock2 minGordon Growth Model7 minMultistage Dividend Discount Model5 minPresent Value Models-Overview3 min

- 3. Relative Valuation Measures7 Lessons 34 MinThe closing section of the Fundamentals of Equity Valuation course examines in detail price multiples to value equity—more specifically, those based on comparables and fundamentals. Moreover, you will learn the specifics and proper use of asset-based valuation models. The section concludes with a thorough overview of all equity valuation categories. This will give you a deeper understanding of their pros and cons from a practical perspective.Multiplier Model5 minCommon Price Multiples5 minPrice Multiples Based on Fundamentals5 minPrice Multiples Based on Comparables6 minEnterprise Value Multiple5 minAsset-based Valuation Model4 minEquity Valuation Models-Strengths and Weaknesses4 min

Topics

Course Requirements

- Highly recommended to take Accounting and Financial Statement Analysis and Corporate Finance courses first

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring financial analysts, investment analysts, investment bankers, valuation experts

- Everyone who wants to work in finance and understand the drivers of company valuation

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ivan Kitov is the COO of 365 Data Science and a CFA charterholder with over 12 years in finance. He holds a Master's in Financial Economics from Erasmus University Rotterdam and combines expertise in corporate finance, investments, and strategy with a passion for AI and machine learning. Since 2019, he has created courses that have helped thousands of students worldwide gain practical finance and data skills, with the goal of making 365 Data Science the top global platform for aspiring professionals.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.