Fixed Income Investments

Invest in Fixed Income securities with confidence: Master essential theories, common valuation techniques, and risk management strategies

Start for Free

Start for Free

What you get:

- 4 hours of content

- 9 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

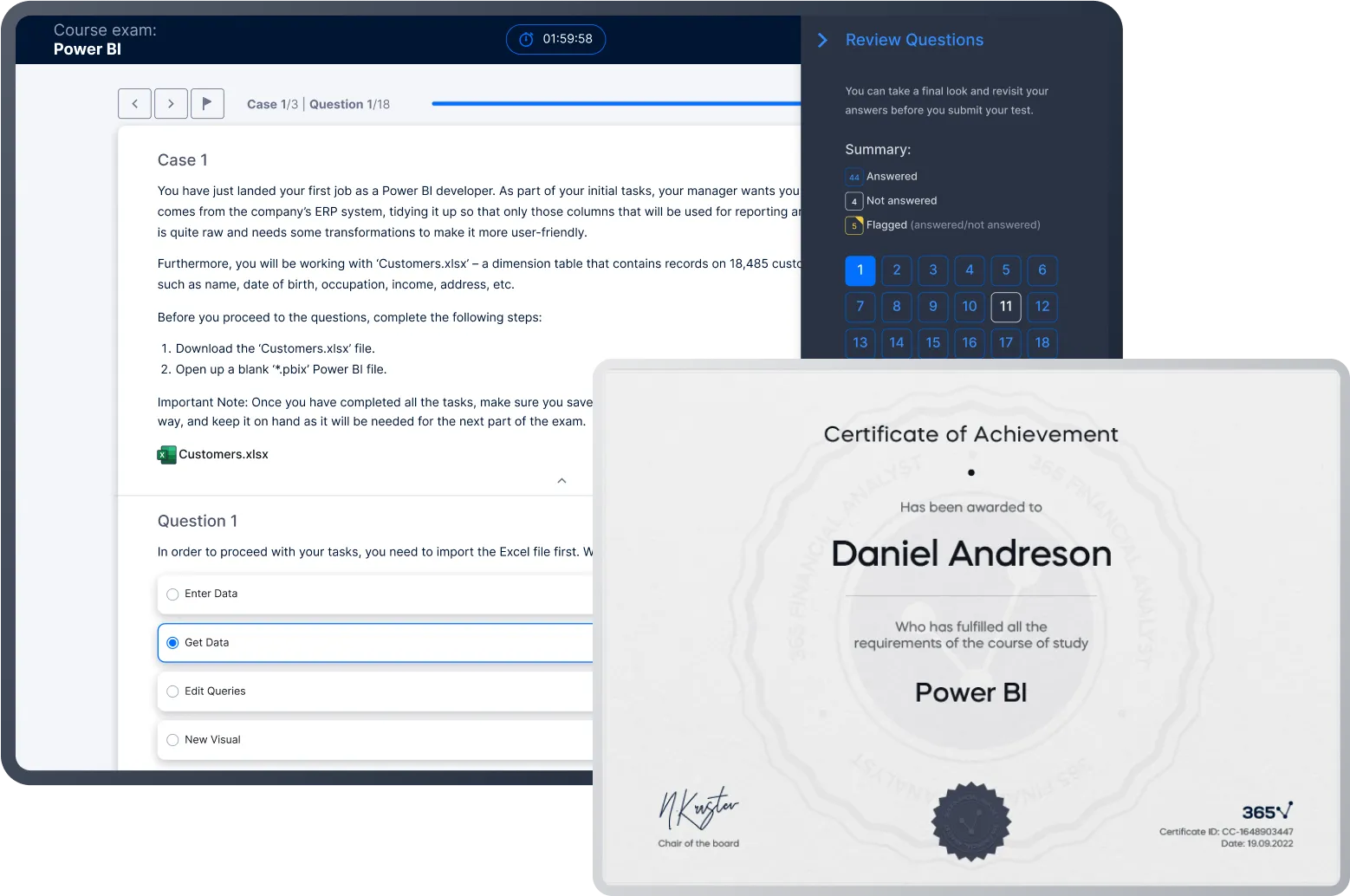

- Course exam

- Certificate of achievement

Fixed Income Investments

Start for Free

Start for Free

What you get:

- 4 hours of content

- 9 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 4 hours of content

- 9 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Develop an in-depth understanding of the fixed income securities asset class

- Master foundational fixed income concepts: price, discount rate, coupon payment, and time to maturity

- Acquire essential technical skills to compute a bond’s price, yield-to-maturity, and accrued interest using Excel

- Describe how primary and secondary bond markets work

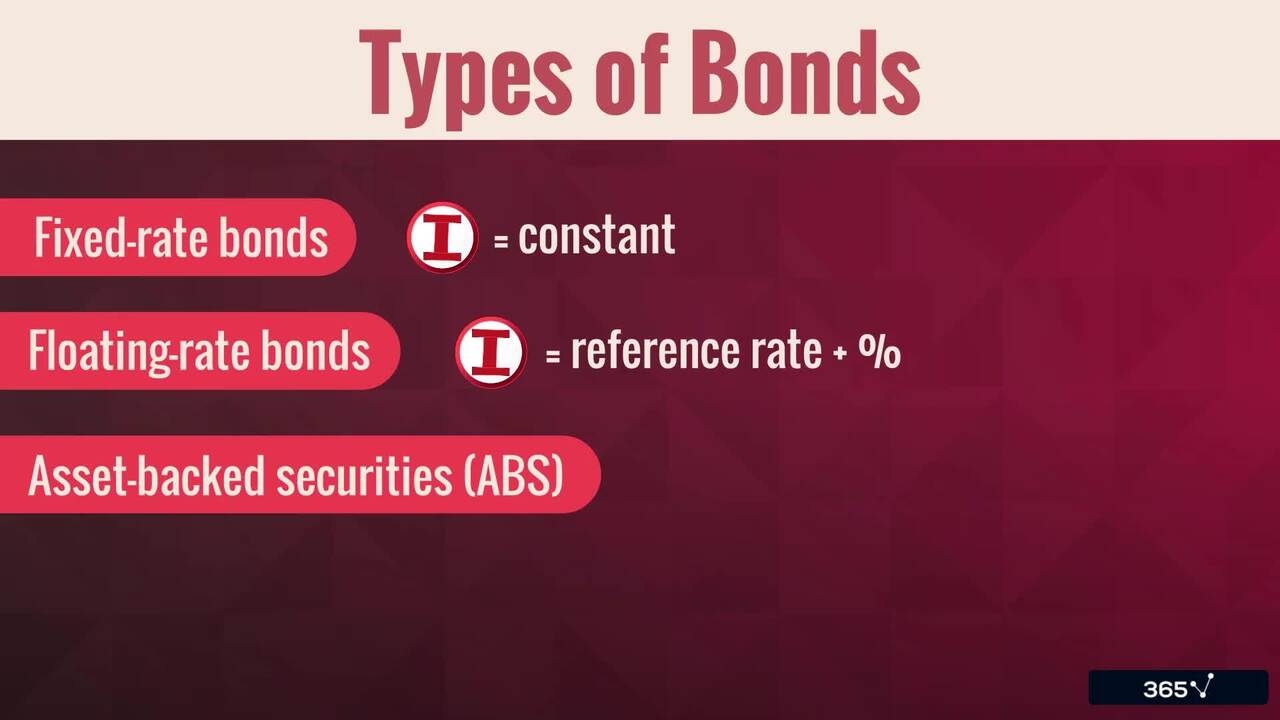

- Explore the diverse types of bonds— from government and corporate bonds to structured financial instruments

- Improve your career prospects by acquiring evergreen technical skills in investment finance

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the course cover

2 min

1.2 Introduction to Fixed Income Terminology

4 min

2.1 Basic Features of a Fixed Income Security

8 min

2.2 What is a Bond Indenture?

3 min

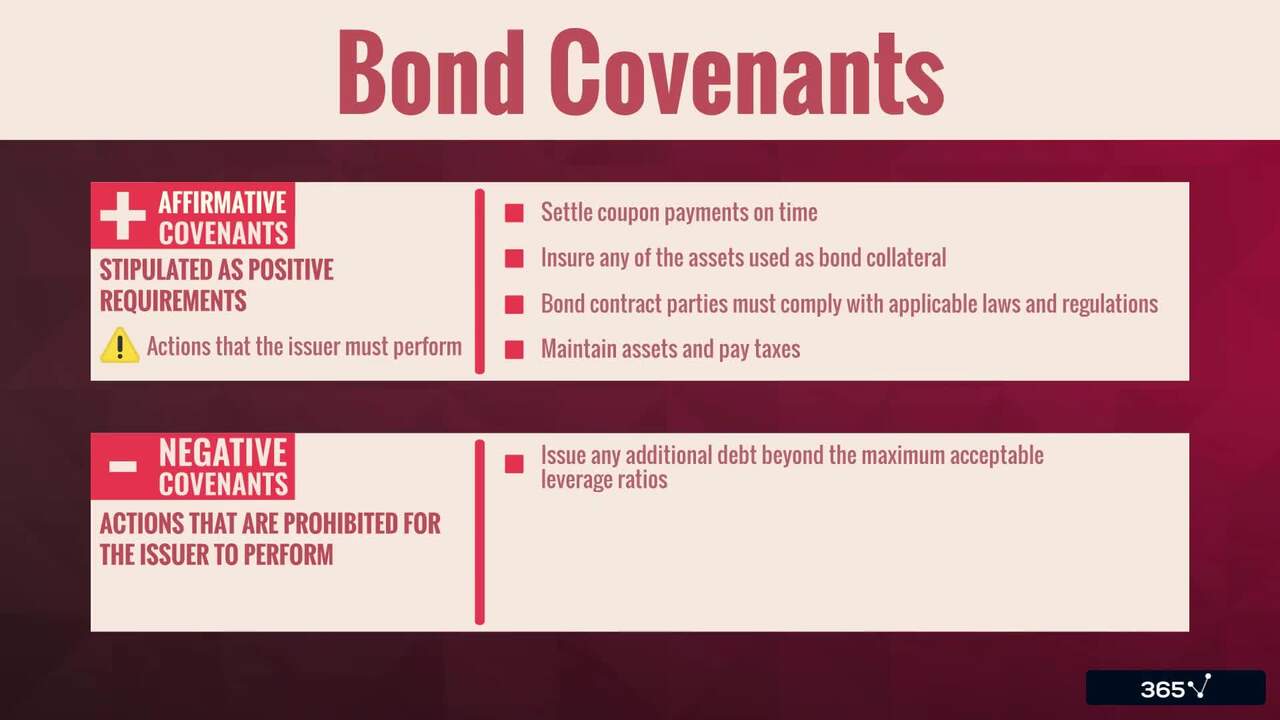

2.3 Affirmative vs. Negative Covenants

2 min

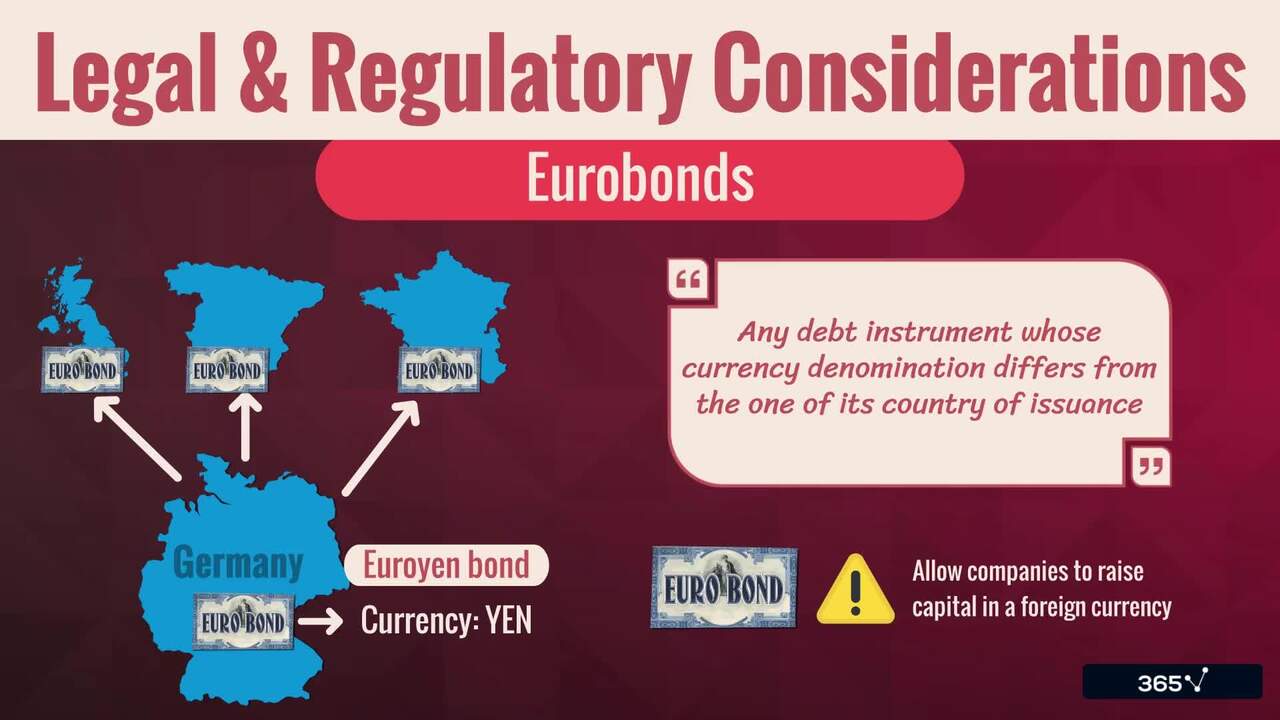

2.4 Legal, Regulatory, and Tax Considerations

5 min

Curriculum

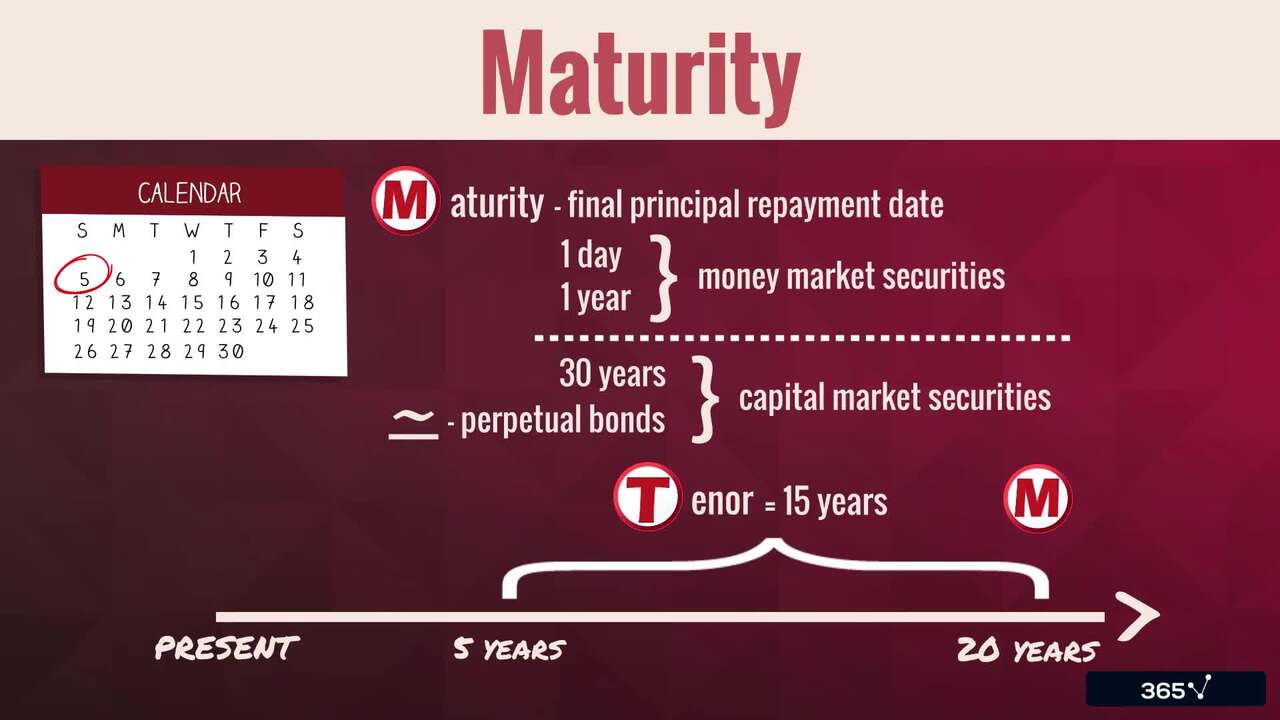

- 2. Structure of Fixed Income Securities8 Lessons 36 MinThis section of the Fixed Income Investments course is dedicated to the features of fixed income securities. We examine various cash flow structures, discuss principal and coupon payments, and explain why some bonds include sinking fund provisions. Moreover, you will understand the meaning of contingency provisions and whether they benefit the bondholder or the bond issuer.Basic Features of a Fixed Income Security8 minWhat is a Bond Indenture?3 minAffirmative vs. Negative Covenants2 minLegal, Regulatory, and Tax Considerations5 minCash Flows Structures - Principal3 minCash Flows Structures - Coupons5 minCash Flows Structures - Sinking Fund Provisions2 minContingency Provisions8 min

- 3. Fixed Income Markets11 Lessons 47 MinOur main goal here is to provide a thorough classification of the global fixed income markets and the types of fixed income securities issued. We discuss in detail the bonds issued by sovereign governments and supranational organizations, the types of corporate bonds, and the significance of the ratings given by credit rating agencies.Global Fixed Income Markets - Classification4 minInterbank Offered Rates3 minPrimary Bond Markets7 minSecondary Bond Markets2 minSovereign Bonds2 minOther Types of Bonds3 minCorporate Bonds (Part 1)5 minCorporate Bonds (Part 2)4 minStructured Financial Instruments6 minShort-term Funding Alternatives4 minRepurchase Agreements7 min

- 4. Valuation of Fixed Income Securities17 Lessons 101 MinIn this section of the Fixed Income Investments course, we cover the practical aspects of fixed income valuation. You will learn how to calculate a bond’s price, yield-to-maturity (YTM), and various other yield measures for fixed-rate bonds, floating-rate bonds, and money market instruments using various Excel functions.Calculating a Bond's Price6 minCalculating a Bond's Price in Excel5 minInterrelationships among Bond Features6 minCalculating a Bond's YTM in Excel2 minSpot Rates5 minCalculating a Bond's Price Using Spot Rates in Excel4 minFull vs. Flat Price12 minCalculating Accrued Interest in Excel7 minMatrix Pricing2 minCalculating Annual Yields5 minYield Measures - Fixed-rate Bonds7 minCalculating Yield-to-Call in Excel3 minYield Measures - Floating-rate Bonds9 minYield Measures - Money-market Instruments8 minYield Curves4 minForward Rates vs. Spot Rates10 minYield Spread Measures6 min

Topics

Course Requirements

- Highly recommended to take the Corporate Finance course first

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring investment analysts, investment bankers

- Everyone who wants to work in investment finance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Antoniya is a finance professional with vast experience in accounting, auditing, financial management, and multiple high-level finance roles. She holds two master’s degrees—in Finance and in Contemporary Educational Technologies. She has worked as an auditor at PwC, as a financial controller at Atos, as an FP&A Manager and Senior Manager at Coca-Cola, and currently, as a Finance Manager at 365. Her passion for finance and teaching brought her to the 365 Тeam. She has been tutoring on various topics, including accounting, financial reporting, financial planning and analysis, economics, etc. Antoniya’s qualifications and engaging teaching style make the learning process enjoyable, and her courses have helped numerous students progress in their careers.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.