Financial Ratio Analysis

Master financial ratio analysis: Evaluate company performance and financial health through key ratios

Start for free

Start for free

What you get:

- 4 hours of content

- 36 Interactive exercises

- 14 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Financial Ratio Analysis

Start for free

Start for free

What you get:

- 4 hours of content

- 36 Interactive exercises

- 14 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 4 hours of content

- 36 Interactive exercises

- 14 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Evaluate a company’s financial position and overall performance using ratio analysis

- Compute financial ratios commonly used in equity and credit analysis

- Develop a comprehensive understanding of the drivers of financial performance

- Master the calculation of efficiency, liquidity, solvency, profitability, and valuation ratios

- Clean and polish financial ratios from one-off and non-core items, ensuring a true representation of a company’s financial performance

- Gain essential financial analysis skills that are crucial for every analyst

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the course cover

2 min

1.2 Tools and Techniques Used in Financial Analysis

8 min

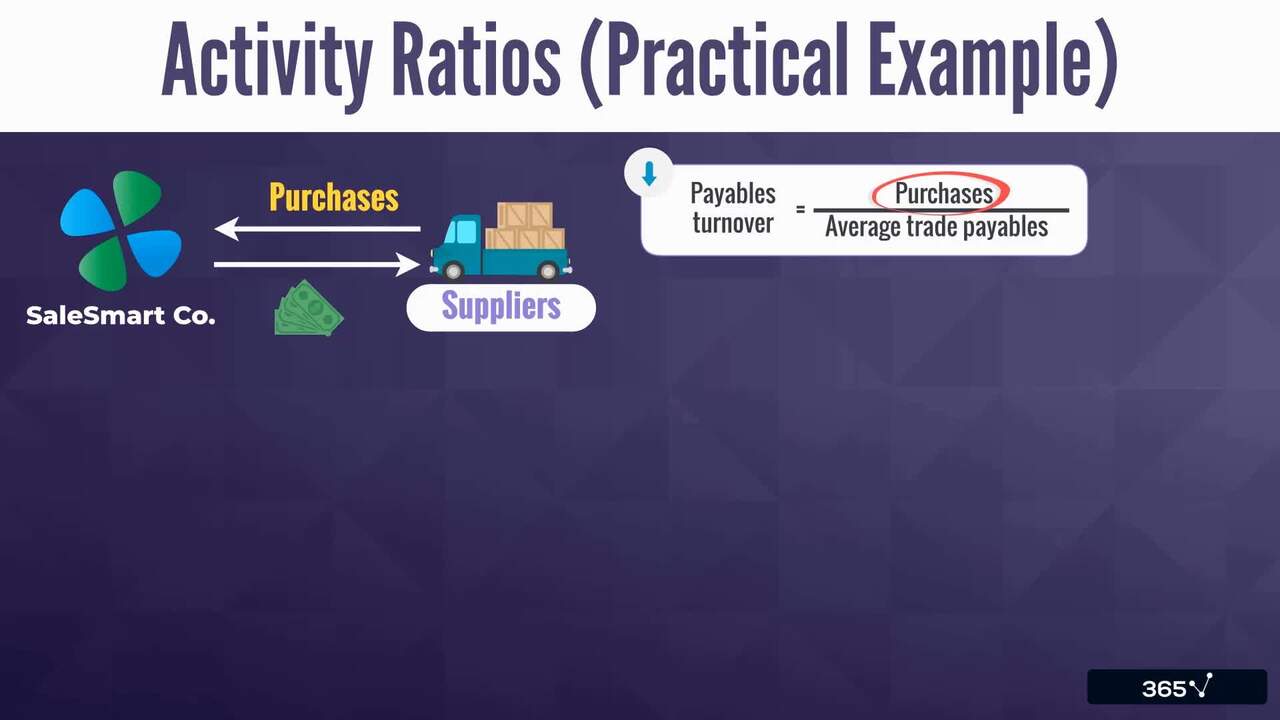

2.1 Calculating and Interpreting Activity Ratios

9 min

2.2 Activity Ratios - Example

9 min

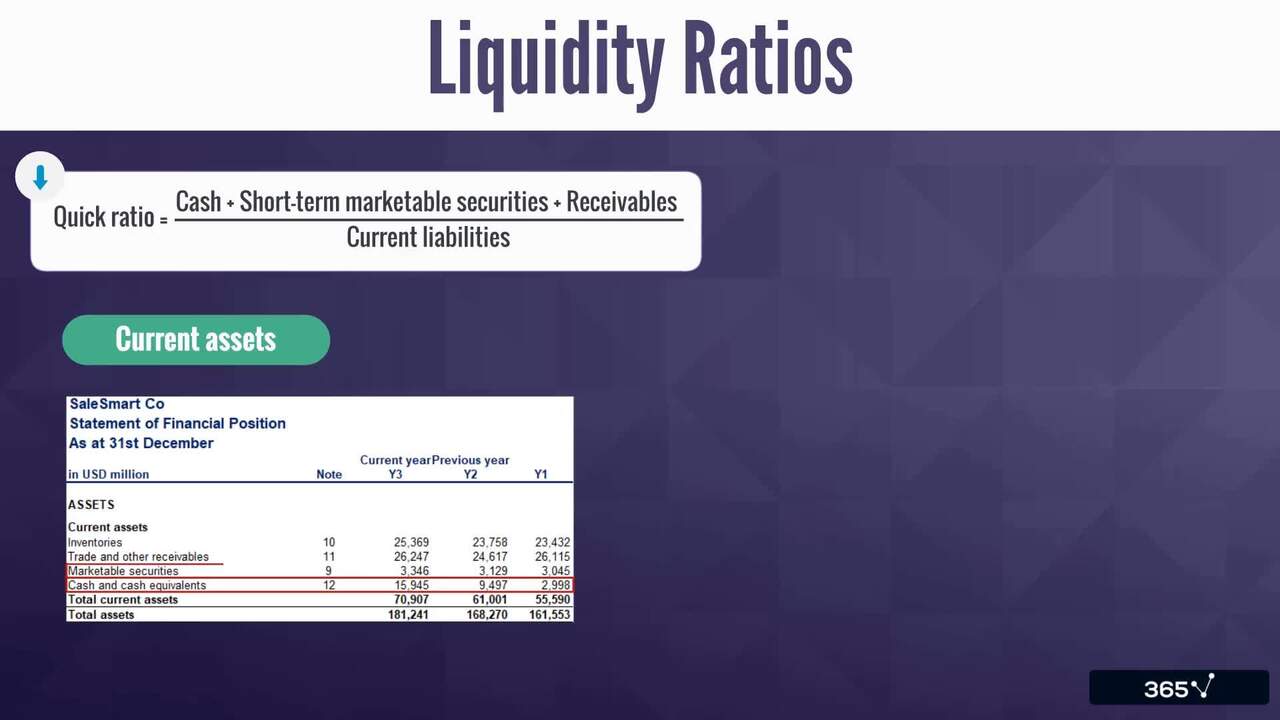

2.3 Calculating and Interpreting Liquidity Ratios

10 min

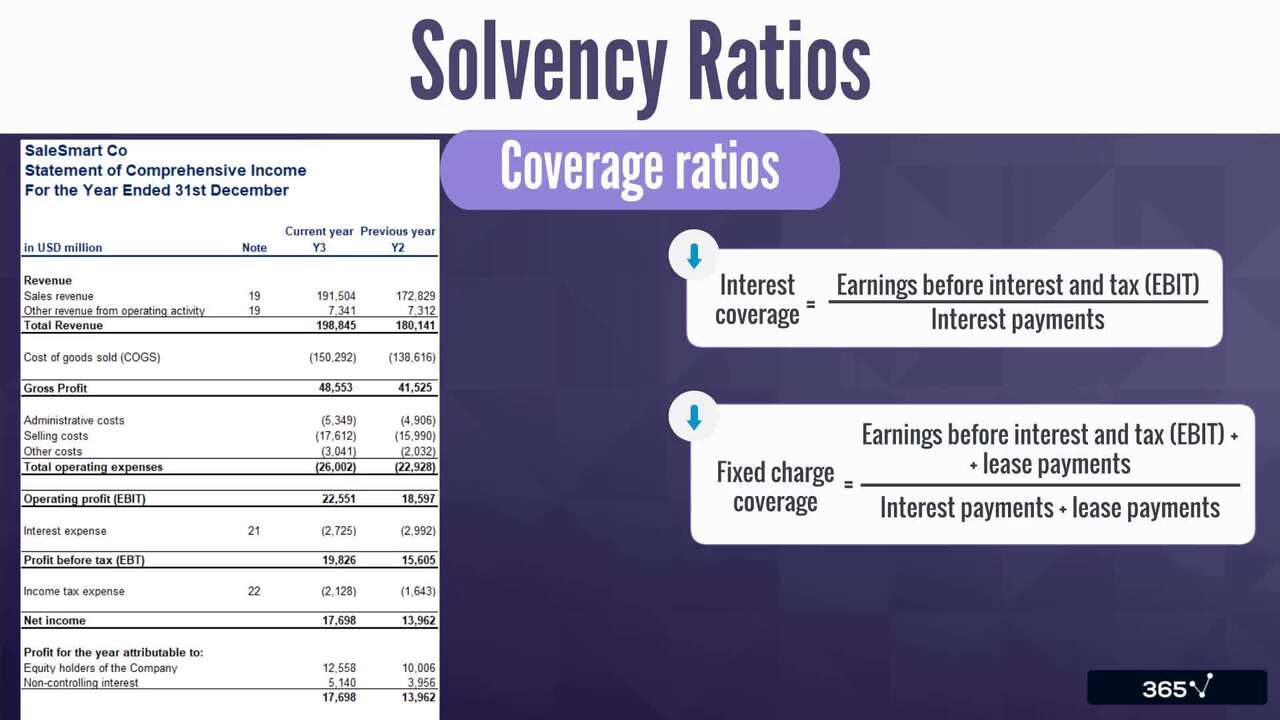

2.5 Calculating and Interpreting Solvency Ratios

10 min

Curriculum

- 2. Types of Ratios7 Lessons 71 MinIn this section, we show you how to calculate and interpret various financial ratios classified into five categories—activity, liquidity, solvency, profitability, and valuation ratios. We’ll take the financial statements of a real company and calculate all the multiples in real time in Excel together with you.Calculating and Interpreting Activity Ratios9 minActivity Ratios - Example9 minCalculating and Interpreting Liquidity Ratios10 minCalculating and Interpreting Solvency Ratios10 minCalculating and Interpreting Profitability Ratios10 minCalculating and Interpreting Valuation Ratios12 minRatio Analysis - Summary11 min

- 3. Using Ratio Analysis in Company Evaluation5 Lessons 36 MinIn this section, we evaluate a company by integrating financial ratio analysis in a single comprehensive framework. We demonstrate the application of DuPont analysis, calculate and interpret ratios used in equity and credit analysis, and discuss the importance of ratio analysis in segment reporting.DuPont Analysis9 minDuPont Analysis - Practical Example8 minRatios Used in Equity Analysis6 minRatios Used in Credit Analysis7 minSegment Reporting6 min

- 4. Ratio Analysis and Forecasting5 Lessons 41 MinIn the last section of the Financial Ratio Analysis course, we put everything you’ve learned so far together and illustrate how you can use ratio analysis for forecasting purposes. You will learn to evaluate a company’s historical performance and make projections about its future. In addition, we will show you how to assess potential debt and equity investments and the typical adjustments an analyst might make in order to scrutinize published financial statements.Ratio Analysis and Forecasting9 minForecasting a Company's Performance10 minAssessing the Credit Quality of Potential Debt Investments5 minScreening for Potential Equity Investments8 minCommon Adjustments to the Financial Statements9 min

Topics

Course Requirements

- Highly recommended to take the Accounting and Financial Statement Analysis and Fundamentals of Financial Reporting courses first

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring financial analysts, investment analysts

- Everyone who wants to work in finance and understand company performance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Antoniya is a finance professional with vast experience in accounting, auditing, financial management, and multiple high-level finance roles. She holds two master’s degrees—in Finance and in Contemporary Educational Technologies. She has worked as an auditor at PwC, as a financial controller at Atos, as an FP&A Manager and Senior Manager at Coca-Cola, and currently, as a Finance Manager at 365. Her passion for finance and teaching brought her to the 365 Тeam. She has been tutoring on various topics, including accounting, financial reporting, financial planning and analysis, economics, etc. Antoniya’s qualifications and engaging teaching style make the learning process enjoyable, and her courses have helped numerous students progress in their careers.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.