Derivatives

Master derivative instruments: Theory and practice for navigating forwards, futures, swaps, and options

Start for free

Start for free

What you get:

- 2 hours of content

- 23 Interactive exercises

- 1 Downloadable resource

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Derivatives

Start for free

Start for free

What you get:

- 2 hours of content

- 23 Interactive exercises

- 1 Downloadable resource

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 2 hours of content

- 23 Interactive exercises

- 1 Downloadable resource

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Develop an in-depth understanding of derivative instruments

- Master foundational derivatives concepts: cost, hedging, arbitrage, and duration

- Acquire essential technical skills to compute a derivative’s price and net cost of carry

- Describe the key differences between using derivative contracts for hedging and speculation

- Explore the diverse types of derivatives — from futures and forwards to European and American options

- Improve your career prospects by acquiring evergreen technical skills in investment finance

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the course cover

2 min

1.2 Defining derivatives

4 min

1.3 Hedging vs. Speculating

3 min

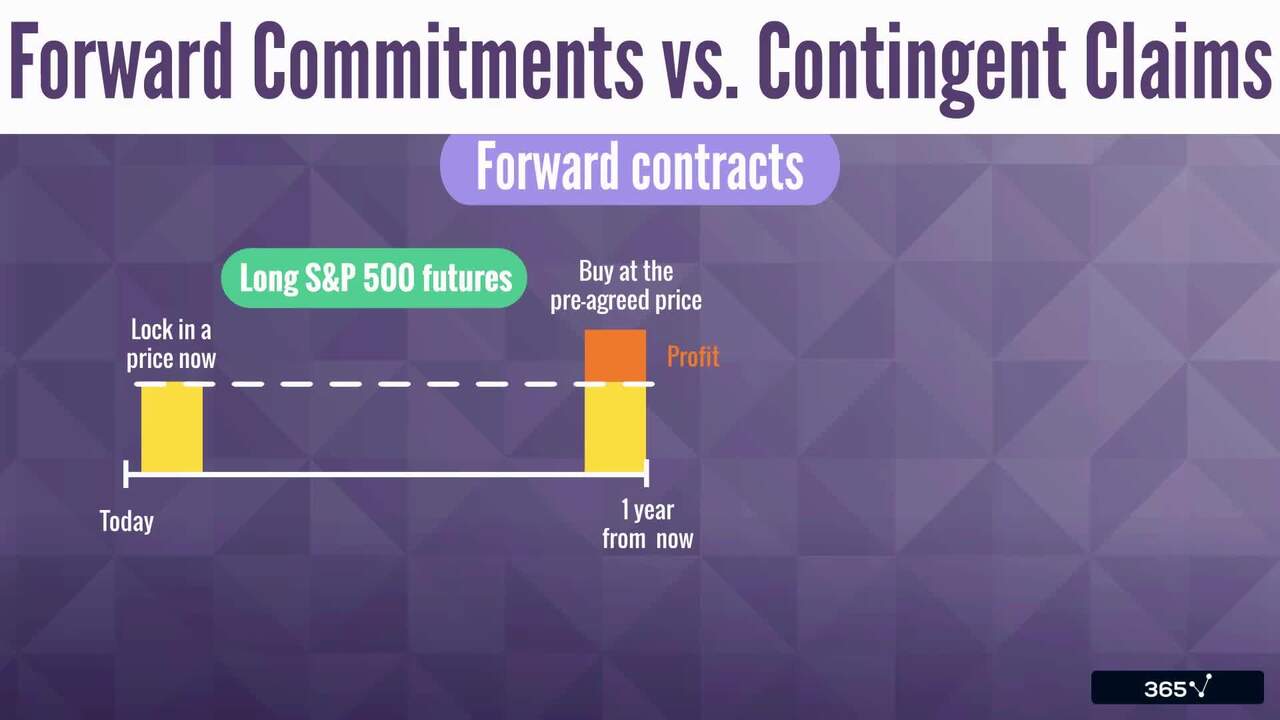

1.5 Forward Commitments vs. Contingent Claims

3 min

1.6 Forwards, Futures and Swaps

9 min

1.8 Options and Credit Derivatives

7 min

Curriculum

- 2. Pricing and Valuation of Forwards, Futures, and Swaps10 Lessons 37 MinIn this section, we examine various forward commitments in detail. We demonstrate how to calculate the value of forwards, futures, and swap contracts. The Derivatives course also covers forward rate agreements (FRAs) and the difference between swaps and a series of forward contracts.Derivatives Pricing4 minPrice vs. Value6 minCalculating Net Cost of Carry3 minCalculating Price and Value for forward contracts3 minMonetary and Non-monetary Benefits4 minEffects of Costs and Benefits on Forwards's Value2 minForward Rate Agreements3 minForwards' vs. Futures' prices4 minSwaps vs. Series of Forward Contracts4 minMechanism of Swaps4 min

- 3. Pricing and Valuation of Option Contracts6 Lessons 27 MinThis section of the Derivatives course is dedicated to option contracts. You will learn to calculate the exercise value, time value, and moneyness of options, differentiate between American and European styles, and evaluate the put-call parity conditions.Options4 minEuropean vs. American Options3 minValue of an Option7 minPut-Call Parity for Options5 minOne-period Binomial Model5 minEuropean vs. American Options: Value Differences3 min

Topics

Course Requirements

- Highly recommended to take the Financial math, Corporate Finance, and Fixed Income Investments courses first

Who Should Take This Course?

Level of difficulty: Intermediate

- Aspiring investment analysts, investment bankers

- Everyone who wants to work in investment finance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ned Krastev is an entrepreneur and educator who has helped over 1.6 million students worldwide gain business, finance, and data skills. After earning his Master's degree in Finance from Bocconi University in Milan, he built a career with leading companies including PwC Italy, Coca-Cola European Partners, and Infineon Technologies. In 2014, Ned published his first online course on financial modeling and valuation, sparking his passion for online education. Today, as Founder & CEO of 365 Careers and Co-founder of 365 Data Science, he leads one of the most successful global providers of professional training, aiming to bridge the gap between academic theory and real-world business application.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.