Building a 3-Statement Model in Excel

Take your financial modeling skills to the next level: learn to seamlessly integrate the three key financial statements

Start for Free

Start for Free

What you get:

- 1 hour of content

- 12 Interactive exercises

- 36 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Building a 3-Statement Model in Excel

Start for Free

Start for Free

What you get:

- 1 hour of content

- 12 Interactive exercises

- 36 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 1 hour of content

- 12 Interactive exercises

- 36 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

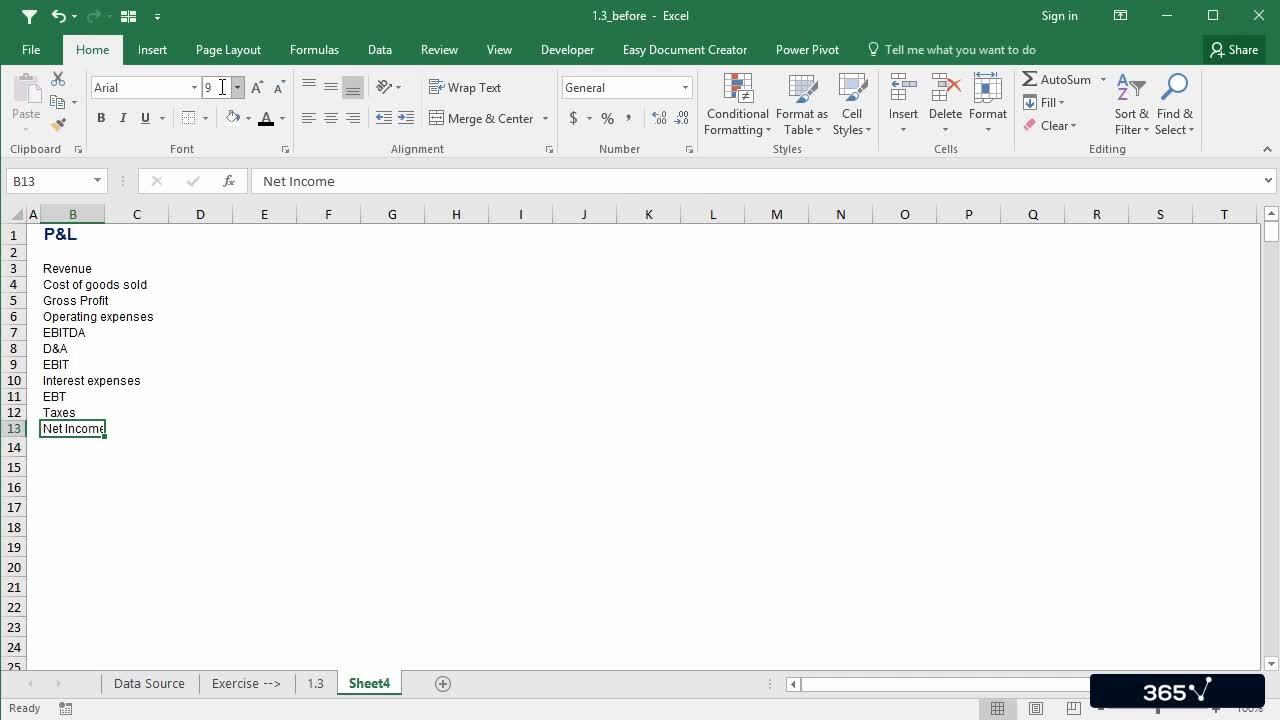

- Master the skills to build an Income Statement, Balance Sheet, and Cash Flow Statement from scratch

- Build an integrated 3-statement model enabling comprehensive financial analysis

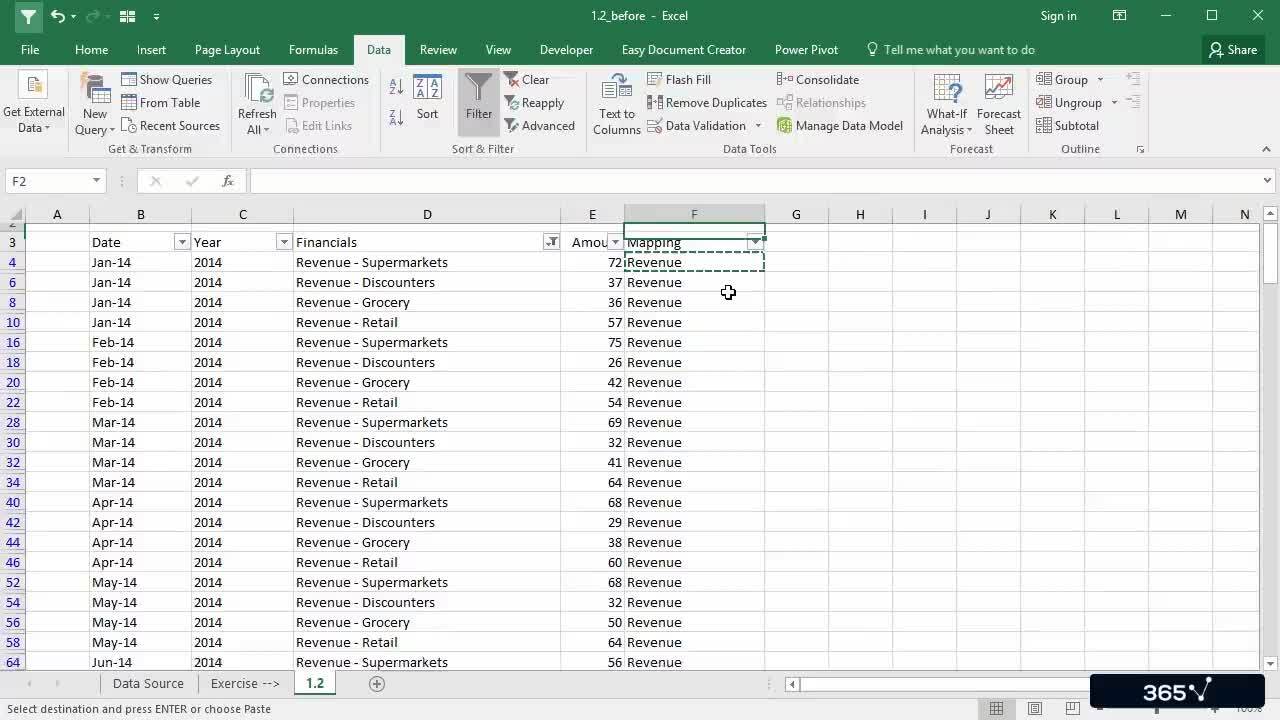

- Create mappings for financial items to ensure consistent analysis

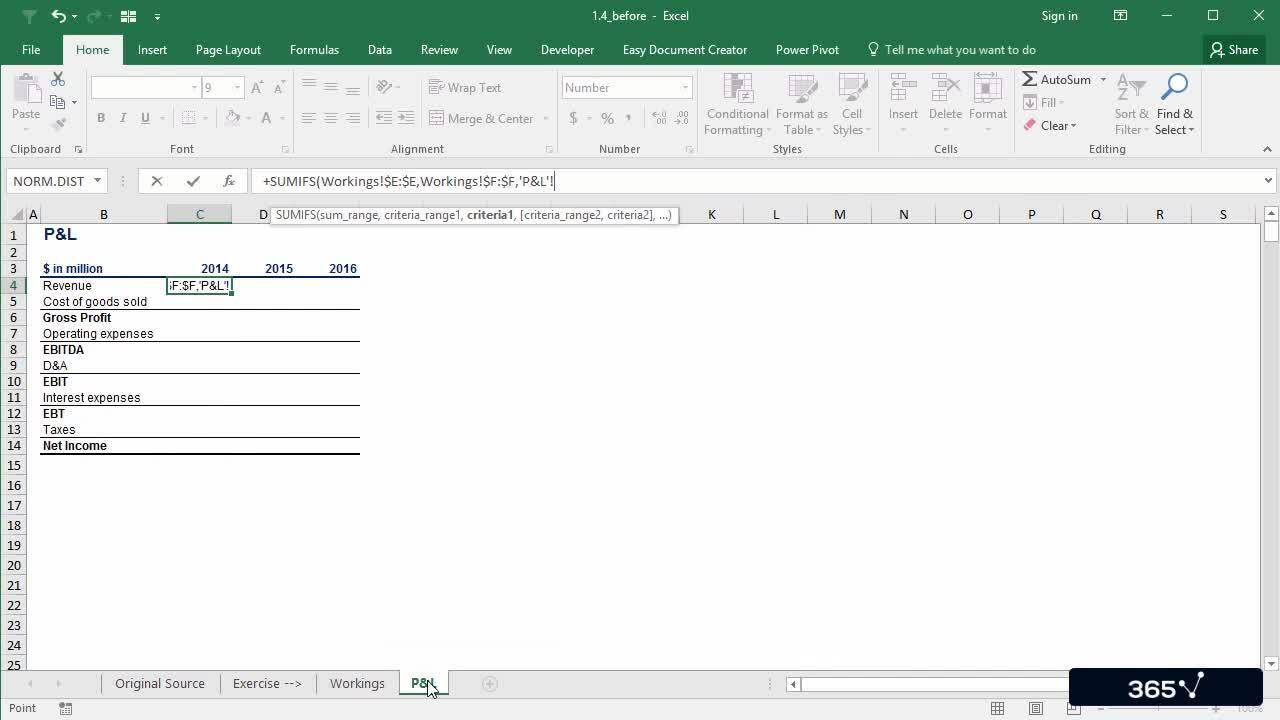

- Use advanced Excel formulas to develop a flexible Excel model with multiple scenarios

- Learn how to avoid mechanical errors by adding checks to your work

- Enhance your Excel proficiency through hands-on practice using a real-life business scenario

- Improve your career prospects by mastering practical financial modeling that are in high demand among hiring managers in the finance industry

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the course cover

1 min

1.2 Introduction to the Exercise

3 min

2.1 Let's Create a Mapping of Financials

3 min

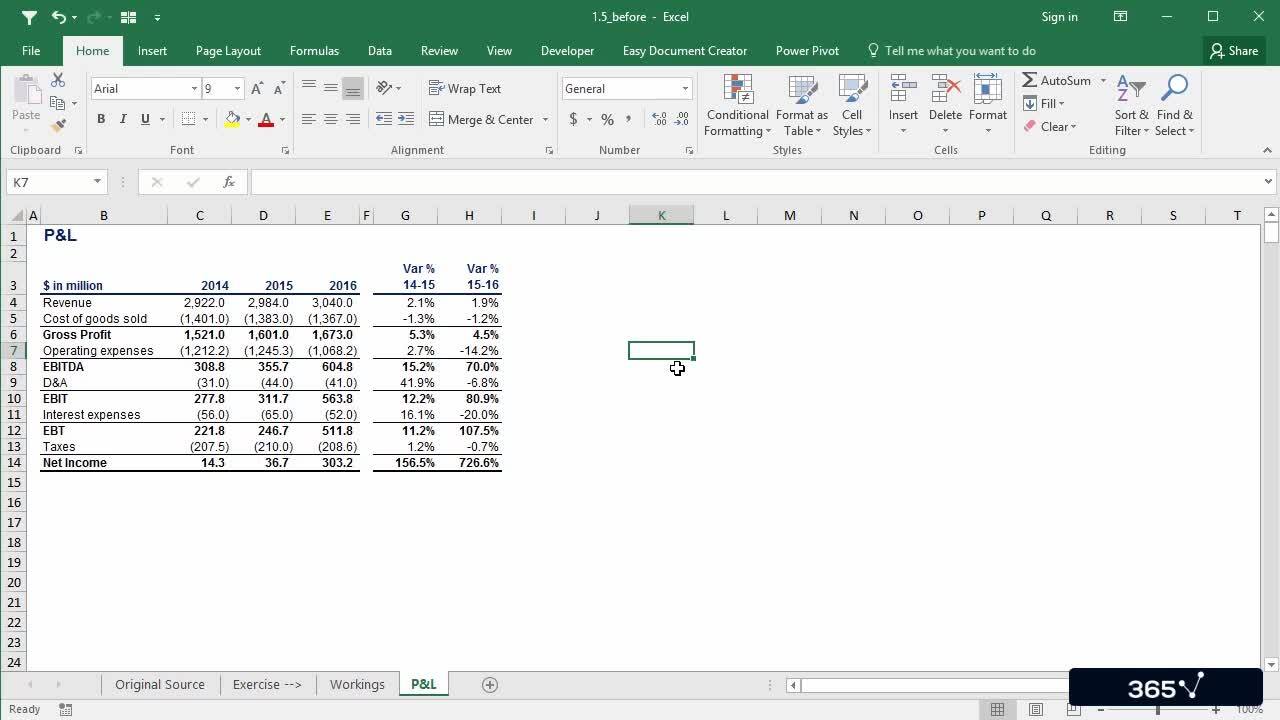

2.2 Building an Output P&L Sheet

4 min

2.3 Filling in the P&L Output Sheet with Historical Financials

3 min

2.5 Calculating Percentage Variances and Applying Conditional Formatting

3 min

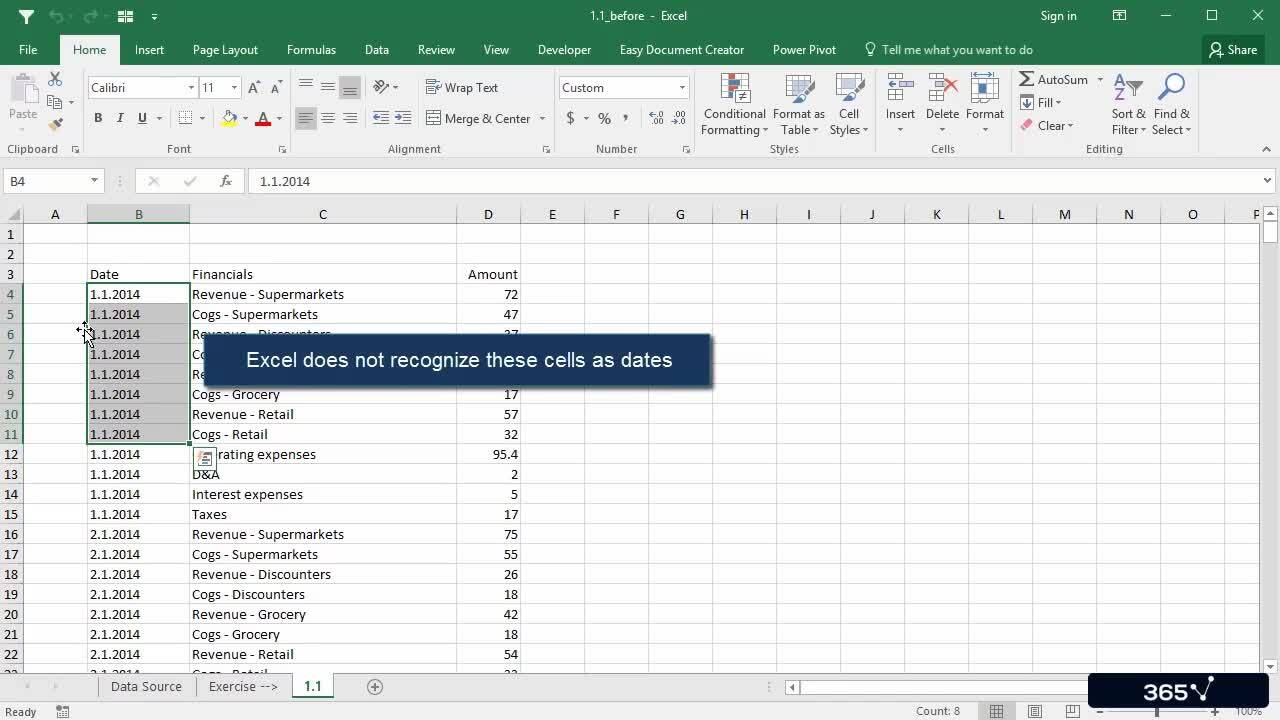

Curriculum

- 2. Building the Model's Framework7 Lessons 26 MinIn this section, we start building the Excel model’s framework. You will learn how to create a mapping of the trial balance, build the Income Statement and Balance Sheet output sheets, and fill them with data using various Excel formulas. Once the historical model is complete, we add the forecast period to the side.Let's Create a Mapping of Financials3 minBuilding an Output P&L Sheet4 minFilling in the P&L Output Sheet with Historical Financials3 minCalculating Percentage Variances and Applying Conditional Formatting3 minBuilding an Output Balance Sheet4 minUsing Index, Match, Match to Fill in the Output Balance Sheet5 minAdding the Forecast Period4 min

- 3. Building a Flexible Model with Multiple Scenarios5 Lessons 18 MinAfter building the Excel model’s framework, you will learn how to integrate multiple forecasting scenarios. In this section, we demonstrate how to use the Choose & Match, Vlookup, and Columns Excel functions to simulate forecasted results in the worst, base, and best-case scenarios. In addition, you will learn to calculate historical DSO, DPO, and DIO multiples and make relevant forecast assumptions.Calculating Historical Percentage Ratios and Use Index and Match for Scenarios5 minBuilding a Flexible Model with Choose & Match2 minBuilding a Flexible Model with Vlookup & Columns3 minCalculating Historical DSO, DPO, DIO, Other assets %, and Other liabilities %5 minForecasting DSO, DPO, DIO, Other Assets and Other Liabilities3 min

- 4. Completing the Model5 Lessons 24 MinIn the last section of this practical Building a 3-statement Model in Excel course, we complete a few Balance Sheet schedules, including the fixed assets roll forward, financial liabilities, and equity schedules. Lastly, we prepare the Cash Flow Statement, and with that, we finalize the comprehensive 3-statement model in Excel.Building a Fixed Assets Roll Forward Schedule5 minBuilding a Financial Liabilities Schedule6 minBuilding an Equity Schedule4 minPreparing a Cash Flow Structure2 minCalculating Cash Flows and Completing the Model & Congratulations!7 min

Topics

Course Requirements

- Highly recommended to take the Intro to Excel and Accounting and Financial Statement Analysis courses before starting this training

- You will need Microsoft Excel 2016, 2020, or Microsoft Excel 365

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring financial analysts, financial controllers

- Everyone who wants to work in finance

- Graduate students who want an opportunity to apply their Excel skills in practice

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Nedko earned a Master’s degree in Finance from Bocconi University (Milan, Italy) in 2012. Then, he gained valuable working experience with exciting firms like PwC Italy (Financial Advisory and M&A), Coca-Cola European Partners (Financial Analyst), and Infineon Technologies (M&A). In 2014, he published his first online course on financial modeling and valuation when he realized that creating educational materials is his true calling. The amazing students and content creators in the data science community, the 365 team, and the strong desire to build the perfect learning platform drive Nedko to continue on this exciting journey. His goal is to establish 365 Data Science as the learning platform that bridges the gap between theoretical knowledge and practical business application.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.