Alternative Investments

Master Alternative Instruments: Understand how to create investment value with alternative asset classes, including real estate, private equity, hedge funds, and commodities

Start for free

Start for free

What you get:

- 1 hour of content

- 15 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Alternative Investments

Start for free

Start for free

What you get:

- 1 hour of content

- 15 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 1 hour of content

- 15 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Develop an in-depth understanding of why alternative investments can help portfolio diversification

- Acquire a comprehensive understanding of valuation methodologies for alternative investments

- Acquire the skills needed to accurately compute fees and analyse returns for alternative investments

- Manage key risks associated with alternative investments

- Explore a broad range of alternative investments including hedge funds, private equity, real estate, and others

- Improve your career prospects by acquiring evergreen technical skills in investment finance

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the course cover

2 min

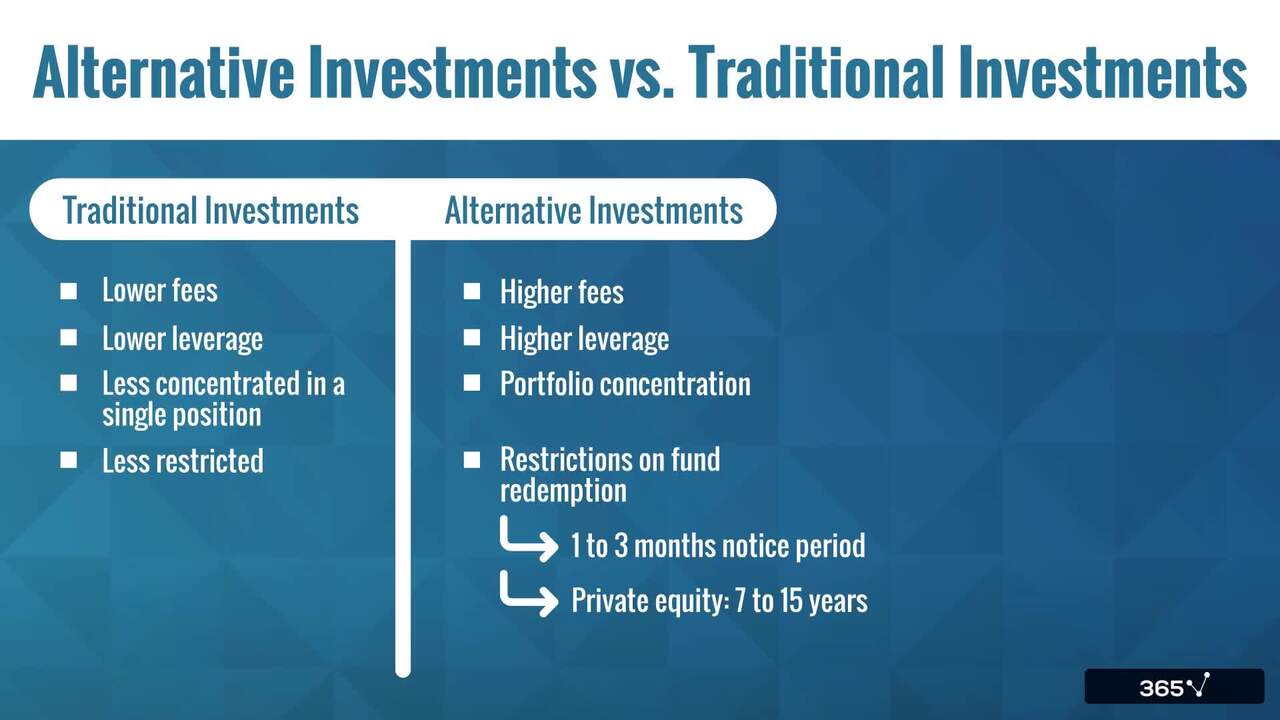

2.1 Alternative Investments vs. Traditional Investments

7 min

2.3 Categories of Alternative Investments

3 min

2.5 Hedge Funds

11 min

2.7 Private Equity

9 min

2.9 Real Estate

6 min

Curriculum

- 2. Types of Alternative Investments6 Lessons 46 MinNext, we provide a detailed overview of the main categories of alternative investments. We describe how hedge funds, private equity, real estate, commodities, and other alternative investments work and discuss their risk and return characteristics.Alternative Investments vs. Traditional Investments7 minCategories of Alternative Investments3 minHedge Funds11 minPrivate Equity9 minReal Estate6 minOther Classes of Alternative Investments10 min

- 3. Alternative Investments - Valuation and Practical Applications4 Lessons 22 MinIn the last section of the Alternative Investments course, we discuss the practical applications of alternative investment valuation. We describe the potential benefits of adding various types of alternative investments to a managed portfolio and show you how to measure risk and return.Benefits of Alternative Investments3 minHedge Funds - Calculating Fees and Returns6 minValuation of Alternative Investments8 minRisk Management Considerations5 min

Topics

Course Requirements

- Highly recommended to complete the Corporate Finance course prior to enroling

Who Should Take This Course?

Level of difficulty: Intermediate

- Aspiring investment analysts, investment bankers

- Everyone who wants to work in investment finance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Peter Lipovyanov is a finance professional and investor with experience in investment banking, private equity, and venture capital. A Bocconi graduate, he began his career at Morgan Stanley before joining HSBC London as Associate Director (VP), advising on multi-billion-dollar M&A across Europe and Asia. Since 2019, he has been with Integral Capital Group, focusing on private equity and growth capital. Alongside corporate finance, Peter has been active in blockchain and fintech, supporting startups with capital and strategic guidance.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.