Advanced Financial Reporting - Long-term Liabilities

Master financial reporting of long-term liabilities: Analyse the impact of bonds, loans, pensions, and leases on financial statements

Start for free

Start for free

What you get:

- 1 hour of content

- 14 Interactive exercises

- 1 Downloadable resource

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

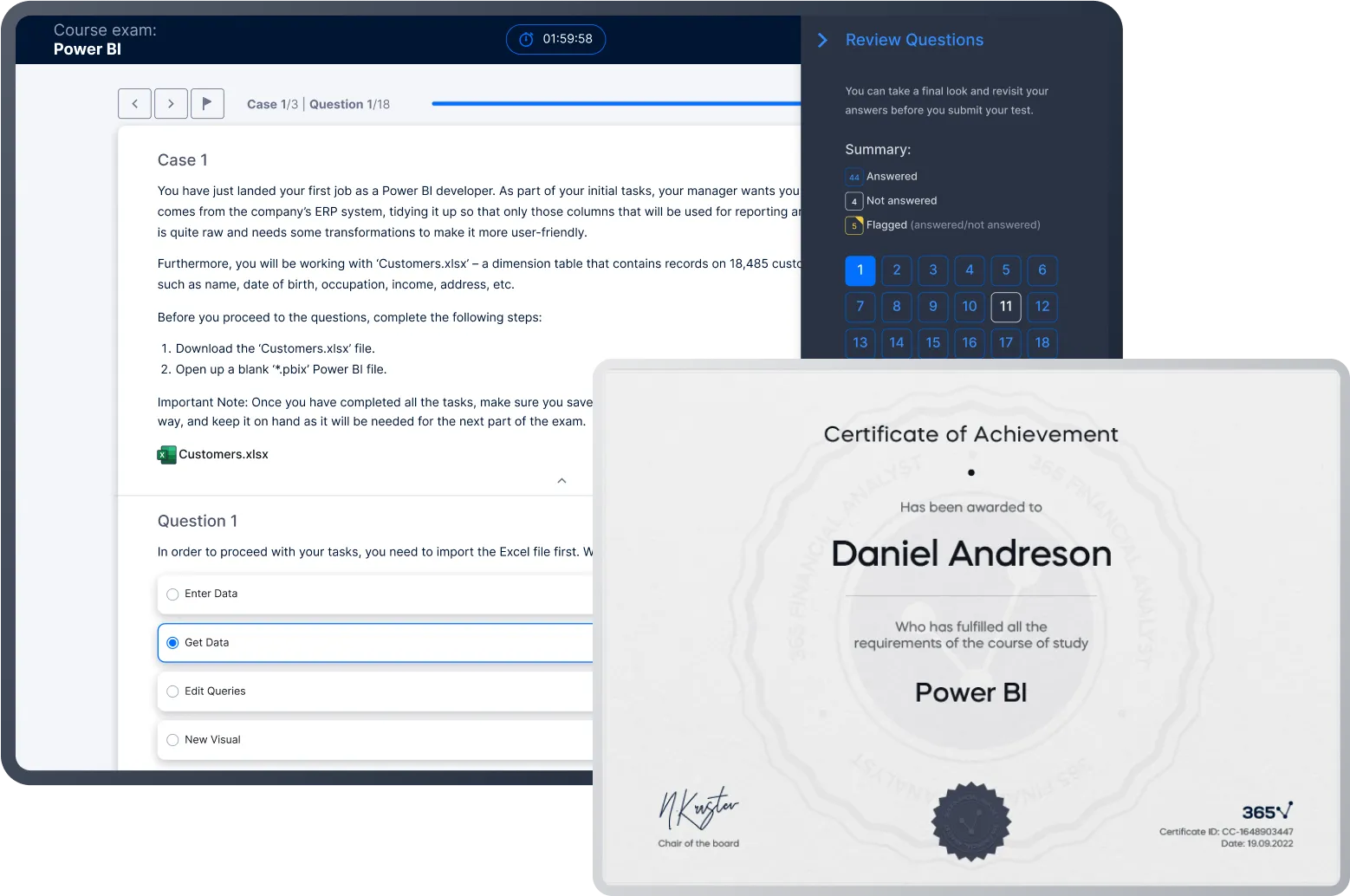

- Course exam

- Certificate of achievement

Advanced Financial Reporting - Long-term Liabilities

Start for free

Start for free

What you get:

- 1 hour of content

- 14 Interactive exercises

- 1 Downloadable resource

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Start for free

Start for free

What you get:

- 1 hour of content

- 14 Interactive exercises

- 1 Downloadable resource

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What you learn

- Gain a comprehensive understanding of long-term liability reporting practices and standards

- Compute a loan’s effective interest rate, a crucial skill for informed financial analysis and decision-making

- Develop the ability to create detailed amortization schedules for bonds to track payment timelines and interest expense accurately

- Master financial lease accounting and analyse its impact for the lessee and lessor

- Appreciate the critical role of long-term liability analysis, focusing on the nuances that critically affect financial outcomes

- Improve your technical proficiency and career prospects by acquiring highly useful financial reporting skills

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What does the course cover

2 min

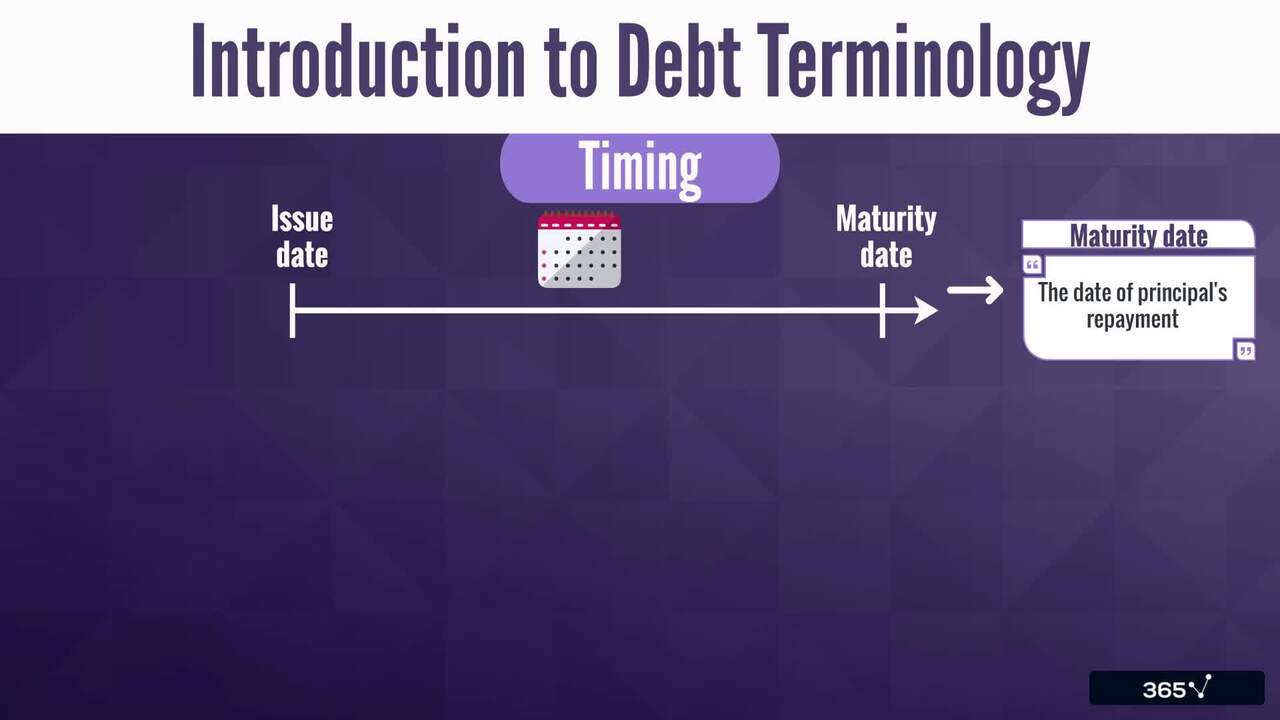

1.2 Introduction to Debt Terminology

7 min

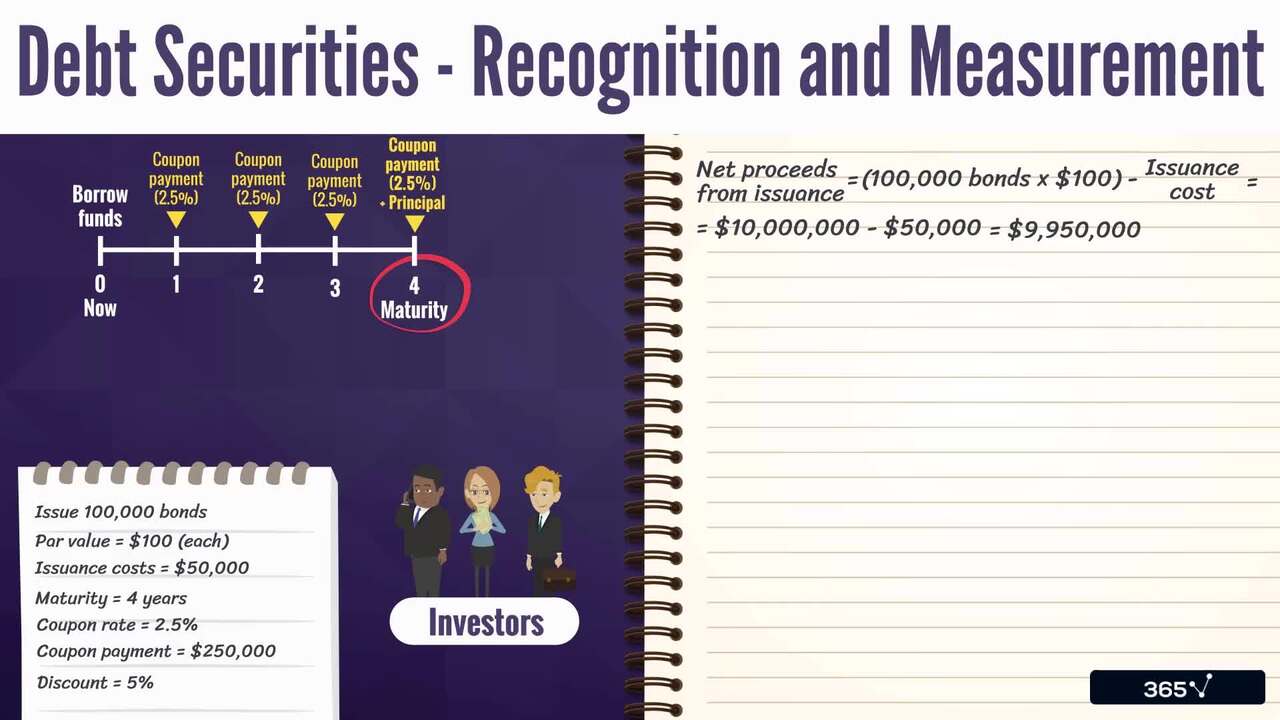

2.1 Debt Securities - Measurement and Recognition

6 min

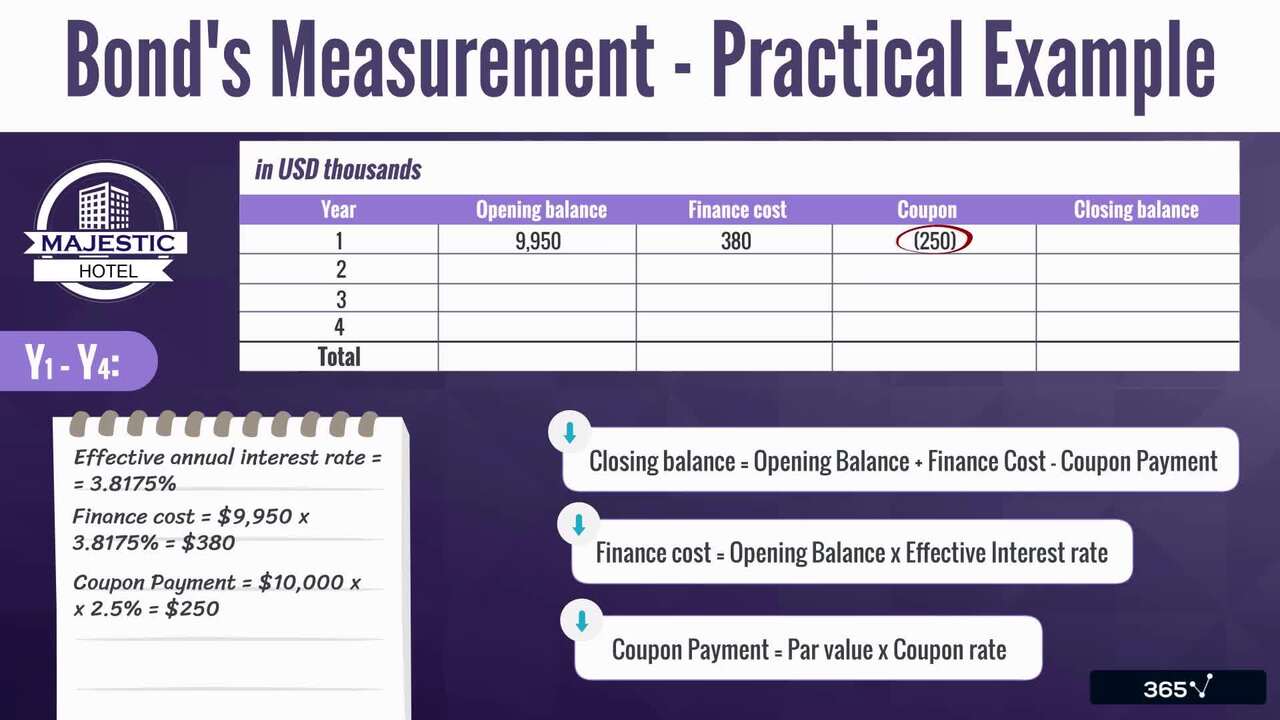

2.2 Debt Securities - Measurement and Recognition (Practical Example)

8 min

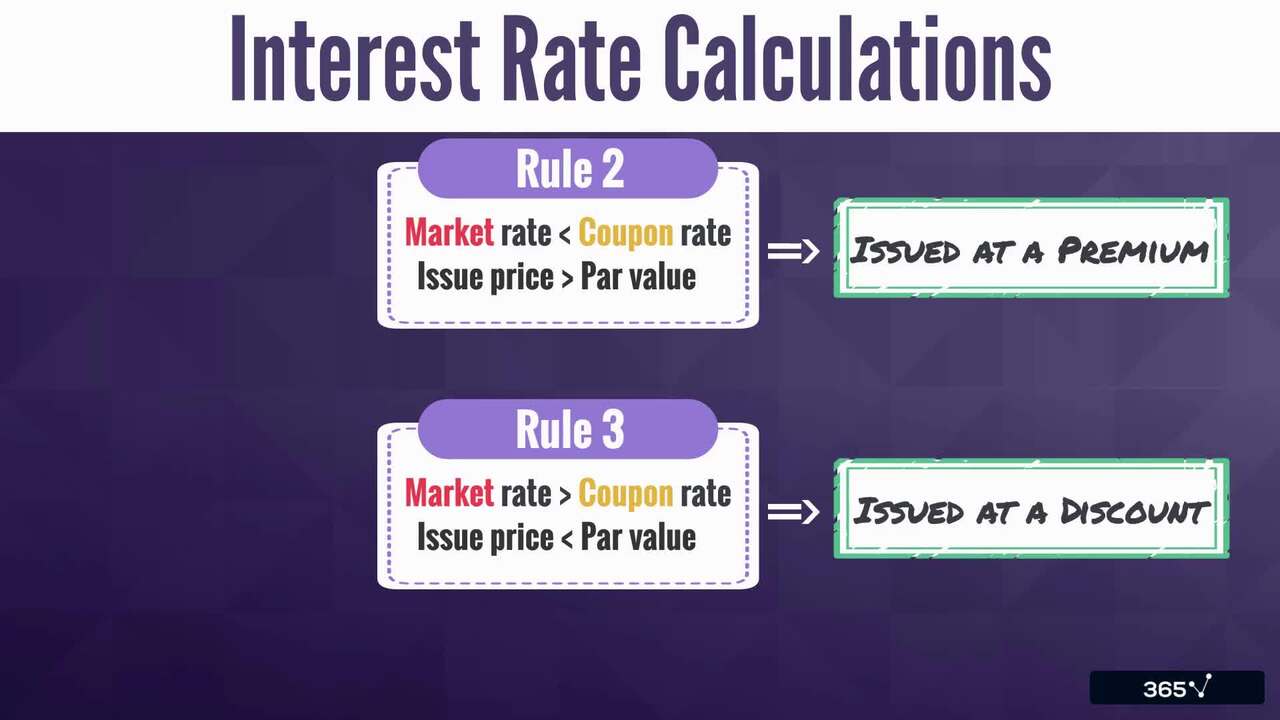

2.4 Calculating Interest Rates

9 min

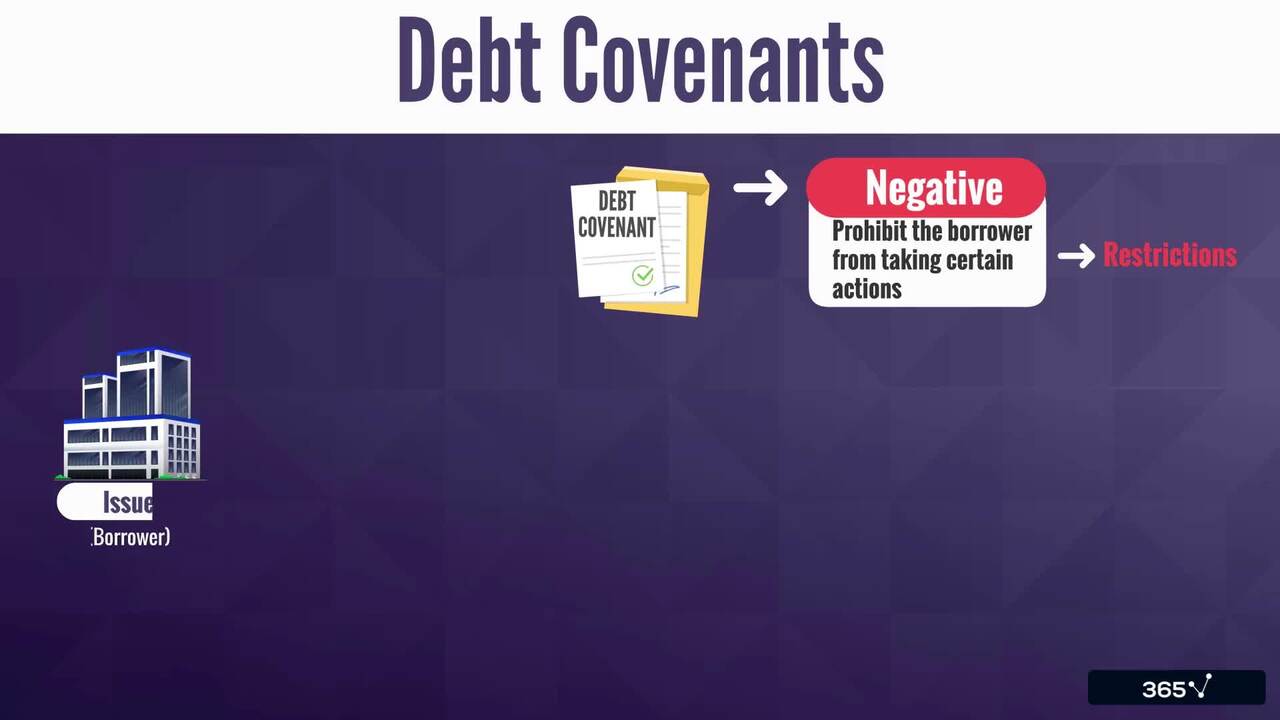

2.5 Types of Debt Covenants

6 min

Curriculum

- 2. Recognition and Measurement of Long-term Debt5 Lessons 31 MinIn this section of the Advanced Financial Reporting – Long-Term Liabilities course, we go over the accounting entries that companies make when taking long-term loans. We demonstrate how bonds are initially recorded and subsequently measured through real-life cases. We also describe the role of debt covenants and examine various examples of positive and negative covenants.Debt Securities - Measurement and Recognition6 minDebt Securities - Measurement and Recognition (Practical Example)8 minCalculating Interest Rates9 minTypes of Debt Covenants6 minPresentation and Disclosure of Non-current Liabilities2 min

- 3. Introduction to Leases and Pension Plans4 Lessons 24 MinIn the final lessons of the Advanced Financial Reporting – Long-Term Liabilities course, we present lease accounting and recognition from the lessee's and the lessor’s perspectives. Lastly, you will learn the difference between a defined benefit and defined contribution plans and why companies choose one or the other.Motivations for Leasing Assets5 minLease Accounting from the Lessee's Perspective9 minLease Accounting from the Lessor's Perspective4 minTypes of Pension Plans6 min

Topics

Course Requirements

- Highly recommended to take the Accounting and Financial Statement Analysis and Fundamentals of Financial Reporting courses first

Who Should Take This Course?

Level of difficulty: Advanced

- Aspiring accountants, financial controllers, financial analysts, investment analysts

- Everyone who wants to work in finance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Antoniya is a finance professional with vast experience in accounting, auditing, financial management, and multiple high-level finance roles. She holds two master’s degrees—in Finance and in Contemporary Educational Technologies. She has worked as an auditor at PwC, as a financial controller at Atos, as an FP&A Manager and Senior Manager at Coca-Cola, and currently, as a Finance Manager at 365. Her passion for finance and teaching brought her to the 365 Тeam. She has been tutoring on various topics, including accounting, financial reporting, financial planning and analysis, economics, etc. Antoniya’s qualifications and engaging teaching style make the learning process enjoyable, and her courses have helped numerous students progress in their careers.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.