Top 10 Finance Interview Questions and Answers You Need to Know in 2025

Answers included. Ace your next interview with these finance interview questions & answers based on real experiences. Start preparing now.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeAcing your finance interview requires more than just a firm grasp of numbers; it demands a lot of preparation and a deep understanding of industry trends. Employers expect you to be well-versed in traditional principles and contemporary market dynamics. This article addresses common finance interview questions and answers that hiring managers ask.

Table of Contents

- How to Prepare for a Finance Interview

- Common Finance Interview Questions and Answers

- Questions to Ask in a Finance Interview

- Finance Interview questions – Key Takeaways

- Bonus Finance Interview Questions

- FAQs

How to Prepare for a Finance Interview

Trying your best to answer complex questions about financial concepts, market trends, and your own experiences can be daunting when sitting in front of a board of seasoned professionals. It’s especially challenging when you’re fresh out of school and don’t have much interview experience.

But imagine you can prepare for the tough questions the board will ask you during your interview. What if you could learn from someone else’s mistakes without making them yourself? Well, that’s precisely why we’re here today.

Common Finance Interview Questions and Answers

This article explores the top 10 finance interview questions you need to know in 2024 and how to answer them like a pro. Whether you’re looking for financial analyst interview questions, searching for an investment analyst or banker role, or wanting to land your first job with interview questions for a finance intern, this guide will give you a leg up in your next interview.

Using the STAR method (Situation, Task, Action, and Result) is an excellent way to tackle these finance questions or any that require an anecdote about your personal experience.

1. How would you explain the time value of money to someone with little to no financial background?

Answering Effectively

It’s straightforward enough, but many candidates find it difficult to answer coherently. The difficulty isn’t that you don’t understand the concept itself, but rather that you don’t know how to break it down so that someone with no financial background could grasp it. Here, interviewers aim to test your ability to communicate effectively—this is a crucial skill in any finance role.

Employers aim to assess your grasp of finance with this basic finance interview question: can you simplify the concept? If not, you might not understand it as thoroughly as you believe.

Secondly, they test how you communicate complex ideas and whether you can convey them effectively to various audiences. In a finance role, you may need to explain complex financial data or concepts to colleagues, clients, or stakeholders who don’t have a financial background.

Our advice is to practice this skill. For your finance interview prep, choose a few complex financial concepts and try explaining them as simply as possible—as if you’re talking to a friend or family member. Remember, the aim is not to impress with big words but to communicate effectively.

Suppose you’re talking to a grandparent who has just asked you about the time value of money. You can ask them if they’ve ever heard of the saying, “A dollar today is worth more than a dollar tomorrow?” Continue by clarifying that that’s the idea behind the time value of money. The money you have right now is generally more valuable than the same amount in the future.

And why is that? There are a few reasons. One is that you can take advantage of the money you have now by putting it in a bank or investing it so that it can grow over time. In other words, you can earn more on top of what you already have.

Answer Example

Situation: Imagine explaining the concept of the time value of money to a college friend studying a non-finance major. They’re curious but don’t have a background in finance.

Task: I aim to explain the time value of money clearly and concisely, using an example that incorporates a bit more technical detail while remaining accessible.

Action: I begin by revisiting the familiar saying, “A dollar today is worth more than a dollar tomorrow,” to set a foundational understanding. Then, I introduce the concept of interest rates to add a layer of specificity. I explain, “If you have $100 today, and you put it in a savings account with an annual interest rate of 5%, in one year, your $100 will grow to $105. This growth is due to interest, which is essentially the reward you get for letting the bank use your money. Now, if you were to receive $100 a year from now instead, you’d miss out on that potential to earn an extra $5. That’s why we say the $100 today is more valuable—it has more potential to grow.”

Then, I move on to the concept of inflation. “Inflation reduces the purchasing power of money over time, meaning what you can buy for $100 today might cost more in the future. A few years ago, $100 could buy you a week’s worth of groceries. Today, it can only last you a few days. This is the result of inflation. So, if you were to receive that $100 one year from now, not only would you miss out on the opportunity to earn the additional $5 in interest, but that $100 might also buy less due to inflation.”

Result: My friend grasped that money has the potential to grow over time through interest, but not taking advantage of this interest could mean losing value through inflation. They recognized how the time value of money plays a crucial role in financial decisions, appreciating its importance in personal finance and investment planning.

2. Tell us about a time when you made a significant mistake in your financial analysis. How did you fix it?

Answering Effectively

This is a complex financial analyst interview question because it asks you to highlight something you’ve not succeeded at voluntarily. Isn’t the point of the interview to stand out? A good candidate also knows how to evaluate their work, which employers look for critically.

This common finance behavioral interview question puts many job applicants on the spot. Some are tempted to avoid admitting they made a mistake, but this could be a lack of self-awareness or an unwillingness to learn. Honesty is crucial when tackling this question. Choose a real example of a time you’ve made a mistake, but ensure it’s a situation you learned from. Give a brief overview to the interview board, focusing on the actions you took to correct the error and emphasize what you learned from the experience.

By showing that you can turn mistakes into opportunities for growth, you’ll demonstrate resilience, problem-solving skills, and a positive attitude. Remember, mistakes can happen; how you handle and learn from them sets you apart.

Answer Example

Situation: In my previous role as a financial analyst at XYZ Corporation, I was tasked with creating a quarterly financial forecast. Due to a tight deadline, I rushed through the data analysis phase, which led to a significant oversight in the revenue projections for one of our key product lines.

Task: My responsibility was to identify and correct the mistake and ensure such an error didn’t recur. Maintaining our financial forecasts’ credibility was crucial, and stakeholders relied heavily on it for strategic planning.

Action: Upon realizing the mistake, I immediately notified my supervisor and outlined a plan to rectify it. I thoroughly reviewed all the data and assumptions used in the forecast, which involved cross-verifying sales volumes, pricing strategies, and market trends.

After identifying the root cause (an incorrect data input), I corrected the error and re-analyzed our projections. To prevent similar mistakes in the future, I initiated a peer-review process for our forecasting methods and introduced a double-check system for data entry.

Result: The corrected forecast was more accurate and provided valuable insights for our strategic planning. My initiative to introduce a peer-review process was well-received and later adopted as a standard practice within our department.

This experience taught me the importance of diligence and verification in financial analysis. It also underscored the value of proactive communication and problem-solving when errors occur. From this mistake, I learned that thoroughness and teamwork are essential in ensuring the accuracy and reliability of financial forecasts.

3. What can you bring to this role that other applicants cannot?

Answering Effectively

Answering this finance interview question can be challenging because it requires you to articulate your unique value proposition that differentiates you from other candidates. It’s an opportunity to showcase your skills, experiences, and qualities that make you a standout candidate.

Start by reflecting on your strengths, experiences, and accomplishments that directly align with the role’s requirements. (There’s a better time to be modest about your achievements.)

Identify critical attributes that make you stand out. Consider your past achievements, industry knowledge, technical expertise, leadership qualities, or the ability to bring a fresh perspective. Clearly articulate how these will benefit the company and contribute to achieving its goals.

Remember: Be confident but also authentic in your response. This common finance interview question is your time to show why they should hire you for this role.

Answer Example

Throughout my career, I’ve gained experiences and skills that qualify me for this role—mainly through my tenure as a financial analyst at XYZ Company.

At XYZ Company, I wasn’t just another financial analyst—I worked heavily with financial modeling, mastering complex techniques that were pivotal for our strategic planning. I managed intricate financial models, analyzing and synthesizing data to develop insights that significantly influenced our decision-making processes.

My professional circle recognizes and values my dedication to accuracy and detail, coupled with my ability to distill and communicate complex financial information clearly.

What sets me apart from other applicants is my profound expertise in financial modeling combined with my analytical prowess and communication skills. These attributes have allowed me to contribute to the financial success of previous employers and positioned me as a go-to resource for my colleagues.

In this role, I’m eager to leverage these strengths to provide unique insights, drive strategic decisions, and foster a culture of clarity and efficiency in financial communication—supporting the company’s goals and growth.

4. If you had to choose one stock to invest in, which would you select?

Answering Effectively

In this banking interview question, the interviewer wants to assess your investment analysis skills, ability to identify potential opportunities, and thought process behind selecting a specific stock.

The stock you’ve selected is not important; what matters is your reason to add it to your portfolio. It’s essential to showcase your knowledge and provide a well-thought-out rationale for your choice.

So, how do you answer this question? Start by expressing your interest in researching various stock market players. Then, present your selection with confidence and explain why you chose it.

Providing clear reasoning backed by relevant information demonstrates your ability to analyze companies, assess growth potential, and make informed investment decisions. Your explanation also helps interviewers understand your own investment style—giving them a well-rounded answer to this finance interview question.

Answer Example

I’m constantly researching the latest and most significant players in the stock market, but if I could pick only one, it would be Netflix. The company still has a large market to capture abroad, and it’s well-positioned to increase its growth over the long term. Netflix’s industry position is enormous and has consistently beaten estimates on earnings, making its stock an appealing choice.

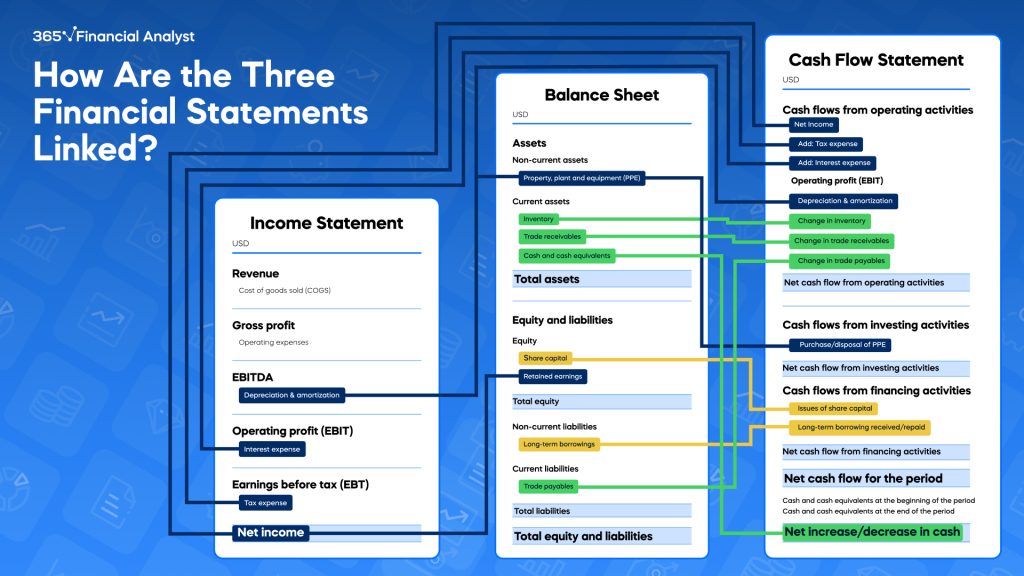

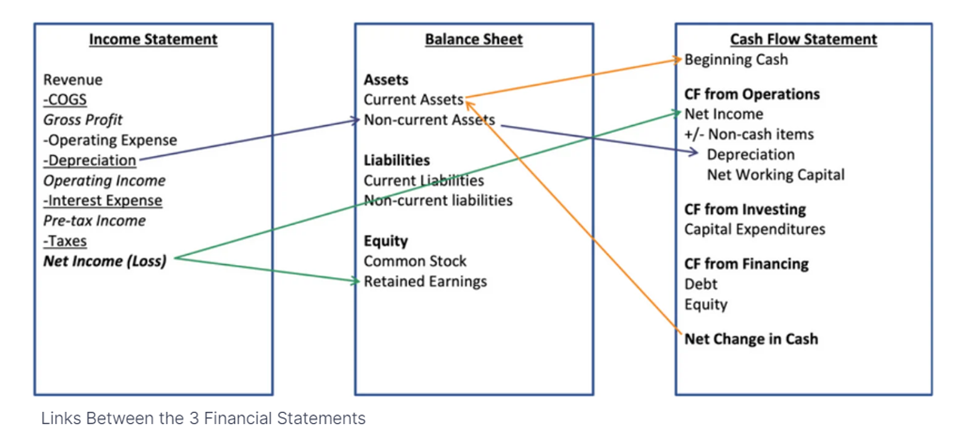

5. How are the three primary financial statements connected?

Answering Effectively

You’ll encounter this FP&A interview question in interviews for various finance roles. Understanding how the three financial statements are interconnected is also crucial in financial modeling.

Most often, candidates answer that question by stating that net income links to the three financial statements: the Income Statement, Balance Sheet, and Cash Flow Statement.

And while that’s correct, the key to answering this finance question is to be thorough. In your finance interview prep, practice your detailed answer to showcase your in-depth knowledge of financial statements.

Answering Effectively

Let’s start with the income statement, which determines the net income. This figure is crucial because it links directly to the Balance Sheet, particularly impacting the retained earnings. The formula here is simple yet fundamental—we add the net income to the beginning retained earnings and subtract any dividends to arrive at the ending retained earnings.

Moving on to the Cash Flow Statement, net income is the starting point in calculating cash from operating activities. This demonstrates how profitability translates into actual cash flow—emphasizing the direct relationship between these statements.

Another critical link is depreciation. While it’s recorded as an expense on the income statement, reducing net income doesn’t involve an actual cash outlay. So, we add it back to the operating cash flows.

Moreover, depreciation affects the Balance Sheet by reducing the book value of non-current assets, specifically property, plant, and equipment (PP&E). This ties back to the Cash Flow Statement, where capital expenditures on PP&E are recorded as investing activities.

Current assets like inventory and trade receivables on the Balance Sheet are closely tied to cash flow from operating activities. An increase in these assets indicates the use of cash, subtracted in the Cash Flow Statement, whereas a decrease signifies a source of money, therefore added back.

Lastly, financial activities like issuing shares or taking on new debt provide cash inflow—as seen in the cash flow from financing activities. Conversely, repaying debt or repurchasing shares are cash outflows.

By understanding these connections, we can see how changes in one statement affect the others—providing a comprehensive picture of a company’s financial health. This interconnectedness is vital for accurate financial modeling and strategic decision-making.

6. What is the impact on the Income Statement when the value of inventory increases by $10?

Answering Effectively

This is a common deceptive question you’ll most likely encounter when applying for an accounting or financial analyst position. There’s no impact on the Income Statements. The interviewer wants to evaluate your knowledge of how inventory-related transactions impact the statement.

When answering this technical finance interview question, applicants often overthink and look for a hidden relationship between the two. The interviewee usually states that the Working Capital changes appear on the Income Statement.

The Income Statement doesn’t directly capture changes in inventory because related expenses—such as the Cost of Goods Sold (COGS) or Operating expenses—are only recognized when the goods are sold. Until the company sells the products associated with the inventory, it does not impact the Income Statement. In other words, inventory represents the value of goods the company holds but has not yet sold.

It’s easy to get tripped up by deceptive questions like these, but staying level-headed can help you spot them quickly and impress potential employers.

Answer Example

An increase of $10 in the inventory value doesn’t directly impact the Income Statement. Inventory is recorded as an asset on the Balance Sheet, and its value changes are not reflected on the Income Statement until the associated goods are sold. At that point, it affects the Cost of Goods Sold and, subsequently, the net income. Therefore, this $10 increase in inventory would only be recognized on the Income Statement when the inventory is sold, impacting the COGS and, ultimately, the net profit.

7. How does an inventory write-down impact the three primary financial statements?

Answering Effectively

This is a classic finance interview question. The interviewer wants to see if you understand how the Income Statement, the Balance Sheet, and the Cash Flow Statement interact.

There are no shortcuts; you must understand the interactions detailed below:

The write-down on the Income Statement is recognized as an expense in either the COGS or a separate line item, ultimately reducing the net income. And although we observe a decrease, it’s important to note that the write-down is a non-cash expense. Therefore, it has been added to the Cash Flow from the Operations section. This adjustment acknowledges that the write-down does not impact the company’s cash position.

The Balance Sheet is impacted in two ways:

The asset’s inventory decreases by the amount of the write-down, which reflects the lower value of the inventory after the write-down.

The shareholders’ equity also decreases by the same amount, as the reduction in net income impacts the retained earnings.

The following is how you could answer this strategic finance interview question.

Answer Example

In the event of an inventory write-down, all three primary financial statements are affected. On the Income Statement, the write-down is recorded as an expense, which reduces the company’s net income.

This expense could appear in the COGS or as a separate line item. Although it decreases net income, it’s crucial to understand that this is a non-cash expense. As a result, when we move to the Cash Flow Statement, this write-down is added to the Cash Flow from Operations, recognizing that there has been no actual cash outflow due to this adjustment.

On the Balance Sheet, the inventory value decreases by the write-down amount, reflecting the reduced valuation of the inventory. This reduction in assets also affects shareholders’ equity, as the decrease in net income from the Income Statement lowers retained earnings. So, the Balance Sheet shows reduced assets (inventory) and equity (retained earnings). At the same time, the Cash Flow Statement adjusts for the non-cash nature of the write-down, ensuring the operating cash flow is not unduly affected.

8. How would you value a company?

Answering Effectively

Now that we’ve discussed the interrelation of financial statements, let’s shift our focus to a crucial aspect of financial analysis: company valuation.

A common finance interview question you’ll most likely encounter when applying for a financial or investment banking analyst position is, “How would you value a company?”

This question is a hurdle for applicants, but why?

There are many valuation models, and stating just one is not enough. The challenge is effectively responding to this finance interview question by providing a structured approach and highlighting critical valuation methodologies. You can start with the most popular ones.

For example, the Precedent Transactions Method involves looking at the prices paid for similar companies in the past to determine a current value. This method is often used in mergers and acquisitions (M&A) and works best if the companies are in the same industry.

While the Precedent Transactions Method provides a quick and easy method to estimate a company’s value, it’s often supplemented with other valuation techniques To understand its worth better.

One includes the discounted cash flow (DCF) model, which involves projecting a company’s future cash flows, determining an appropriate discount rate, and calculating the present value of those cash flows to estimate the firm’s intrinsic value.

Another valuation method is the relative valuation model, where you estimate an asset’s value relative to that of another. The fundamental principle of relative valuation asserts that similar assets should trade at similar prices. It entails comparing the financial ratios and metrics of the target company to those of comparable firms—examining multiples like price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA (EV/EBITDA).

Next, we have an asset-based valuation, which estimates a company’s intrinsic value as the difference between the market value of its assets and liabilities. With this method, there’s room for interpretation as to which assets and liabilities to include in the valuation and how to measure their worth. And that may be tricky at times.

These popular valuation methods should thoroughly prepare you for this finance interview question.

Answer Example

Situation: In my previous role as a financial analyst, I valued a mid-sized manufacturing company, which provided a hands-on opportunity to apply various valuation methodologies.

Task: I aimed to determine a fair and comprehensive company valuation to guide our investment decision-making process.

Action: I began with the Precedent Transactions Method, analyzing recent acquisitions within the manufacturing sector to establish a baseline. I looked at several vital transactions to understand the price paid for similar companies, adjusting for size, market position, and financial health.

Next, I employed the Discounted Cash Flow (DCF) model. I projected the company’s future cash flows based on historical performance, industry trends, and economic forecasts. By determining an appropriate discount rate, I calculated the present value of these cash flows, providing insight into the company’s intrinsic value.

To complement these methods, I conducted a relative valuation analysis. I compared the company’s financial ratios, such as P/E and EV/EBITDA, with those of similar companies in the sector, which helped contextualize its market standing and potential value.

Finally, I considered an asset-based valuation approach because the company had significant tangible assets. I assessed the market value of its assets and liabilities to understand its net asset value, ensuring a holistic view of its worth.

Result: Combining these methodologies allowed me to present a well-rounded valuation to our team, highlighting different perspectives on the company’s value. This multifaceted approach informed our investment decision and reinforced my ability to adapt and apply various valuation techniques in real-world scenarios—showcasing my analytical depth and versatility in financial analysis.

9. Why should a company consider issuing debt instead of equity?

Answering Effectively

There are no hidden traps here. With this corporate finance interview question, the interviewer wants to assess your understanding of corporate finance principles, capital structure decisions, and your ability to weigh the pros and cons of different financing options.

To effectively respond, highlight the benefits of debt financing, such as potential tax advantages and fixed interest payments, as well as maintaining ownership control and decision-making authority within the company.

Note that a firm should always raise capital according to its optimal capital structure. If the business consistently has sufficient cash flows to cover interest payments, issuing debt might be justified if it lowers the company’s weighted average cost of capital.

Here’s how you might answer this finance question.

Answer Example

A company might choose to issue debt over equity for several reasons.

Firstly, debt financing offers tax advantages because interest payments on debt are tax-deductible, reducing the company’s overall tax liability.

Secondly, debt does not affect the ownership structure, unlike equity—which involves selling a portion of the company’s ownership and possibly diluting control among shareholders. This means the original owners retain full decision-making authority and control over the company.

Additionally, debt comes with fixed interest payments, which can be planned for and managed within the company’s financial forecasting. This predictability is often seen as an advantage over the potentially variable costs associated with equity financing, such as dividends.

It’s also essential to consider the company’s capital structure. A firm with a stable and predictable cash flow can support the regular interest payments associated with debt, making it a viable option.

Suppose the cost of debt is lower than the cost of equity. In that case, issuing debt can lower the company’s weighted average cost of capital (WACC), enhancing shareholder value and making it an economically sound decision.

But a company must assess its financial situation carefully because excessive debt can lead to financial distress. Ultimately, the decision to issue debt or equity should align with the company’s financial strategy, growth plans, and overall goal of maximizing shareholder value.

10. If you were the CFO of our company, what are some key challenges that you’d face?

Answering Effectively

You’ll likely encounter the CFO interview question in an interview for a higher-up finance role. A strategic mindset and the ability to consider the bigger picture is essential.

You must adopt a long-term perspective and consider various aspects of a company—including its goals, financial performance, and overall well-being. Your answer will showcase your ability to think strategically and connect your response to relevant issues, encompassing the three financial statements.

To tackle this finance interview question, take a step back and provide a high-level overview of the company’s current financial standing or the position of industry players in general. Highlight key aspects from each financial statement and considerations beyond them to demonstrate well-rounded analytical thinking.

Starting with the Income Statement, assess the growth rates, margins, and profitability to gauge the company’s financial performance. Look at revenue growth trends, gross profit, and net income margins to understand if the business can generate consistent profits and sustain growth over time.

Moving to the Balance Sheet, evaluate liquidity, capital assets, credit metrics, and leverage. Consider the company’s ability to meet short-term obligations through current assets and liquidity ratios. Assess the composition and quality of its capital assets and examine credit metrics such as credit ratings and debt levels to assess the financial stability and borrowing capacity.

Finally, the Cash Flow Statement must be scrutinized to determine the company’s short-term and long-term cash flow profile. Identify potential cash flow challenges, such as negative operating cash flow or significant investing or financing cash flows. Evaluate the need to raise money through external sources or return capital to shareholders through dividends or share buybacks.

Answer Example

Situation: If I were the CFO of your company, I’d anticipate facing a variety of challenges that span across operational, strategic, and financial aspects. These challenges could range from managing the company’s capital structure to navigating market volatility, ensuring compliance with new financial regulations, and driving the company’s financial strategy amidst economic uncertainties.

Task: As CFO, I would proactively identify, assess, and address these challenges. This would involve a strategic approach to balance risk and opportunity, optimize financial performance, and align the company’s financial strategy with its long-term goals.

Action: To tackle these challenges, I would first analyze the Income Statement to assess our financial performance, focusing on revenue growth, profit margins, and cost management. Understanding these metrics is crucial to identifying areas for improvement and driving profitability.

Next, I will examine the Balance Sheet to evaluate our liquidity and capital structure. This includes assessing the company’s ability to meet short-term obligations and reviewing our asset management to ensure it supports our strategic objectives.

Additionally, I would scrutinize our debt levels and equity to maintain a healthy capital structure and ensure financial stability.

On the Cash Flow Statement, I would focus on maintaining a positive cash flow, which is essential for operational effectiveness and strategic investments. I would closely monitor cash flows from operating, investing, and financing activities to ensure the company maintains a strong liquidity position and is prepared for future growth or downturns.

Result: By addressing these varied challenges, I aim to enhance the company’s financial health and resilience, enabling us to achieve strategic goals and create shareholder value. My approach is to ensure that the company is prepared to handle immediate financial issues and positioned for sustainable long-term success.

Questions to Ask in a Finance Interview

You may wonder why asking the interviewer at least one question at the end of an interview is essential. Asking questions in a finance interview is not just a formality—it’s a crucial part of the interview process.

This is your opportunity to demonstrate your genuine interest in the position and the company while showing that you have researched and are thinking critically about your potential role within the firm. The following are reasons why asking insightful questions is essential, along with examples of questions to ask in your finance interviews.

Engagement

Asking questions shows that you’re engaged in the conversation and genuinely interested in the role and the company. It’s an opportunity to make a lasting impression on the interviewer by showing your proactiveness and enthusiasm about the opportunity.

Examples:

- Can you tell me more about the team I would be working with and how this position contributes to the overall success of the finance department?

- What are the most immediate projects that need to be addressed by the person filling this position?

Clarification

Interviews are not just for employers to learn about you; they’re also an opportunity for you to learn about them. Asking questions in your finance interview can help clarify your understanding of the role, the team dynamics, the company’s financial strategies, or the challenges and opportunities the company is currently facing.

Examples:

- Could you elaborate on the daily responsibilities of this role and how it interacts with other departments within the company?

- What are the biggest challenges that someone in this position would face?

Cultural Fit

Understanding the company’s culture is essential to determine if you’ll enjoy working there and if you align with their values. Questions about company culture, team structure, and management style can give you insight into what it’s like to work there and whether it’s a good fit for you.

Examples:

- How would you describe the company culture here, and what types of personalities tend to thrive in this environment?

- Can you explain how the company supports employees’ professional development and growth?

Future Prospects

Asking questions about the company’s growth plans or the department’s future goals can provide insights into the company’s stability and potential for advancement. These finance interview questions don’t just show your employer that you’re considering your future with the company; they also give you insights into your own career trajectory.

Examples:

- What are the company’s growth plans for the next few years, and how does the finance department contribute to achieving these objectives?

- How does this position support the strategic goals of the company?

Expectations

Asking about your expectations in the first 30, 60, or 90 days can give you a clearer idea of success in the role you’re applying for. This can help you understand whether the expectations align with your skills and career goals.

Examples:

- What are the critical priorities for someone in this position within the first 90 days?

- How will the person’s performance in this position be measured and evaluated?

Remember, the quality of the questions you ask in your finance interview can be just as important as the quality of your answers. Thoughtful questions provide you with valuable information and reinforce your suitability for the role.

Finance Interview Questions – Key Takeaways

Preparation is key! Understanding the nature of deceptive questions and what interviewers seek to learn from them can significantly enhance your chances. Confidence and a well-thought-out strategy are crucial to impressing interviewers and ensuring you stand out. The finance interview questions outlined in this article are an excellent place to start your preparation.

Subscribe to 365 Financial Analyst for top-rated courses that effectively prepare you for the job market. Our practical training equips junior analysts and others with the skills to be productive from day one.

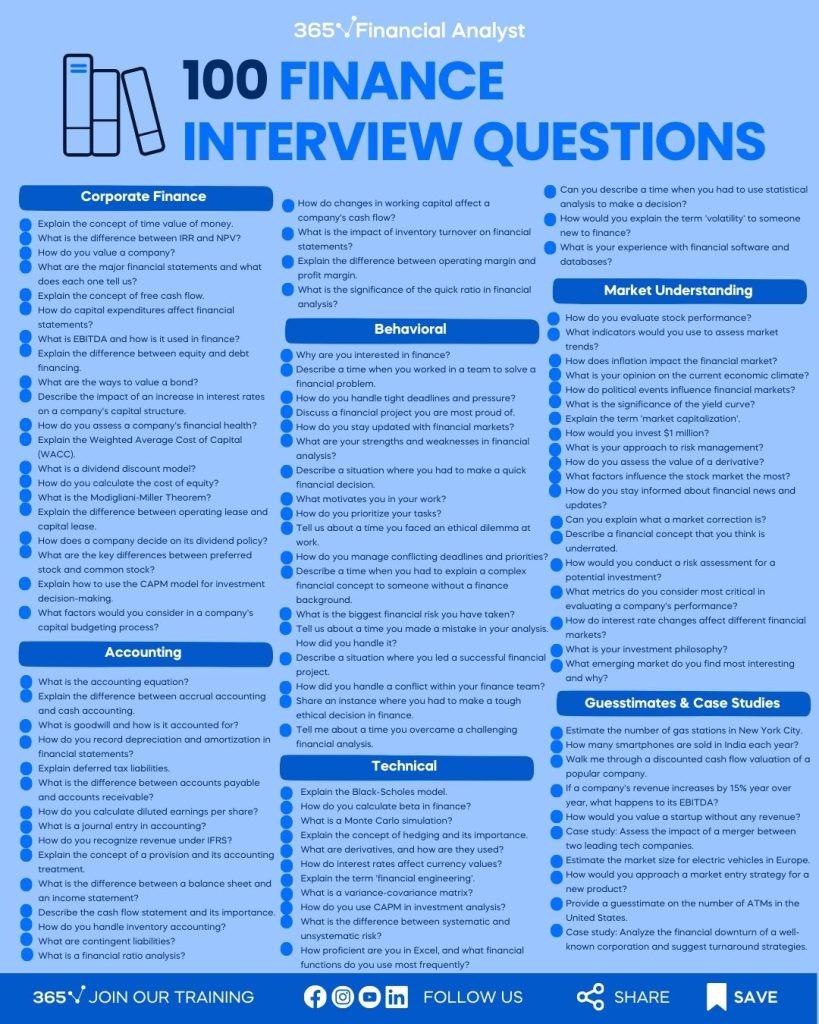

Bonus Finance Interview Questions

Consider the following top 100 finance interview questions you should anticipate.

FAQs

To ace a finance interview, prepare thoroughly by understanding the company and its industry, practicing financial concepts and technical skills, and being ready to discuss recent market trends. The key to success is demonstrating a solid grasp of financial principles and showing how your skills can benefit the company.

Behavioral questions in finance interviews often explore how you handle challenges, teamwork, and problem-solving. Examples include, “Describe a time when you had to analyze complex financial data under a tight deadline” or “Tell us about a time you worked on a team to solve a financial problem.”

When asked about your strengths in a finance interview, focus on qualities valuable in finance, such as attention to detail, analytical skills, proficiency in financial software, or the ability to communicate complex financial concepts.

Adaptability also showcases your ability to navigate the ever-changing financial landscape. At the same time, your commitment to continuous learning demonstrates your dedication to staying current with financial trends, regulations, and technologies—ensuring you bring the most updated and relevant expertise to the role.

To prepare for a finance interview without direct experience, emphasize your relevant educational background and any finance-related coursework or projects that demonstrate your understanding of financial principles. And highlight certifications or additional training you’ve pursued in finance or related areas, such as financial modeling or Excel proficiency.

Discuss personal finance projects or investments that showcase your practical application of financial knowledge. Stress your transferable skills, such as analytical thinking and attention to detail, which are crucial in finance roles.

Finally, express your strong interest in the finance sector and your eagerness to learn and adapt, underscoring your commitment to growing within the field.

If you want an excellent place to start building your portfolio, our program offers finance courses and prepared hands-on projects.

Here’s an answer example: “I’m enthusiastic about this opportunity because it blends my finance skills with my keen interest in [industry sector]. [Company Name]’s innovative approach to [specific aspect of the company’s operations] is inspiring, and I see a great synergy between my background in [specific skill or experience] and the goals of this role. I’m particularly excited about the prospect of contributing to [a specific project or objective of the company], aligning my career trajectory with the cutting-edge work your team is doing.”

Common questions include “How do financial statements link together?”, “What is NPV and why is it important?” and “Explain the difference between stocks and bonds.” The best way to answer these is to be concise, ensure your explanations demonstrate your understanding, and relate them to real-world applications or examples when possible.

To prepare for a finance interview question, thoroughly understand the job description and the company’s financial context.

Review the basics of finance, including key concepts, terminologies, and current trends in the industry. Brush up on your technical skills, particularly in financial modeling and analysis, and be ready to demonstrate your proficiency with relevant software tools like Excel.

Practice answering common finance interview questions, focusing on technical knowledge and behavioral aspects. Reflect on your previous experiences—even if they are not directly related to finance—and think about how the skills you gained are transferable to the finance role.

Finally, stay updated on the financial news and understand how global economic events might impact the company or the industry you aim to enter.

One insightful question to ask in a finance job interview is: “Can you describe the team’s approach to risk management and how the finance department contributes to this strategy?” This question demonstrates your strategic thinking and shows that you’re interested in the day-to-day tasks and how the finance department fits into the broader picture of the company.

It allows you to understand the company’s risk tolerance and the strategic role of finance in achieving its objectives, providing a deeper insight into the position and how you can contribute effectively.