Forward Contracts: Price vs Value

Understanding the price vs value distinction is crucial when dealing with forward contracts. While the price is fixed at the contract’s start, the value shifts over time based on market movements. This guide breaks down how each concept works and why the difference matters in real-world trading.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeTwo terms are often misunderstood regarding derivatives like forwards and futures: price vs value. Though they might sound similar, they represent very different ideas and play distinct roles in a contract. This guide explains how the forward price is set and calculated and how the contract’s value can change based on market conditions.

The Price of a Forward Contract

The price of a forward contract is the fixed amount the buyer agrees to pay the seller for the underlying asset at the end of the contract term. This amount is set when the contract begins and remains unchanged throughout the agreement.

To illustrate, consider Ben, who owns 100 shares of Company ABC, each currently trading at $10. He enters a forward contract with Evelyn, agreeing to sell all 100 shares to her one year from now. The agreed-upon price at the beginning of the contract is known as the forward price.

In a perfectly efficient market, this forward price should match the return Ben could earn if he invested in a risk-free asset instead. This ensures there’s no arbitrage—no risk-free profit to be made from inconsistencies in pricing. The concept of price vs value comes into play here, as the forward price essentially reflects the future value of the asset’s current market price, accounting for interest over time.

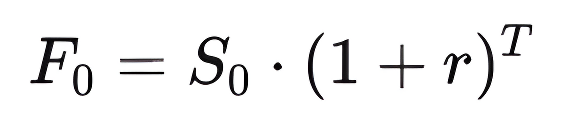

This is captured in the following formula:

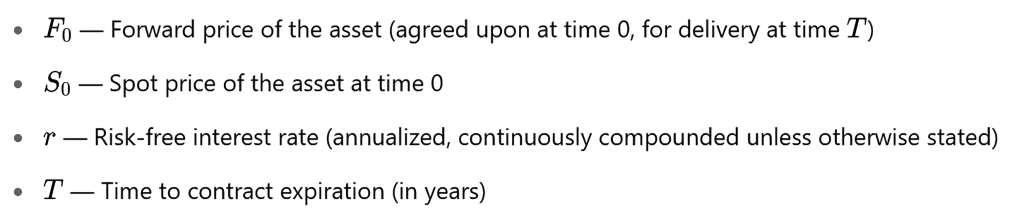

If the spot price is $10, and the risk-free interest rate is 10% per year with one year until expiration, then the forward price is calculated as:

So, Ben and Evelyn agree that the shares will be exchanged at $11 each at the end of the year. This is the price of the forward contract—derived purely from the time value of money applied to the asset’s current price.

The Value of a Forward Contract

While the price remains fixed, the value of a forward contract is dynamic. It reflects the actual worth of the contract to either party at any point in time. This distinction highlights the concept of price vs value, as the value is influenced by changes in the underlying asset’s market price and is determined by comparing that market price to the present value of the forward price.

At the beginning of the contract, the value is typically zero for both the buyer and the seller. That’s because no money has changed hands, and the agreed forward price equals the expected future value of the asset based on current market conditions and interest rates.

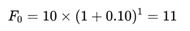

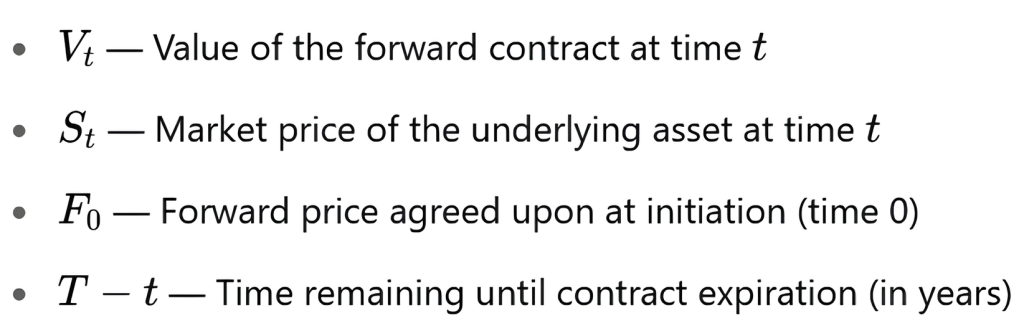

As time passes and the market price fluctuates, the value of the contract changes. To calculate it at any time t before expiration, we use:

This formula returns the forward price to its present value—allowing it to be compared to the current spot price.

What Happens at Expiration?

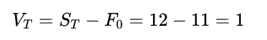

Let’s see what happens when the contract reaches expiration. Suppose the market price of ABC shares rises to $12. Ben is still obligated to sell the shares to Evelyn for $11, per their agreement. The value of the contract at expiration is straightforward:

Evelyn gains $1 per share because she can buy from Ben at $11 and sell immediately at $12. On the other hand, Ben incurs a $1 loss per share because he’s forced to sell below the market price.

Fixed Price vs Value Fluctuation

The forward price is the fixed amount agreed upon at the start of the contract. It reflects the expected future value of the asset based on current market conditions. It stays constant throughout the contract’s life.

In contrast, the value of the contract changes over time, capturing each party’s potential gain or loss as the underlying asset’s market price fluctuates. Understanding this distinction is essential for anyone dealing with forward or futures contracts—it highlights the price vs value dynamic: the difference between what’s agreed on and what’s ultimately gained or lost.

If you’re ready to deepen your knowledge and build practical skills in finance, join the 365 Financial Analyst platform and start learning from industry experts today.