Key Features of Fixed-Income Securities

Features of fixed-income securities provide a dependable source of regular income through interest payments and promise the return of principal at maturity. They offer stability and predictable financial returns and are integral to diversified investment portfolios. This guide addresses their basic characteristics, types, and the benefits they bring to both individual and institutional investors.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeSecuritization offers significant benefits by transforming illiquid assets into tradable fixed-income securities, enhancing market liquidity, and providing stable returns for investors. This article explores the fundamental characteristics and advantages of fixed-income securities, including bonds—the most common type. Features of fixed-income securities include providing investors regular income through fixed interest payments and returning the principal at maturity—making them a cornerstone of diversified investment portfolios. Let’s examine some of their basic features.

Basics of Fixed-Income Securities

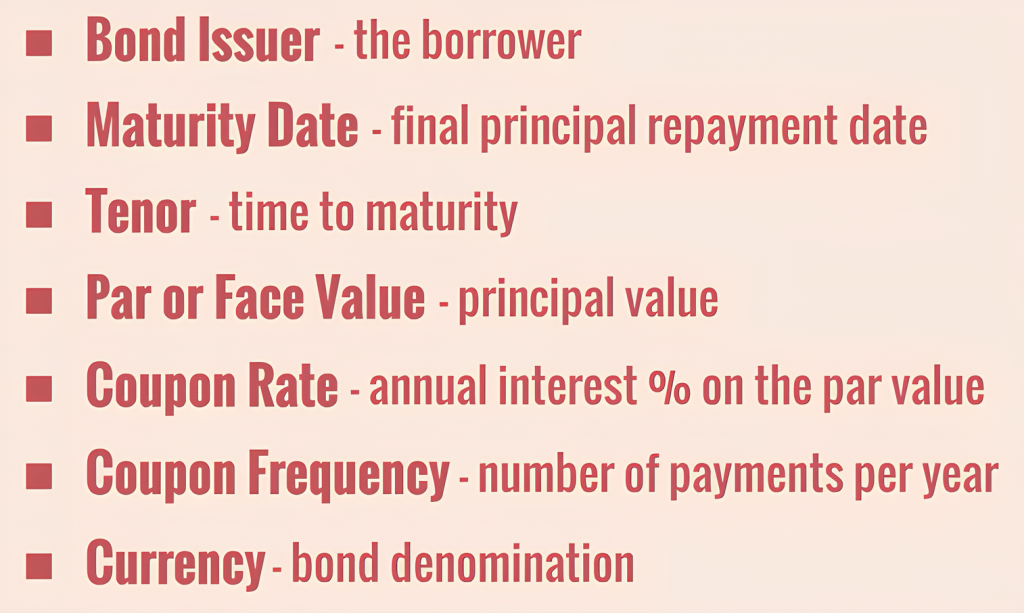

Fixed-income securities, or bonds, are financial instruments various entities use to raise funds. These securities require repayment at a specified future date known as the maturity date. Key features of bonds include their par value, coupon rate, payment frequency, and currency denomination.

Types of Bond Issuers

Bond issuers range from corporate entities to government institutions and even individual issuers, generally categorized into the following.

- Government-Related Sector: This sector includes sovereign bonds issued by national and local governments and bonds from quasi-government entities like La Poste in Paris. Features of fixed-income securities in this context also include bonds issued by supranational organizations—such as the World Bank and the European Investment Bank—which also issue bonds. These represent a significant portion of the global bond market, with the US and Japan being the largest issuers.

Research shows that government-related bonds account for more than 50% of the global fixed-income market, with the US and Japan being the largest issuers.

- Corporate Sector: The corporate realm encompasses companies of various sizes—from financial institutions like banks and insurance companies to non-financial entities like manufacturing firms. This sector is a major participant in the global bond market, with significant transactions that shape the financial landscape.

- Structured Finance Sector: The structured finance domain features special purpose vehicles (SPVs) that issue asset-backed securities (ABS) secured by diverse assets, such as auto loans, mortgage loans, or credit card debts. These bonds are sold on the secondary market, contributing to financial market dynamics.

Key Features of Bonds

- Maturity: Features of fixed-income securities like bonds are defined by their maturity dates, ranging from overnight to more than 30 years, with perpetual bonds existing indefinitely. For instance, a 20-year fixed-rate bond issued today would mature in 20 years, with its tenor becoming 15 years after five years.

- Principal Value (Par Value): Also known as Face Value or Nominal Value, this is the amount agreed to be repaid at maturity. For example, a bond with a Face Value of $1,000 currently priced at $800 is quoted at 80% of its Par Value.

- Coupon Rate: The coupon rate is the annual interest rate the issuer pays, which can be fixed or variable. For example, a bond with a $1,000 Par Value and a 6% nominal fixed coupon rate would generate $60 in annual interest. If this bond has semi-annual payments, it will pay 3% or $30 twice yearly.

Bonds can be issued in any currency, though US dollars and Euros dominate. Dual-currency and currency-option bonds offer varied repayment terms.

Yield Measures: Evaluating Bond Returns

- Yield to Maturity (YTM)

Features of fixed-income securities include YTM—a comprehensive measure that predicts the total return if the bond is held until maturity, demonstrating the inverse relationship between its current price and yield.

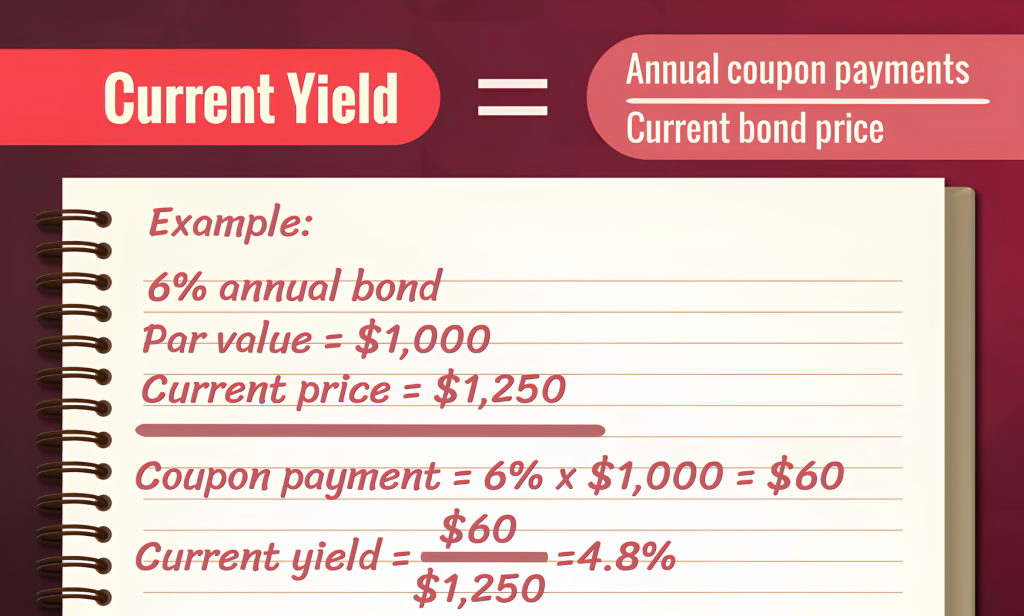

- Current Yield

The current yield on a bond is calculated by dividing its annual coupon by its current price. For example, a bond with a 6% coupon and a current market price of $1,250 has a current yield of 4.8%.

Mastering the Basics Features of Fixed-Income Securities

Understanding the features of fixed-income securities and their foundational elements, along with yield measures, equips investors to better assess and engage with the world of fixed-income securities. By grasping these core concepts, investors can make informed decisions that align with their financial goals and risk tolerance, ultimately enhancing their investment strategies in the bond market.

To further deepen your understanding and skills in fixed-income investment, consider joining the 365 Financial Analyst platform—where you can access expert-led courses and resources tailored to enhance your investment acumen.