How to Calculate the WACC: The Weighted Average Cost of Capital

This guide explains how to calculate WACC and use it to evaluate project viability through Net Present Value (NPV) analysis. Understanding WACC helps ensure your investments deliver returns that justify their financing costs.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeAs the newly appointed CEO of Beta Corporation, your first major decision is whether to approve a $20 million investment in a new Enterprise Resource Planning (ERP) system. The projected benefit: $8 million in annual after-tax savings for the next five years. But how can you determine if this investment is worthwhile?

This is a classic example of capital budgeting, where a company must evaluate the potential value of a long-term investment. The key tools for making this assessment are the Net Present Value (NPV) and the weighted average cost of capital (WACC). This guide walks you through the logic, formulas, and calculation steps—including how to calculate WACC—and how to use it to assess the viability of a project.

What Is the Cost of Capital?

The cost of capital represents the rate of return that fund providers (debt holders and equity investors) expect in exchange for investing in a company. It is the minimum return a project must earn to justify the cost of financing it.

Think of it as an opportunity cost—if the company cannot deliver returns equal to or higher than what investors could earn elsewhere (with similar risk), they will take their money elsewhere. Firms typically raise capital through:

- Debt (loans, bonds)

- Equity (common stock)

- Preferred stock (a hybrid between debt and equity)

Each source has its own cost, called the component cost of capital. Because investments are funded through a combination of these sources, we calculate the firm’s overall capital cost using a weighted average, which brings us to WACC.

What Is WACC?

The weighted average cost of capital (WACC) is the average rate a company is expected to pay to finance its assets, weighted by the proportion of each capital source in the overall structure. Understanding how to calculate WACC is crucial, as it serves as the discount rate in NPV calculations, helping decision-makers assess whether an investment adds value to the firm.

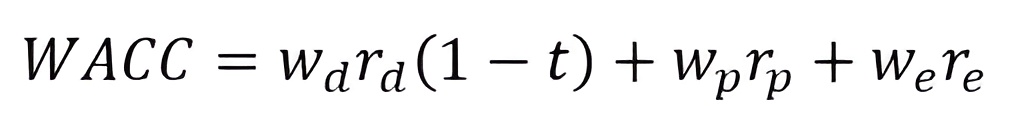

WACC Formula

- wd: Proportion of debt the company uses when raising new capital

- rd: Before-tax marginal cost of debt

- t: Company’s marginal tax rate

- wp: Proportion of preferred stock used when raising new capital

- rp: Marginal cost of preferred stock

- we: Proportion of equity the company uses when raising new capital

- re: Marginal cost of equity

The weights (Wd + Wp + We) always sum to 1 because they reflect the complete breakdown of the firm’s capital structure across debt, preferred stock, and equity.

Note: The cost of debt is adjusted for taxes because interest payments are tax-deductible in many jurisdictions.

Applying the WACC: A Case Study of Beta Corporation

Let’s apply the WACC concept to evaluate Beta Corporation’s ERP project. The company has the following capital structure and costs:

- Debt: 45%, cost before tax = 6%

- Preferred stock: 15%, cost = 8%

- Equity: 40%, cost = 9%

- Corporate tax rate: 40%

Step-by-Step WACC Calculation

- Calculate the after-tax cost of debt by multiplying the before-tax rate of 6% by 1−0.4, where 0.4 is the company’s marginal tax rate.

This gives an after-tax cost of 3.6%. We then multiply this by the debt proportion of 0.45, resulting in a weighted cost of 0.0162. - Calculate the weighted cost of preferred stock by multiplying its cost of 8% by its weight of 0.15, giving 0.012.

- For equity, multiply the cost of 9% by the equity proportion of 0.40, resulting in 0.036.

- Sum all three weighted components:

0.0162 + 0.012 + 0.036 = 0.0642

This means Beta Corporation has a weighted average cost of capital (WACC) of 6.42%.

Since debt and equity make up the bulk of Beta’s capital structure, their costs have the greatest influence on the overall WACC.

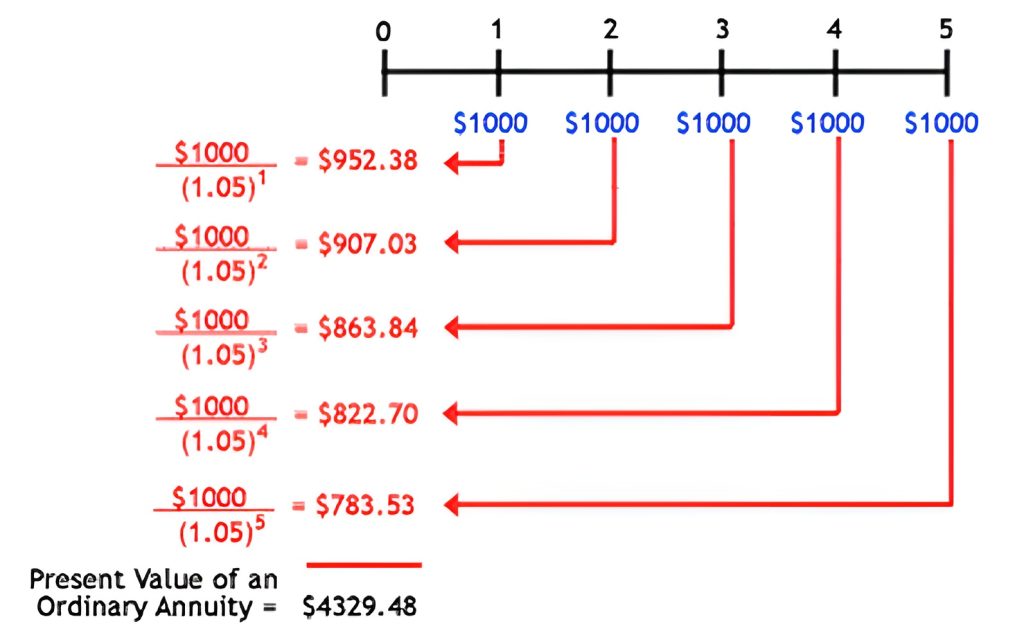

Evaluating the Project Using NPV

Now that we have the discount rate (WACC = 6.4%), we can calculate the Net Present Value of the ERP investment.

The project requires an initial investment of $20 million in year 0. In return, it’s expected to generate annual after-tax savings of $8 million each year for five years—from year 1 through year 5.

Using a financial calculator:

- Enter CF = -20,000,000 (CF₀)

- Enter CF = 8,000,000 (CF₁), frequency = 5

- Enter discount rate = 6.4%

- Compute NPV

This yields a Net Present Value (NPV) of $13,335,352—indicating that the project is expected to generate significant value above its cost. Since the NPV is positive, the investment is financially sound. As the CEO of Beta, your decision should be to approve the investment in the ERP system.

How to Calculate WACC—Why It Matters

The weighted average cost of capital is a critical tool in capital budgeting. It reflects the average rate of return required by all capital providers and serves as the benchmark for evaluating the profitability of investment opportunities.

In Beta Corporation’s case, calculating WACC helped us determine the correct discount rate for computing NPV. The positive NPV confirmed that the ERP project is a sound investment—guiding you, as the CEO, toward a confident and data-driven decision.

Understanding how to calculate WACC and applying it effectively enables you to measure investment feasibility, compare projects consistently, and ensure returns justify financing costs. Mastering WACC isn’t just about crunching numbers—it’s about making smarter, value-driven business decisions.

To further develop these decision-making skills, the 365 Financial Analyst platform offers practical training that bridges financial theory with real-world application.