What Is a Budget?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

A Budget is a financial plan that guides companies towards achieving their objectives. Without proper projections, organizations run the risk of losing sight of the big picture. Thus, we can say that planning, or budgeting, in particular, is a key tool for any firm that strives to remain competitive.

Defining a Budget

Generally, budgeting is the process of creating a plan for a firm’s resource allocation. In the same way, a Budget is a written statement estimating a company’s income and expenses for a future period. Organizations often compare it to a business barometer where projected and actual figures stand side by side.

The Budget contains the goals set for the upcoming year(s). More importantly, it includes a detailed plan of how to achieve these goals. Planning identifies potential opportunities and bottlenecks in advance and helps management make many important decisions when leading the company towards its goals.

In reality, almost every organization uses a Budget in its daily operations – the gelato shop around the corner does it, the local deli you stop by every morning drafts their projections, and so does Walmart! Statistics even show that one in three Americans also rely on various household budget planners.

Understanding the Concept of Budgeting

Let’s try to understand the basics of corporate budgeting through the prism of personal finances. Suppose that Jennifer comes up with a goal at the beginning of the year. She wants to save $1,200 in the upcoming year, which is significantly more than her annual savings from previous years.

There are two ways for her to achieve the desired outcome.

The first one is to simply go with the flow, hoping that at the end of the year she would turn out with savings of $1,200. Nevertheless, the chances of this strategy being successful are rather low, especially when we know that Jennifer did fail to do so in the past.

The second alternative is for Jennifer to make a personal budget and follow it as much as possible. If you prepare a detailed plan that shows the exact steps you will take to save $1,200, you are much more likely to succeed. This option sounds a lot better than making no plans at all!

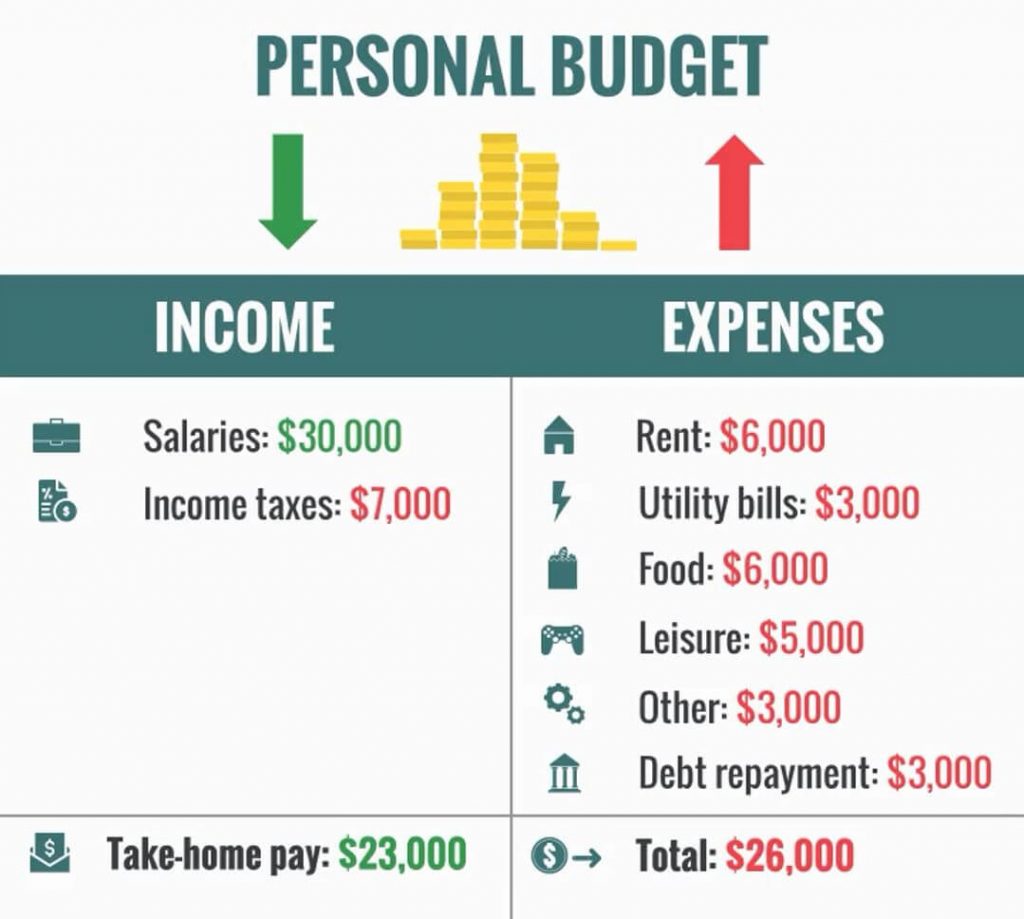

Let’s assume that Jennifer sits down and drafts a rough plan of her finances for the next 12 months, which includes her personal income and expenses. Here is an overview of Jennifer’s expected cash inflows and outflows throughout the year:

As a junior financial analyst, Jennifer earns an annual income of $30,000, and she pays $7,000 in income taxes. At the end of the year, her take-home pay will be $23,000.

The expenses, on the other hand, come to a total of $26,000. The house rent arrives at $6,000 per year, while the utility bills account for another $3,000. The food she buys at the supermarket comes to an additional $6,000. Of course, Jenn spends some money on entertainment, such as cinema tickets, weekend getaway trips, night outs, and cosmetics treatments. Thus, we draw up an estimate of $5,000 on leisure.

Throughout the year, some ad hoc expenses occur as we go. Mostly, we include taxes, parking, and donation in “Other”. In Jennifer’s case, these are projected to be $3,000 over the next year. Moreover, she will have to repay a $3,000 installment for a bank loan she took three years ago to help her refurbish the apartment she had rented.

As you can see, both columns income and expenses add up to a negative balance:

$23,000 – $26,000 = -$3,000

This simply shows that spending is expected to be more than earnings.

If Jennifer wants to achieve savings of $1,200 at the end of the year, she must:

- earn more

- spend less, or

- both

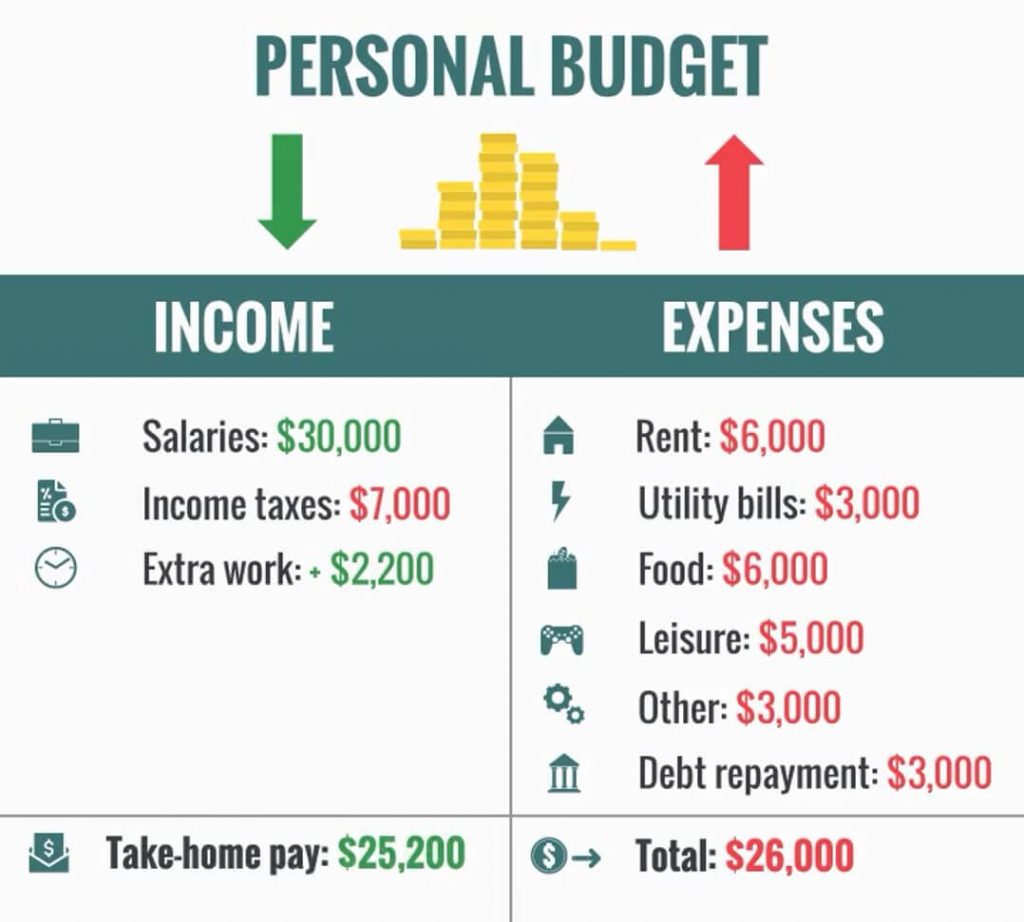

Let’s see what she can do to earn more. Jennifer’s job allows her to work overtime every week. By working an hour or two more per week, she will be able to generate an additional $2,200:

Nevertheless, this still amounts to a shortage of $800:

$26,000 – 25,200 = $800

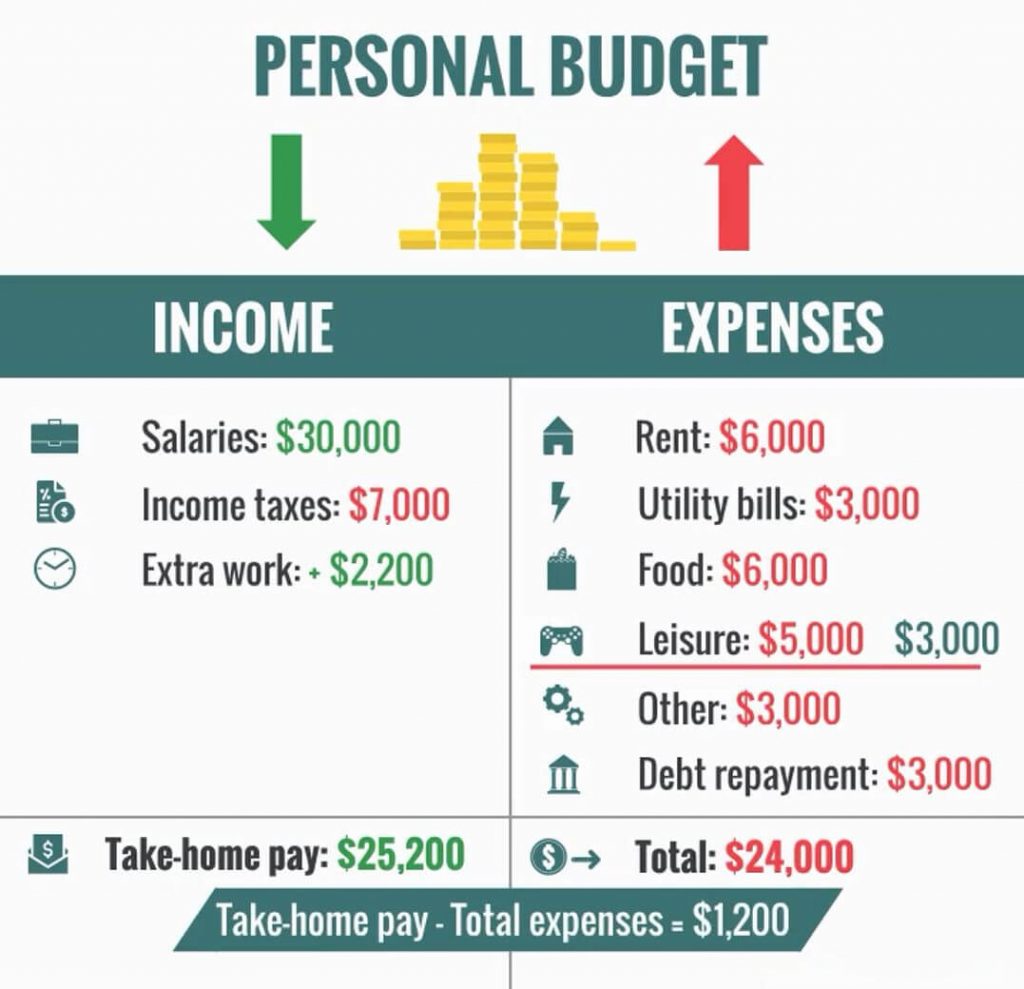

Considering the goal of saving up $1,200 and the overspend of $800, we establish that a surplus of at least $2,000 is required for the next year:

$800 + $1,200 = $2,000

So, Jennifer must not only earn more but also spend less.

Unfortunately, most of the expenses are fixed, such as taxes, rent, debt repayment, and utility bills. Others, however, are a bit more flexible. After carefully studying the various expenses, Jennifer decides that $5,000 for leisure is too much. So, instead of dining out with friends twice a week, she cuts it to once. Besides, she has decided to travel less to faraway destinations for a while. She estimates that this will save her exactly $2,000 overall. In this way, Jennifer can cover the shortage of $800 and achieve her goal of saving up $1,200. That’s how Jennifer’s personal budget looks like in the end:

Although way more complex and multi-layered, the budgeting process is pretty much the same for companies. The Budget they prepare should be in line with their strategic plans to further allow them to project the direction of the business.

What’s Next?

Now, we would like to offer you a challenge! We’ve just worked out Jennifer’s personal budget. Why don’t you try to draw a similar budget for your own revenue and expenses? Go ahead and use the template we have provided for you.

Next, you can learn more about the importance and benefits of budgeting!