Understanding the Monetary Transmission Mechanism

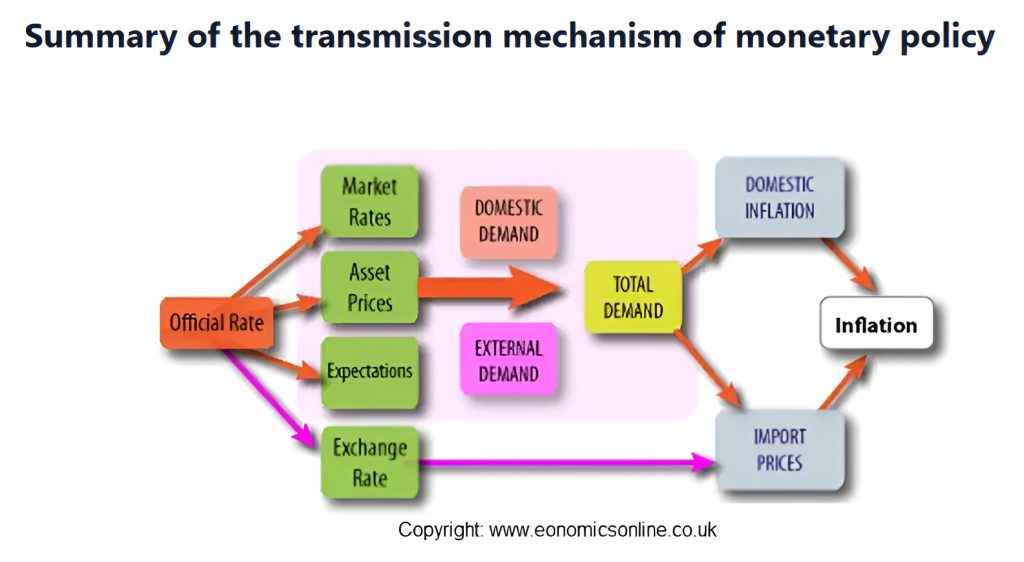

The monetary transmission mechanism explains how central bank interest rate decisions influence inflation and economic activity. It operates through key channels such as market interest rates, asset prices, expectations, and exchange rates, making it essential for understanding the impact of monetary policy.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeThe monetary transmission mechanism refers to the process by which a country’s central bank sets the official interest rate, which in turn influences the broader economy, particularly inflation. This complex mechanism operates through four main channels: market interest rates, asset prices, expectations about the future, and exchange rates. By understanding how these channels function, we can see how central banks influence inflation and economic activity through their monetary policy decisions.

How Contractionary Monetary Policy Works

When a central bank raises the official interest rate—also known as the policy rate or refinancing rate—it typically implements a contractionary monetary policy. This decision sets off a series of effects throughout the economy.

1. Market Interest Rates

An increase in the policy rate leads to higher short-term market interest rates. As a result, commercial banks raise the cost of borrowing for households and businesses. Loans become more expensive, leading to a reduction in borrowing and a decrease in consumer spending. With less money being spent, domestic demand falls, slowing economic activity and putting downward pressure on inflation.

2. Asset Prices

Higher policy rates also affect the valuation of financial assets. As the discount rate applied to future cash flows increases, the present value of assets—such as bonds and capital projects—decreases. This decline in asset prices reduces household wealth, slowing consumption and investment. As total demand contracts, inflation tends to decline.

3. Expectations and Confidence

Rising interest rates influence the expectations of consumers, businesses, and investors through the monetary transmission mechanism. As borrowing becomes more expensive, confidence in future economic growth may weaken. This reduced optimism leads to more cautious financial behavior, which further suppresses aggregate demand and contributes to lower inflation.

4. Exchange Rates

Interest rate hikes often attract foreign capital as investors seek higher returns on domestic assets. This inflow of capital leads to an appreciation of the domestic currency. A stronger currency makes imports cheaper and exports more expensive, thereby reducing net exports. The fall in export demand contributes to a slowdown in overall economic activity and reinforces disinflationary pressure.

How Expansionary Monetary Policy Works

When the central bank lowers the policy rate, it engages in expansionary monetary policy. The effects are essentially the reverse of contractionary policy.

- Market interest rates decline—making borrowing cheaper and encouraging consumption and investment.

- Asset prices rise as lower discount rates increase the present value of future cash flows.

- Economic confidence improves as households and businesses anticipate stronger growth and become more willing to spend.

- The currency depreciates, boosting export competitiveness while making imports more expensive—both of which stimulate aggregate demand.

Together, these factors result in increased aggregate demand, higher employment, and an upward inflation pressure.

The Monetary Transmission Mechanism and the Central Bank’s Balancing Act

The official interest rate influences inflation through a series of interconnected channels: market interest rates, asset prices, economic expectations, and exchange rates.

An increase in the policy rate slows down economic activity and reduces inflation, while a decrease stimulates demand and drives up price levels. Due to these significant consequences, central banks must carefully calibrate interest rate changes to maintain economic stability, encourage sustainable growth, and avoid overheating the economy or plunging it into recession.

Understanding how the monetary transmission mechanism works is crucial for policymakers, businesses, investors, and consumers. It sheds light on the rationale behind central bank actions—helping stakeholders anticipate how monetary policy decisions might affect economic conditions and financial markets.

To deepen your understanding of topics like this and gain practical financial skills, consider joining the 365 Financial Analysis platform—a learning hub designed to help you think and work like a financial professional.