Exploring the Exchange Rate Definition: Nominal, Real, Spot, and Forward

Understanding the exchange rate definition is essential for navigating international finance. This article breaks down the key types (nominal, real, spot, and forward)—highlighting how each functions and what they reveal about currency values. Whether you’re a student or a finance professional, this guide clarifies complex concepts with practical examples.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeExchange rates are a fundamental concept in international finance and economics. This article introduces the basic exchange rate definition and distinguishes between nominal and real exchange rates, as well as spot and forward exchange rates.

What Is an Exchange Rate?

An exchange rate is the price of one currency in terms of another. For instance, if the rate is 0.87 euros per US dollar, it means that one dollar can be exchanged for 0.87 euros. Every exchange rate involves two currencies:

- Base currency—the one being bought or sold

- Price currency—used to express the value of the base currency

The exchange rate definition also determines how currency quotes are presented. A direct quote (or price quotation) shows the value of one unit of domestic currency in a foreign currency. An indirect quote does the reverse—it expresses the value of a foreign currency in terms of the domestic one.

The distinction between direct and indirect quotes depends on the speaker’s location and perspective.

Nominal vs Real Exchange Rates

Nominal Exchange Rates

The nominal exchange rate is the prevailing market rate at which one currency is exchanged for another. It’s commonly published and indicates the number of units of one currency required to purchase one unit of another.

For example, as of June 19, 2025, the European Central Bank reported the EUR/USD rate at €1 = $1.1478. This means it takes approximately 1.1478 US dollars to buy one euro.

This rate is significant for foreign investors because it indicates the current cost of investing or doing business in a foreign currency.

Real Exchange Rates

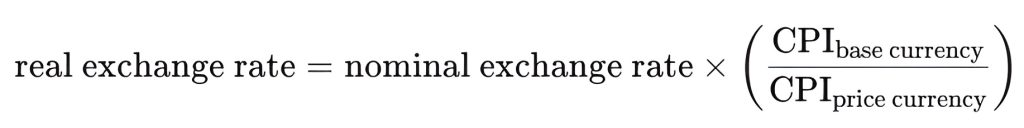

The real exchange rate adjusts the nominal rate for differences in price levels (inflation) between two countries. It reflects the relative purchasing power of the currencies and is calculated as:

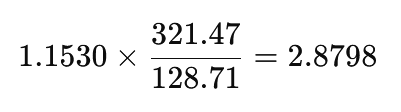

For example, if the nominal EUR/USD rate is 1.1530—with a US price index of 321.47 and a Euro Area index of 128.71—the real exchange rate would be:

A real exchange rate higher than the nominal rate suggests that inflation is higher in the base currency country (in this case, the US) than in the price currency country (Eurozone).

A popular informal tool for illustrating real exchange rates is the Big Mac Index—introduced by The Economist magazine in 1986. It compares the price of a Big Mac in different countries to evaluate purchasing power, using the McDonald’s burger as a consistent reference item.

Spot vs Forward Exchange Rates

Spot Exchange Rates

The spot exchange rate is the rate at which a currency can be exchanged immediately or within two business days for most currencies. It reflects the current market value and is used for immediate transactions.

Forward Exchange Rates

In contrast, the forward exchange rate refers to a rate agreed upon today for a currency exchange that will occur at a future date. These are often used in international business contracts to provide certainty about future costs or revenues in foreign currencies. Forward contracts help companies hedge against the risk of currency fluctuations.

Clarifying the Exchange Rate Definition and Types

A clear understanding of the exchange rate definition and its various forms (nominal, real, spot, and forward) enables more informed decisions in global finance. Recognizing the roles of inflation, timing, and market conditions helps decode currency values beyond face rates—thereby supporting more informed analysis in international economic contexts.

To deepen your understanding of concepts like purchasing power and explore real-world applications, consider joining the 365 Financial Analysis platform—where practical insights meet expert-led instruction.