Working Capital Management

Working capital management is essential for maintaining a company’s financial health and operational efficiency. This article explores the crucial tactics of managing short-term assets and liabilities—highlighting strategies to optimize liquidity and ensure long-term success. It covers practical approaches for balancing cash flows and investments to avoid financial distress and maximize returns.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeWorking capital management is crucial for maintaining a company’s financial health and operational efficiency. This article introduces the essential concepts of managing short-term assets and liabilities—focusing on liquidity sources and factors influencing a company’s liquidity position. It aims to provide insights into how effective working capital management ensures stability and long-term success.

Working Capital Management Overview

The working capital management definition involves making short-term financial decisions influencing a company’s current assets and liabilities. Current assets—expected to convert to cash within a year—are listed on a balance sheet in order of liquidity.

Understanding Liquidity

Liquidity order indicates how quickly current assets can be converted into cash. On a balance sheet, this sequence starts with the most liquid assets: cash, marketable securities, accounts receivable, and inventory.

Current Liabilities

In managing current assets, companies also handle short-term obligations known as current liabilities. Typically due within 12 months, these include accounts payable, accrued expenses—such as wages and taxes—and notes payable.

Objectives of Effective Working Capital Management

Effective working capital management ensures a company has sufficient funds for daily operations while investing assets productively. Balancing these objectives is crucial—insufficient liquidity could force asset sales or even lead to bankruptcy, whereas excess cash might not yield the best returns.

Managing Cash for Optimal Returns

Cash carries opportunity costs—prompting companies with surplus funds to invest in liquid, short-term securities like U.S. Treasury bills, bank certificates of deposit, and commercial paper. These investments allow companies to earn returns on idle cash and provide liquidity when needed.

Key Strategies in Working Capital Management

To manage working capital effectively, companies should:

- Maintain necessary cash levels and invest excess in short-term securities.

- Quickly convert short-term assets like receivables and inventory into cash.

- Manage outgoing payments to vendors, employees, and other stakeholders efficiently.

Working capital management is crucial for maintaining a business’s operational liquidity and health. It involves managing the relationship between a company’s short-term assets and short-term liabilities to ensure that it can meet its financial obligations and operate effectively.

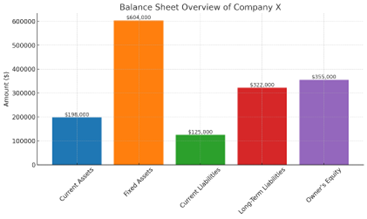

The balance sheet of Company X (below) illustrates a well-balanced financial structure, showcasing total assets of $802,000. This includes $198,000 in current assets and $604,000 in fixed assets. The liabilities are equally managed, with $125,000 in current and $322,000 in long-term liabilities, complemented by an owner’s equity of $355,000. These figures collectively mirror the total assets—highlighting a stable financial position.

Efficient working capital management for Company X involves optimizing the cash cycle (CCC) and balancing assets and liabilities to ensure financial stability and support business activities.

Financial Stability with Working Capital Management

Effective working capital management is essential for maintaining financial stability and operational efficiency. Companies like Company X can ensure sufficient liquidity to meet daily obligations and avoid financial distress by carefully managing current assets and liabilities. This balance supports long-term success by optimizing cash cycles and maintaining healthy financial ratios. Understanding why working capital is important helps in appreciating its role in ensuring a business’s smooth operation and financial health.

To further enhance your understanding and skills in financial management, consider joining 365 Financial Analyst—where you can access specialized courses and resources tailored to optimizing practices like these.