Peer Group Analysis

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Peer Group Analysis is a way for financial professionals to better identify the competitive position of an organization. The collected information provides an ample opportunity to gain valuable industry-specific insights.

Defining a Peer Group

A peer group refers to a group of comparable companies that compete in the same industry. These are same-size firms that have similar:

- Business activities

- Demand factors

- Cost-structures, and

- Access to capital

The bottom line is that we must compare “apples to apples”. For example, if you need to form a peer group for Daimler, you do not include Microsoft and Apple in the pack. Rather, you would group companies such as Volkswagen, General Motors, BMW, and Toyota. Otherwise, the comparison would be useless.

Peer Practices

In investment research, peer group analysis is an essential part of finding the “true” stock value. It allows investors to spot valuation discrepancies.

Suppose we have a stock trading at a price to earnings ratio of 20. This means that its stock price is 20 times higher than its yearly earnings per share. At the same time, the average multiple of the company’s peer group is 12. An analyst could easily conclude that the stock is overvalued and sell it. Alternatively, they can delve more and uncover the potential reasons for the higher earnings indicator. Either way, practitioners need a benchmark value to compare against. That’s how peer group analysis comes into play!

How Do You Form a Peer Group?

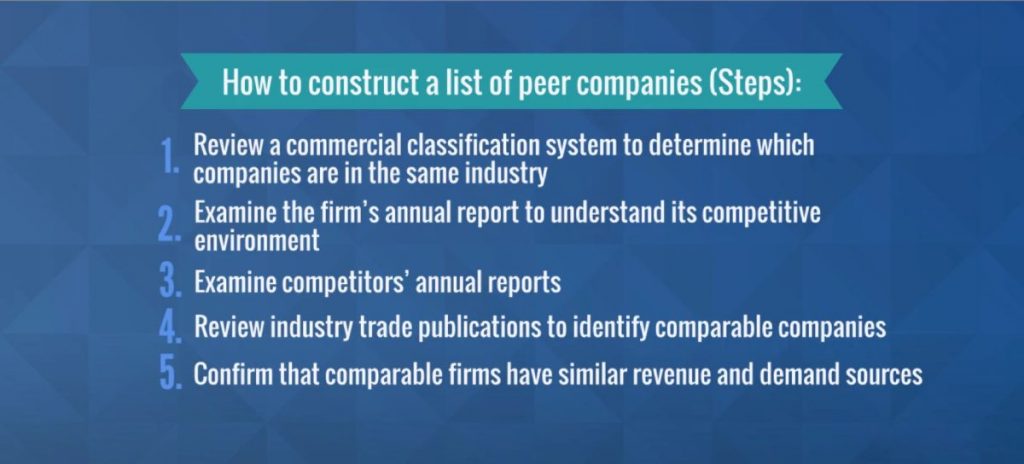

The table below outlines the five steps one takes to construct a list of peer groups:

Step 1: Identify the firms operating in the same industry or sub-industry. To do that, analysts check out the different commercial classification systems. Let’s say we want to find the peer group of Tesla. So, we look at the firm’s industry classification according to the Global Industry Classification Standard. Of course, the most narrowly defined category would be at the sub-industry level where we can find all the companies engaged in the same business line. Quite often, however, we need to adjust the list to make the firms included indeed comparable. For example, Toyota and Hyundai are not primarily focused on the premium auto segment, thus we exclude them.

Step 2: Review the firm’s annual report. When flipping through its pages, we will most likely find out that companies often name their direct competitors. In Tesla’s annual report, we see that the company identifies BMW, Ford, Lexus, Mercedes, and Volkswagen Group as its main rivals.

Step 3: Examine the competitors’ annual reports. By doing so, you find out if there are any other comparable companies you might include. Looking back at the previous example, Ford could also identify Volvo, Mitsubishi, and General Motors as its competitors.

Step 4: Review trade publications and single out any other competitors.

Step 5: Confirm that each comparable company derives its revenues from similar business activities as the subject firm. The higher the sales compatibility, the more meaningful the comparison. Practically, a firm can participate in multiple peer groups. For example, Hewlett-Packard generates its revenues from Hardware and Software services. In that regard, we should also make sure peer firms have comparable demand sources. It would be meaningless to juxtapose companies that are exposed to different business cycle stages. That’s often the case with multinational firms.

How Do You Rank a Company Within a Group?

Once this process is complete, a peer group must be put to use. Many professionals rank companies within a group based on certain criteria, to further help them understand industry norms versus an individual company’s competitive position. Some of the most common points for comparison include a firm’s:

- Life-stage

- Competitive forces

- Most significant macroeconomic factors

- Relevant external factors

- Volatility relative to the overall industry

- Experience curve

- Financial ratios

Taking Peer Group Analysis to the Next Level

Constructing a peer group is tied to a number of company and industry analyses such as Porter’s 5 Forces, Industry Life Cycle Model, and PESTEL. Therefore, it lays a solid foundation for high-quality analysis.

What are the main elements of company analysis and industry analysis? Find out now!