Common Stock vs. Preferred Stock

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Equity securities represent the shareholder’s stake in a company mostly in the form of common and preferred stocks. Investors use them as a tool to profit from the future growth of a business. For a sound decision to be made, an investor should be able to recognize the key differences between these two instruments.

Common Stock

What we know about common stock is that they get the remainder of what’s left after all the assets liquidate and the company’s debt is paid off. So, common shareholders receive dividends only after preferred stockholders obtain theirs, and debtholders receive their interest. In general, firms have no obligation to pay back shareholders.

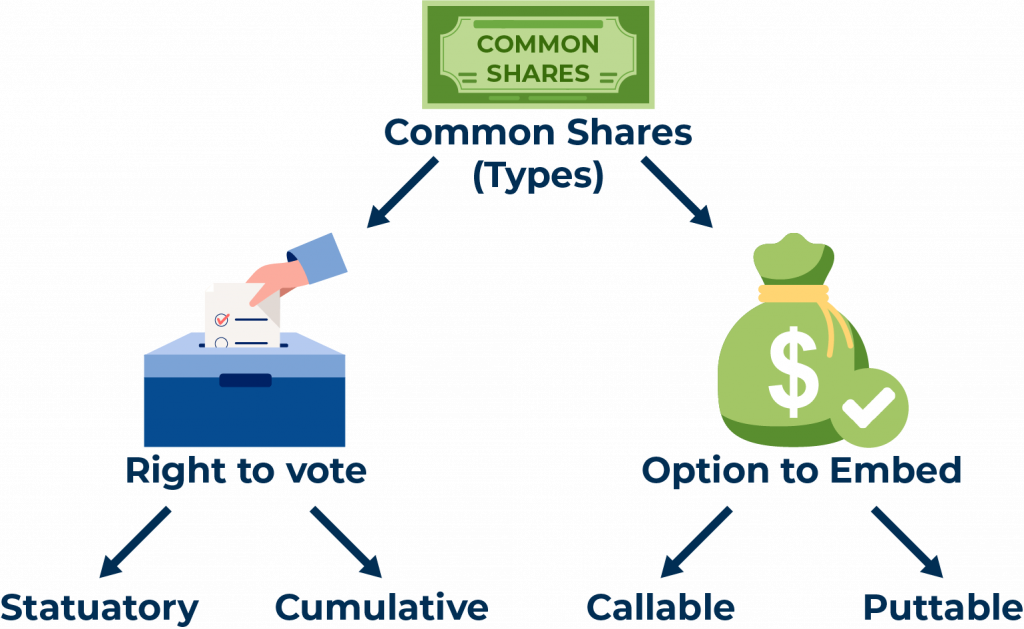

Besides, common shareholders have the right to vote on corporate issues such as Mergers and Acquisitions and Board of Directors elections. When a common representative is unable to partake in a conference, they send a knowledgeable replacement instead, typically an investment adviser. We call this “proxy voting”.

When it comes to common stock voting mechanisms, we may come across either statutory (straight) or cumulative voting. In the former, each share counts for one vote, and votes must be divided evenly among the candidates or issues discussed. If you, for example, own 100 shares and vote on a new Board of Directors with 3 positions available, you could cast 100 votes for each board member, for a total of 300 votes. But you could not place 10 votes for each of the two board members and 280 for the third.

On other occasions, we encounter a cumulative voting structure. It allows shareholders to direct their total voting rights to specific candidates. Instead of doing it for each Board member, they can decide to accumulate their positions and cast them for a single representative only. So, you can place all 300 shares on one executive. This way, minority shareholders get a higher chance of electing their director of choice. Consequently, they will have a bigger representation on the Board than they would otherwise have in a straight voting system.

Typically, common shares are divided into callable and puttable. Callable stock give the company the right to buy them back at a predetermined call price. From a strategical standpoint, this feature is valuable to the issuer because it “calls back” the stocks whenever the market price is higher than the call. Obviously, these securities allow for a firm to retain tighter control over its business.

With puttable common stock, on the other hand, investors have the option of selling their shares back to the issuer at a specified price. The put option has been designed to help shareholders by acting as insurance in the event the price falls significantly. This makes such stocks attractive to investors. Understandably, their price is higher as compared to callable stock.

Preferred Stock

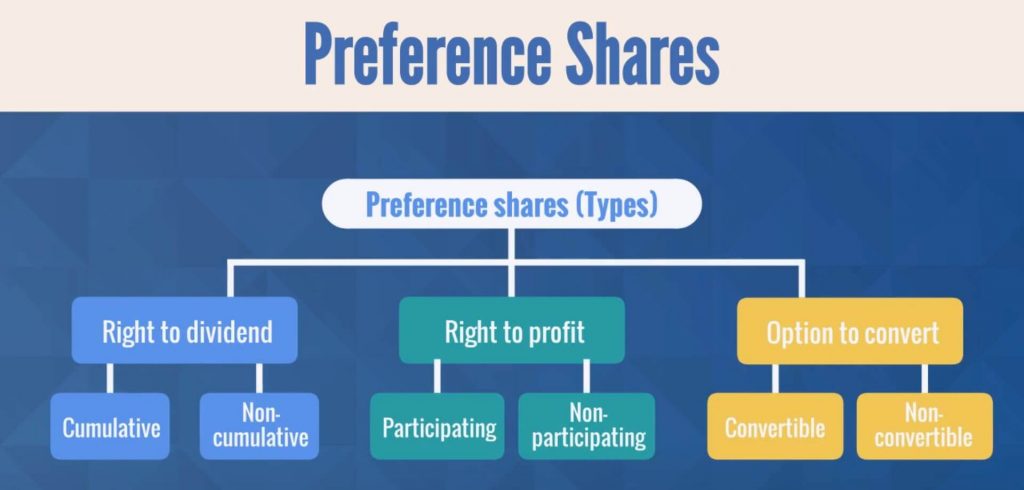

Preferred stock is a hybrid financing instrument because it has features of both common stock and debt. Like common equity, it does not have a maturity date. Nevertheless, it grants a fixed-size dividend resembling a fixed coupon rate bond. Same as any investment vehicle, preferred shares aren’t flawless. One downside is that they do not offer any voting rights, giving their holders no control over the firm’s management.

In a sense, “preferred” means that firms offer investors additional insurance. If the company becomes financially insolvent, preferred stockholders claim on assets before common shareholders do. They also offer more predictable cash inflows. Overall, preferred stock carries a par value and a stated dividend rate based on that par value. Thus, compared to common shares, their fixed dividends are generally higher. That’s why it is only natural for corporations to hold an affinity for them.

In terms of structure, preference stock can be cumulative and non-cumulative. The former specifies that any missed and unpaid dividends must be made up before common shareholders receive theirs. By contrast, non-cumulative preference shares lack such a provision. If the company doesn’t pay dividends in a given year, investors forfeit the right to claim any of the unpaid amounts in the future.

Besides, preference stocks can be divided into participating and non-participating. Participating preference shareholders have the right to receive the standard preferred dividend plus an additional one, based on pre-agreed terms and conditions. To a certain extent, they have ‘upside protection’ and will collect additional dividend any time common stockholders do. For the most part, the bonus payment equals the difference between the two dividends.

Suppose that Alpha issues a $100 par issue with a 5% dividend and pays a dividend of $5 per year. If common shareholders receive a dividend of $2 per share, whereas preferred stockholders only $0.5, the latter are entitled to an extra dollar and a half.

On the non-participating preference front, shareholders get only a fixed dividend payment. Put simply, they don’t share in a firm’s profits. Back to the same example, we already know that each preferred share is entitled to receive $5 in dividends. Now, imagine the firm has better than expected financial results and decides to pay $6 in dividends to common shareholders. A participating preferred stock would ‘participate’ with the common stock to secure an additional dollar per share ($6 minus $5). On the contrary, a non-participating preferred stock would receive a dividend of $5 per year only.

The last criterium that differentiates preferred shares has to do with the option of stock convertibility. Thus, we distinguish between convertible and non-convertible options. The former can be “converted” into common stock at a fixed conversion ratio, determined at issuance. For instance, at a fixed conversion ratio of 6, you can trade in 1 preferred share for 6 common shares at your discretion.

Convertibles are popular for those who want to participate in the stock market without taking wild risks. That’s why these securities are often used to finance risky venture capital and private equity firms. Value-wise, whenever common shares outperform convertible, preferred stockholders should go ahead and convert. That’s because, under these circumstances, common stock will earn higher profits.

At a Glance

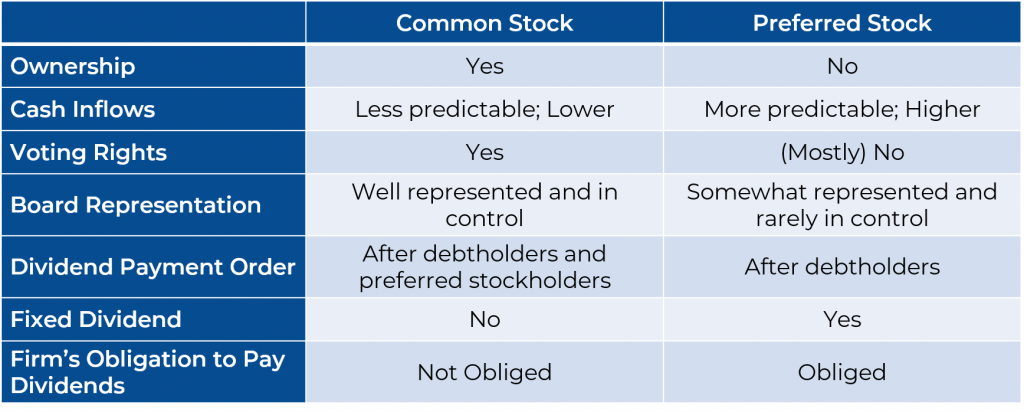

Below is a summary table representing the main characteristics of common stock and preferred shares:

Apart from stocks, professionals can invest in indexes as well. They track a market performance and its underlying constituent securities. This is something any financial analyst should keep an eye on!